Trading China’s Coronavirus (Part 3)

Diversifying with International ETFs

Key Coronavirus Updates:

- Estimated number of global coronavirus infections has risen to 7,792 with 170 associated fatalities

- The 2002-2003 SARS epidemic achieved 6,000 total infections in 47 days, whereas the Wuhan coronavirus has achieved that same milestone in only 19 days

- Several countries have reported coronavirus infections in citizens who never traveled to China

- The World Health Organization (WHO) is again deliberating whether or not to declare a global health emergency

- Some large international airlines (British Airways and Air Canada) have cancelled all flights to and from China

- Swiss Pharmaceutical company Novartis has warned that development of an effective coronavirus vaccine could take up to a year

Since a new strain of coronavirus has spread through China (and to a lesser degree abroad), there’s been plenty of action in the financial markets.

As outlined in Part 1 of the Luckbox series “Trading China’s Coronavirus,” there’s been a number of individual stocks that have received extra attention in the last week of trading.

A common sight has been a huge spike in the price of stocks whose fortunes are viewed as closely tied to protective gear in the healthcare industry, or biotechnology companies that are perceived to possess the capability to create a vaccine that could help slow the epidemic.

In Part 2 of the series, the focus shifted to China exposure—specifically, an overview of the different ways that traders and investors can take and manage risk using underlyings leveraged to the Chinese stock market.

In this installment to the series, the focus shifts once again—Luckbox is delving deeper into international exchange-traded funds (ETFs) such as the China-focused ETFs (FXI, MCHI, GXC, etc.) highlighted in Part 2.

International ETFs are securities that are designed to provide market participants with exposure to a specific region of the world or to a group of international companies with a similar profile.

For example, the iShares China Large Cap (FXI) is composed exclusively of large-cap companies with direct exposure to the Chinese stock market. On the other hand, the iShares MSCI EAFE (EFA) comprises large and mid-cap companies operating in a variety of developed countries around the world (excluding the U.S. and Canada).

As with SPY, which is exposed to the performance of 500 American companies, international ETFs offer the opportunity for traders to take and manage risk using both directional strategies and volatility strategies that incorporate associated ETF options.

In terms of the latter approach, traders can build portfolios of long and short volatility in ETFs, much like they would in single stocks.

For example, if a trader were to hypothetically get short premium in SPY because they thought implied volatility was too high, then a long premium trade in EFA might theoretically offer protection against the SPY trade—especially if EFA were considered cheap in terms of Implied Volatility Rank (IVR) or another metric like it.

Alternatively, a trader might be seeking to add additional short volatility exposure to a portfolio that offers global diversification beyond trading only American companies. For example, if a trader was already short premium in the SPY, they may not want to add additional short premium in Apple (AAPL) because it is included in SPY.

In some ways, that would essentially be adding to the same bet.

Instead, a short premium trade in SPY, which comprises large and mid-cap companies in the United States, might be better paired with a short premium trade in EFA, which comprises large and mid-cap companies in other developed countries (excluding the U.S. and Canada).

From this standpoint, a trade in EFA diversifies exposure in the portfolio by spreading it across a larger percent of the world economy (not just the U.S.) and a larger pool of companies. A recent episode of Market Measures focusing on international ETFs may be of interest to traders considering such an approach.

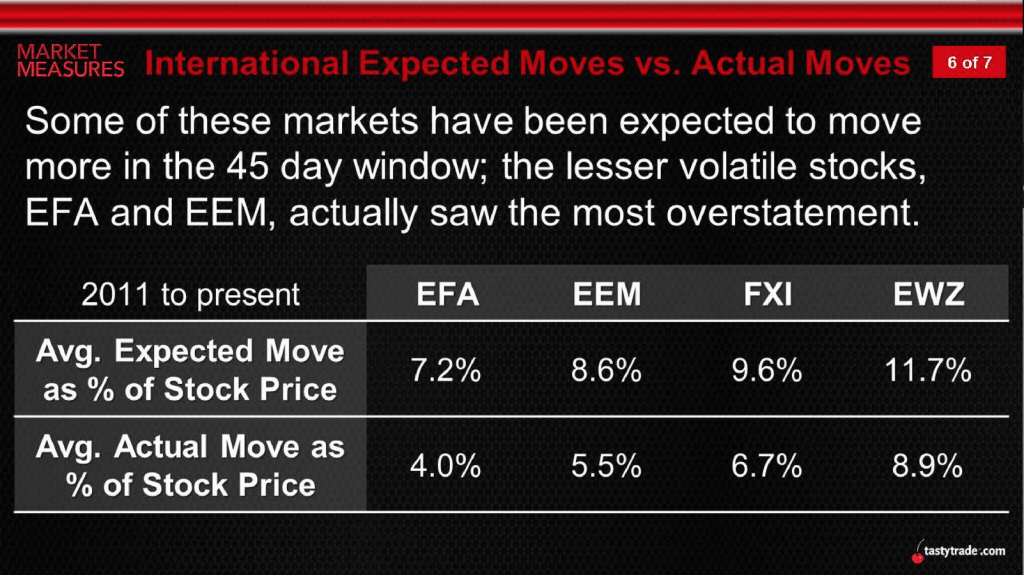

In this installment of the series, the tastytrade research team reviewed the expected and actual moves in four highly liquid international ETFs, including EFA, EEM, FXI and EWZ. Conducting an analysis of these four symbols, the team evaluated whether implied volatility tends to be historically overstated, as has been consistently observed in SPY.

The results of this investigation, relying on data from 2011 to 2017, are illustrated below:

As one can see in the graphic above, historical data in these four symbols supports the notion that implied volatility tends to be overstated in international ETFs—at least with the four included in this study.

Looking at the results, EFA, EEM, FXI and EWZ all had smaller actual volatility (i.e. realized volatility) when compared to the expected moves implied by the market price of volatility at the time of trade deployment.

The above information suggests that international ETFs, such as the China-focused issues that are currently seeing a pop in volatility, might offer additional opportunities for portfolio diversification, assuming they match one’s risk profile and outlook.

The next issue of Luckbox magazine is focused on China. Help us with our coverage by lending your thoughts on the China Threat, Trade policy & Trump. Your responses may be published in our next issue. Check out the current Luckbox Reader Survey here.

To read the previous post in this series click here.

To learn more about trading international ETFs, traders may want to review the complete episode of Market Measures focusing on expected moves versus actual moves in these products when scheduling allows.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.