Trading the 2024 Elections

Last night’s debate aside, most Americans wrongly believe today’s healthy economy is in recession

- Before their clash, polls indicated for months that Trump held the edge over Biden.

- However, polling data from October 2016 showed Hillary Clinton with a significant lead over Donald Trump, yet she ultimately lost.

- Prof. Allan Lichtman, who successfully predicted the results of nine of the last 10 U.S. presidential elections, has indicated “a lot would have to go wrong for Biden to lose.”

Opinions on last night’s presidential debate are fueling panicky chatter on social media, cable news and front pages—not to mention at the kitchen table, around the office water cooler and in the diner down on the corner.

Many faulted President Joe Biden for a shaky performance and accused former President Donald Trump of showing little regard for the truth.

But reactions to the matchup aside, the outcome of the election will shape U.S. domestic and foreign policy, but the performance of the stock market is less dependent on who sits in the Oval Office. After all, excluding the temporary correction brought on by the COVID-19 pandemic, the stock market performed well during the tenures of both Biden and Trump.

For example, the S&P 500 rallied by more than 60% during Trump’s time in office. And since President Biden was inaugurated in January 2021, the S&P 500 has increased by another 48%. These results suggest the stock market could theoretically perform well no matter which candidate wins the upcoming election.

That said, there’s no guarantee the record-breaking performance will continue, even if one candidate is perceived as “better for the stock market.” That’s because the stock market generally takes cues from the underlying economy and corporate earnings, not from the agenda of the executive branch of government.

For insight into the upcoming election and its potential impact on the financial markets, let’s view some details.

Allan Lichtman’s prediction for the 2024 presidential election

Dr. Allan Lichtman, a professor of history at American University, has accurately predicted the winners of nine of the last 10 presidential elections, including Donald Trump’s victory in 2016.

Lichtman bases his prognostications on a proprietary model he developed in conjunction with the Russian seismologist Vladimir Keilis-Borok. It relies upon 13 inputs (aka “keys”), which are highlighted below:

- Party mandate: After the midterm elections, the incumbent party holds more seats in the U.S. House of Representatives than after the previous midterm elections.

- Nomination Contest: The incumbent candidate easily secures the nomination of the party.

- Incumbency: The incumbent party candidate is the sitting president.

- Third-party: There is no significant third-party or independent campaign.

- Short-term economy: The economy is not in recession during the campaign.

- Long-term economy: Real per capita economic growth during the term equals or exceeds mean growth during the previous two terms.

- Policy change: The incumbent administration affects major changes in national policy.

- Social unrest: There is no sustained social unrest during the term.

- Scandal: The incumbent administration is untainted by scandal.

- Foreign/military failure: The incumbent administration suffers no major failure in foreign or military affairs.

- Foreign/military success: The incumbent administration achieves a major success in foreign or military affairs.

- Incumbent charisma: The incumbent party candidate is charismatic or a national hero.

- Challenger charisma: The challenging party candidate is not charismatic or a national hero.

Using the above inputs/keys, Lichtman and Keilis-Borok next ascertain which are true and which are false. If eight (or more) of the 13 keys are true for the incumbent candidate, the model indicates the incumbent will win the election—but if fewer than eight are true, the model indicates the challenger will win.

One potential complication with this approach lies in its subjectivity. Take the state of the underlying economy as an example. In 2024, this particular input isn’t cut and dried—not because the economy is underperforming but because many Americans believe it is underperforming.

Many believe the economy is in recession, even though it isn’t

The U.S. economy is not technically in recession because it has not suffered two consecutive quarters of negative growth. In fact, it hasn’t suffered a single quarter of negative growth since Biden took office in January 2021.

However, a pole by The Guardian found 56% of American respondents believe the U.S. economy is in a recession. Even more alarming, 49% believe unemployment in the United States is at a 50-year high. In fact, it’s the opposite. It’s at a 54-year low.

To understand how critical the state of the economy is to a presidential election, let’s go back to 1927. Of the 24 elections since then, the incumbent has been victorious 13 times. But of those 13 victories, only one occurred during a recession. In all other instances when the economy was in recession, the incumbent lost.

These figures underscore why the state of the economy will be so important come November. Moreover, they highlight how widespread misperceptions about the economy could complicate Lichtman’s prediction.

For the record, Lichtman hasn’t yet revealed his official prediction for the 2024 election. But a couple of months ago told The Guardian that “a lot would have to go wrong for Biden to lose.” Lichtman reiterated that opinion in June, after Trump was found guilty of 34 felonies in New York.

When Lichtman does reveal his prediction for the 2024 election, it will undoubtedly carry weight on both Wall Street and Main Street.

Corporate earnings aren’t as strong as the headline numbers suggest

Another factor that’s muddling the economic picture in the United States is misconceptions about corporate earnings.

In Q1 of 2024, companies in the S&P 500 saw profits increase by 5.9%, according to FactSet. However, the S&P 500 doesn’t represent the entirety of the U.S. corporate sector. Instead, it represents only the largest and best companies.

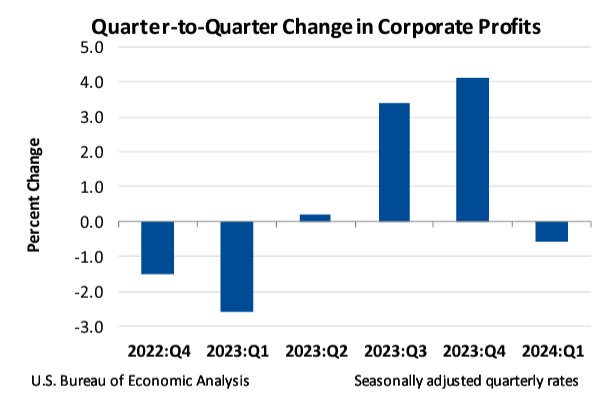

In contrast, figures compiled by the U.S. Bureau of Economic Analysis showed corporate profits declined by approximately 0.6% in Q1, compared to Q4 of 2023 (illustrated below).

The U.S. Bureau of Economic Analysis (BEA) evaluates results from the entire corporate sector—ranging from small private businesses to large publicly traded corporations. Moreover, the BEA adjusts the earnings to account for changes in inventory valuation and capital consumption to gauge income from current production.

The BEA analysis appears to indicate the earnings performance of the country’s top companies has diverged from that of the broader corporate sector. And that may help explain why some Americans believe the economy is underperforming.

Republicans are favored to take control of the Senate, but the House remains a toss-up

Looking beyond the presidential race, the November elections will also determine the balance of power in Congress. At present, Democrats hold a thin majority in the Senate, while Republicans lawmakers hold a narrow majority in the House.

According to a recent report by Intelligencer, those thin majorities make each chamber susceptible to a flip come November. And the dynamics of the races for the seats up for re-election indicate Republicans will win control of the Senate, while Democrats will win control of the House.

Polling by The Wall Street Journal suggests Republicans are slightly favored to win control of both chambers of Congress. However, similar to The Intelligencer’s forecast, these projections indicate a Republican-controlled Senate is a higher likelihood than a Republican-controlled House.

Wall Street monitors the balance of power in Congress because historical data indicates gridlock is the preferred outcome for the financial markets. “Government gridlock creates less policy uncertainty,” which is why Wall Street leans in that direction, according to Fidelity. As highlighted in the graphic below, the stock market has produced the best returns historically (on average) when the two major parties share control of the White House and Congress.

Final takeaways

With about four months to go until the election, it’s still difficult to predict the outcome.

Donald Trump led Joe Biden in most polls before last night’s debate, but polling from October 2016 showed Hillary Clinton led Trump by a wide margin, and she ultimately lost.

Wall Street’s favored election guru—Allan Lichtman—has yet to release his official prediction for the presidential election but has indicated his model favors Biden.

That said, Lichtman’s model relies heavily upon the fact that the U.S. economy is performing well, and recent surveys show many Americans don’t see it that way.

At the end of the day, the U.S. financial markets performed well during the tenures of both Trump and Biden, which suggests future performance in the stock market probably doesn’t hinge on the outcome of this election. Instead, it’s the underlying economy that tends to influence the direction of the stock market, and that’s likely to continue—no matter the outcome in November.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.