Trading the New Low Volatility Environment

Due to dissipating volatility in the financial markets, investors and traders may need to adjust their playbooks for the remainder of 2021—as evidenced by the recent drop in the CBOE Volatility Index (VIX).

Don’t look now, but the high-flying volatility regime of 2020 is finally over.

With the CBOE Volatility Index (VIX) currently trading under 19, the risk environment in the financial markets appears to have finally “normalized.”

How long that holds is anyone’s guess, especially with a full-scale conflict between Russia and Ukraine starting to look like a real possibility.

Until that war escalates—or another highly impacting market-wide event materializes—investors and traders may be stuck in the current low volatility environment.

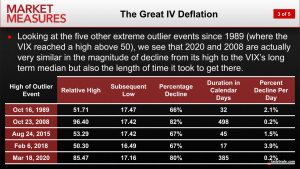

One question market participants often struggle with during such periods is whether it’s prudent to sell volatility. After all, volatility has historically demonstrated a tendency to mean-revert, and looking at the last 13 months of trading activity in the VIX, it appears that volatility has done exactly that. Last spring, the VIX notched an all-time high when it traded just north of 82 on March 18, 2020.

As highlighted in the chart below, the recent reversion in VIX (from 82 to 16) took 385 days—the second-longest-lasting decline in recent VIX trading history (going back to 1989).

So if the VIX has historically demonstrated mean-reverting behavior, and it is currently trading below its long-term historical mean, does that mean it’s time to buy volatility?

Maybe or maybe not—depending on one’s approach, outlook and risk profile.

The problem with long volatility (aka long premium) positions is that those holding them are forced to constantly fight the “time decay” phenomenon. Time decay refers to the fact that as time passes, options theoretically lose value. That reality tends to work in the favor of short-volatility traders and work against long-volatility traders.

To help illustrate this point, readers may want to review recent research conducted by the tastytrade financial network. In a series of new market studies, tastytrade researchers examined the performance of short volatility positions in low volatility environments.

Given the mean-reverting behavior of volatility, one would think that short volatility would perform less efficiently when volatility in the marketplace is low. And the new research does back up that hypothesis—short premium performance does suffer, relatively speaking.

However, the research also reveals that a short volatility approach in low volatility environments can still be profitable—albeit less profitable as compared to high volatility environments. As such, the findings from this research provide additional insight into the complicated nature of buying option premium—even when volatility is low—due to the existence of time decay (aka theta decay).

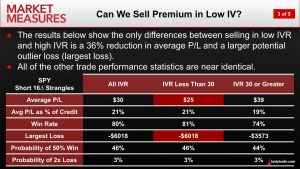

In order to study these topics, the tastytrade research team conducted three different market backtests in the SPDR S&P 500 ETF (SPY). The purpose of this effort was to evaluate the relative performance of a short options approach (i.e. short strangles) in three different volatility environments.

The threshold utilized in the study was an implied volatility of 30. So the three backtests measured the performance of short strangles when IV was below 30, when it was above 30, and also in “all environments”—the latter being effectively a control group.

The findings from this examination are summarized in the slide below.

As one can see in the above data, the performance statistics for the short strangles were fairly consistent across all three volatility environments. However, one metric that appears to suffer in low IV is average P/L, which was lowest when IV was below 30, and highest when it was above 30.

In sum, the data suggests that selling volatility in low vol environments is still overall a profitable exercise—assuming the trader/investor is willing to accept slightly reduced returns.

Interestingly, this research appears to affirm the findings from another tastytrade study that focused on buying options premium after the “vol crush” associated with earnings.

Traditionally, implied volatility tends to rise heading into earnings because of the uncertainty associated with such events. Once earnings have been released, volatility tends to experience a “crush,” as that uncertainty is sucked out of the options.

Ultimately, this earnings-related market study revealed that time decay can be a harsh mistress. Based on a variety of historical backtests, the study showed that long option purchases in the wake of earnings represent a low probability bet at best.

The main takeaway from both aforementioned studies is therefore that “low volatility” doesn’t necessarily equate to “cheap.” And while volatility does tend to revert toward its mean, the existence of time decay puts outsized pressure on the long side of the volatility equation.

For this reason, some traders/investors elect to trade less frequently in low volatility environments, or at least attempt to reduce risk exposure by trading smaller positions. The latter tactic—trading small and nimble—can actually be a prudent approach in all trading environments.

With Q1 2021 earnings season currently in full swing, the information may be especially pertinent to investors and traders as they continuously evaluate opportunities in the options marketplace.

To learn more about the topics covered in this post, readers can review the following tastytrade programming:

- Market Measures: The Great Volatility Deflation

- Market Measures: Should We Sell Premium in Low IV?

- Best Practices: Why Trade Earnings

- Market Measures: Evaluating Volatility After Earnings

- Best Practices: Strategies for Low IV

To follow everything moving the markets, TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST—is also recommended.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.