Trading the Potential for ‘Secondary’ Sanctions on China

China and Russia have strengthened their bilateral relationship in recent years, but any attempt by China to help Russia sidestep Western sanctions during the Ukraine crisis could result in so-called “secondary sanctions” being applied to the Chinese economy.

In the wake of Russia’s invasion of Ukraine, an international coalition led by the United States and the European Union moved swiftly to apply crippling economic sanctions on the Russian Federation.

Make no mistake, the impact of those economic and financial penalties has been devastating.

In the course of the last week, the Russian ruble has lost roughly 45% of its value, while several key ETFs that track the Russian stock market are down over 75%.

The Russian stock market itself remains shuttered as leaders in Russia opted to suspend operations instead of facing the harsh reality of a cataclysmic crash in prices.

To date, the international sanctions targeted at the Russian Federation have been comprehensive, but the global coalition aligned against Russia has by no means exhausted the range of possibilities.

So far, the sanctions have mostly avoided Russia’s key energy export market, which is one of the primary financial lifelines of the current Russian regime.

On any given day, roughly 10% of the crude oil consumed by the global economy originates from Russia. And the West is likely holding back sanctions against the Russian energy sector as a sort of last resort.

Importantly, however, the next round of sanctions may not even be targeted at Russia.

Instead, it’s China that may find itself on the wrong end of stiff economic penalties, especially if the Middle Kingdom helps Russia circumvent its own sanctions in the coming weeks and months.

China and the potential for “secondary” sanctions

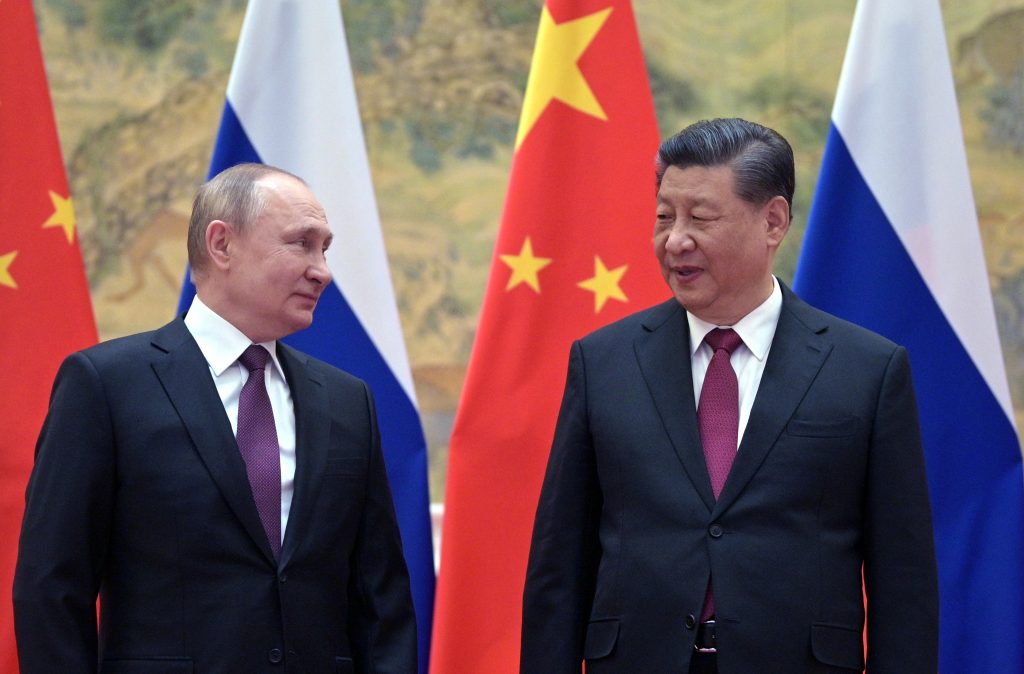

One of the most important geostrategic developments of the last decade has been the warming of relations between the People’s Republic of China and the Russian Federation.

Increased cooperation and understanding between the two countries appears to be rooted in a singular mutual goal: countering and containing the global influence of the United States.

Through increased cooperation and partnership, the two neighboring countries have been able to set aside their own differences and focus their attention and resources on other geopolitical aspirations.

The strategic importance of warming Sino-Russian relations has been on full display during the current Ukraine crisis.

In early February—during the lead-up to the invasion—President Vladimir Putin of Russia visited President Xi Jinping in Beijing. Hindsight suggests that the Russian leader used that meeting to update the Chinese president about his intentions in Ukraine.

In the wake of the meeting, both leaders voiced their support for one another’s foreign policy objectives, as well as speaking to mutual “security concerns” related to NATO’s continued expansion.

Based on that recent history, it was certainly no great surprise that China elected to abstain from voting on the recent United Nations resolution that condemned the Russian invasion of Ukraine. The resolution passed nonetheless, with 141 of the 193 member countries ultimately backing the motion.

To date, China has not only failed to publicly condemn the invasion but has also gone so far as to criticize the West for sanctioning Russia.

Importantly, China represents one of Russia’s most important international trade partners.

In 2021, roughly 16% of Russia’s total exports were directed to China. The trade relationship between the two countries has become so extensive that the Russian central bank has even converted a large portion of its foreign reserves from U.S. dollars to Chinese yuan.

In addition to the above changes, many Russian businesses switched their system of payments to China’s Cross-Border Interbank Payment System (CIPS)—basically a Chinese substitute for the Society for Worldwide Interbank Financial Telecommunication (aka SWIFT).

CIPS is far less ubiquitous than SWIFT, but its relevance may grow as a result of Russia’s current isolation from the global financial system.

And the potential for China to offer Russia a lifeline amid its current economic crisis is one of the scenarios that most worries authorities from the European Union and the United States.

Moreover, if China does help Russia circumvent sanctions levied by the West, it’s almost assured that so-called “secondary” sanctions will be targeted at the Middle Kingdom itself.

Primary sanctions, such as asset freezes and trade embargoes, prohibit citizens and companies of the sanctioning country from engaging in certain activities with their counterparts from the sanctioned country. Secondary sanctions, on the other hand, put pressure on third parties to stop their activities with the sanctioned country by threatening to cut off the third party’s access to the sanctioning country.

In this case, secondary sanctions applied to China by the United States would limit China’s ability to do business with American citizens and businesses. That’s probably not a situation the Chinese would relish.

In an effort to dissuade the Chinese from helping Russia, the U.S. State Department already issued a stern preemptive warning.

According to senior advisor Derek Chollet of the State Department, “China, if it were to seek to evade the sanctions, or somehow divide the sanctions, they would be vulnerable.” Chollet elaborated in saying, “Any country that tries to evade these sanctions will also face the consequences of its actions. I don’t want to speculate [on what] that would be.”

While secondary sanctions against countries that assist Russia haven’t yet been articulated, comments from Mr. Chollet suggest the United States wouldn’t hesitate to sanction China if it helps Russia break out of the economic isolation levied by the West.

The potential for U.S. sanctions against China may help explain why Chinese stocks listed in the United States have continued to exhibit weakness. Since the start of 2022, the KraneShares CSI China Internet ETF (KWEB) has dropped by an additional 20%. That’s on top of the 57% decline observed in KWEB during 2021.

As one might expect, some of the best-known Chinese American Depository Receipts (ADRs) have also declined further in recent days. Shares in companies such as Alibaba (BABA), Baidu (BIDU) and Pinduoduo (PDD) are all trading at or near 52-week lows.

And if China does find itself the subject of punitive economic sanctions as a result of its assistance to Russia, one could easily envision Chinese-focused shares dropping further.

To learn more about the challenges facing Chinese shares, readers are encouraged to review a past installment of Options Jive on the tastytrade financial network.

To track everything moving the markets, readers can also tune into TASTYTRADE LIVE weekdays from 7 a.m. to 4 p.m. Central Time at their convenience.

Get Luckbox! Subscribe to receive 10-issues of Luckbox in print! See SUBSCRIBE or UPGRADE TO PRINT (upper right) for more info or visit getluckbox.com.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.