Trading the Promising Future of Quantum Computing

Quantum computers are exponentially more powerful than traditional computers, and most projections suggest this emerging technology could become commercially viable in the next five years

In the global capital markets, investors and traders are always thinking about the next big thing.

Recent examples include electric vehicles (EVs), cloud computing and smartphones. Today, these products and services produce hundreds of billions in revenue every year.

The next major breakthrough in battery technology—whether it be solid-state batteries or another innovative approach—will undoubtedly be one of the next big things.

Another emerging technology that investors and traders would be wise to keep an eye on is quantum computing. According to PitchBook Data, a capital market company, roughly 250 companies in the quantum computing space have altogether raised more than $5.4 billion in venture capital since the start of 2017.

That type of scratch isn’t easy to come by—which means investors gravitating toward quantum computing obviously see gold at the end of the rainbow.

However, due to the complexity of this emerging technology, it will likely take another 5 to 10 years before quantum computing becomes viable at the commercial level.

That may sound like a long time, but that timeframe also seems to indicate that one of the current players in the quantum computing universe will reach the finish line first.

For these reasons, market participants with longer time horizons may want to start monitoring the quantum computing niche for potential breakthroughs that push this technology to the point of practical application.

What is quantum computing?

Computational power refers to the speed at which a machine can perform a task.

Fast computer processors can perform more calculations per second than slow ones, and fast processors are also better equipped to handle more complex problems.

The fastest and most efficient processors are therefore required to solve the most advanced problems. For example, to create artificial intelligence (AI), a system must first be trained to differentiate between voices or facial features. But to get to that point, the AI has to process a slew of data.

The only way to achieve this is to use computers that can process millions of data points every single second. And from a traditional computing perspective, supercomputers represent the top of the ladder.

Supercomputers leverage more than one central processing unit (GPU), and group these CPUs into what’s referred to as nodes. Supercomputers are typically used to test mathematical models for complex designs or physical phenomena, such as cryptology, chemical compounds and climate models.

But despite its advanced nature, supercomputing still relies on the same mechanics as traditional computing—transistor-based binary computational bits. Bits represent the smallest possible pieces of data, and can only exist in two states, zero or one.

Quantum computing trumps supercomputing because it is built upon qubits, quantum bits, instead of bits. Like bits, qubits have two primary states—zero or one. But qubits can also exist in a state known as superposition, in which a qubit can be both zero and one simultaneously. Or at least denoted with a statistical probability of being one or the other, as illustrated below.

Source: Medium.com

Qubits are so dynamic that this technology allows for exponential growth in computing power. For example, to match the computing power of 100 entangled qubits, one would require roughly 10 trillion years of traditional computing time.

And the differences between quantum computing and traditional computing don’t stop there. Due to the linear nature of traditional computing, problems are solved sequentially, whereas quantum computing allows for the simultaneous evaluation of all possible solutions.

Taken all together, that means quantum computing is taking problem-solving to the next level.

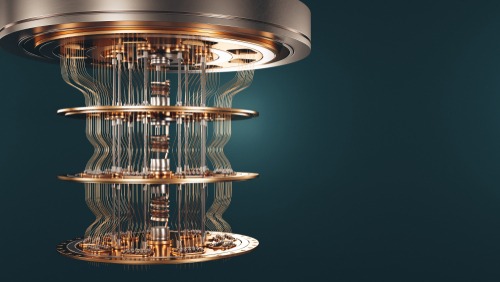

But due to their intricacy and high-tech nature, quantum computers are very difficult to build. They are extremely sensitive to temperature, vibration, material impurities and other environmental factors. That means trial and error is still very much a key part of the quantum computing development process.

Moreover, quantum computers are so powerful that they also require specialized cooling systems, which means their physical representation looks somewhat unorthodox to the naked eye. The word that often comes to mind when looking at a quantum computer is chandelier, as shown below.

Source: newsucdennver.edu

Quantum computing business landscape

In order to reach commercial viability, it’s estimated that quantum computers will need the horsepower to process millions of qubits.

Today, the most advanced quantum processors can only handle a few hundred qubits, which is why most projections suggest it will be another several years before this technology starts producing meaningful revenues. At this time, there’s only a small group of companies with the knowledge to get there.

IBM (IBM) is one of the early front-runners in the race to make quantum computing commercially viable. Since 2016, IBM has built roughly 30 quantum computers. And in early November 2022, IBM announced it had built a 433-qubit quantum processor. The company hopes to produce a 4,000-qubit processor by 2025.

At this stage, only a few other companies in this niche are voicing equally ambitious projections. Rigetti (RGTI)—which went public back in March—announced it will launch a quantum system with 336 qubits at some point in 2023. PsiQuantum, for its part, raised eyebrows in the industry when the company claimed it would produce a one-million-qubit computer by 2025.

Once quantum computers reach commercial viability, the next step will be figuring out how best to utilize them.

D-Wave Quantum (QBTS), for example, is using quantum computing to help companies optimize operations. On its website, D-Wave indicates that its “customers are building quantum applications for a broad spectrum of industries and use cases such as logistics, financial services, drug discovery, materials sciences, scheduling, fault detection, mobility, and supply chain management.”

Another important sector that will undoubtedly utilize quantum computing is cryptography—particularly as it relates to cybersecurity. Unfortunately, the knife cuts both ways, and many experts have voiced concerns that the emergence of commercially viable quantum computers will put existing cybersecurity systems at risk of compromise.

In a 2021 report, the Global Risk Institute suggested, “the threat posed by quantum computers could lead to a catastrophic failure of cybersystems, both through direct attacks and by disrupting trust.”

That’s one of the complicating factors associated with a revolutionary technology—it can be a total game changer, and have an unpredictable effect on other parts of not only the technology sector, but also the broader business world.

But those concerns certainly won’t slow quantum’s development. Going back to 2012, thousands of new patents have been registered for quantum computing-related technologies.

And looking at the global picture, it’s the United States and China that appear to be leading the quantum charge. As illustrated below, an analysis of global patent registrations (2012-2019) revealed that the U.S. had registered the most quantum computing-focused patents, while China had registered the most quantum communications-focused patents.

Some of the world’s biggest tech titans are also competing to control the future quantum computing market, with many of them hailing from the U.S. and China. A shortlist of those companies include Alphabet (GOOGL), Amazon (AMZN), Baidu (BIDU), Honeywell (HON), IBM (IBM), Intel (INTC), Microsoft (MSFT), and Nvidia (NVDA).

From a startup perspective, some of the companies to make the biggest recent splashes (in terms of fundraising), include PsiQuantum, Xanadu, IQM, Atom Computing, ColdQuanta, Zapata Computing, Classiq, Q-CTRL, and Pasqal.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.