Trading the Recent Collapse in Volatility

The VIX is down more than 40% since late October as election results crystallize.

President Donald Trump has yet to concede the election, and there may be recounts forthcoming, but the CBOE Volatility Index (VIX) has signaled that the presidential outcome is no longer in question.

After rallying all the way up to 40 leading up to the election, the VIX experienced a severe correction in the aftermath—dropping by 42% since Oct. 28 and currently trading at 23.10.

The VIX hasn’t closed below 20 since February but looks likely to do so in the near future. Encouraging COVID-19 vaccine results released last week have undoubtedly contributed to the weakness.

Officially, the VIX has been trading above 20 for 186 consecutive trading days—its longest such run since the 2008-2009 Financial Crisis. The CBOE VVIX Index (VVIX), often referred to as the “VIX of VIX,” confirmed the decline in market “fear,” retreating by roughly 20% since Oct. 30.

In the summer, most traders circled November on their calendars because two potentially explosive events were set to be decided then. With the election outcome now mostly an afterthought—and an effective vaccine expected soon—it’s no surprise market volatility suffered a mini-collapse.

According to new research conducted by tastytrade, recent movement in VIX aligns with previous historical collapses in the “fear gauge.”

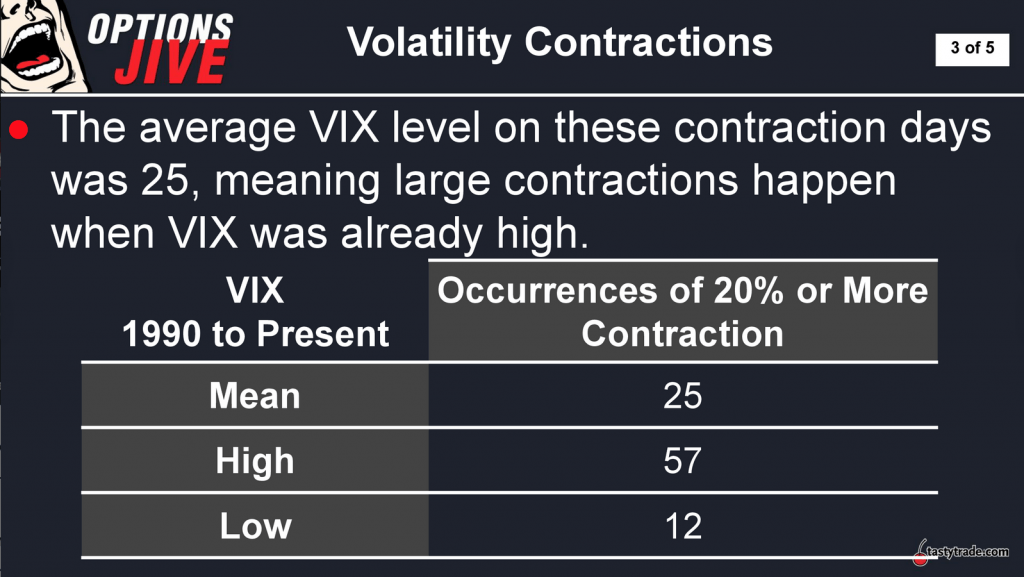

On Nov. 4, the VIX dropped by 20% in a single day. That has happened 18 other times in the roughly 30-year history of the VIX. Interestingly, the mean average in the VIX during those 18 instances was 25—right around where the VIX was trading after the election.

Adding further context to the above, the average move in the stock market during these VIX collapses was +3.3%. In 2020, the S&P 500 similarly rallied 4.1% when the VIX was nosediving—clear confirmation of the longtime negative correlation that exists between the VIX and broad-market stock indexes.

Of course, the big question now is what happens next. 2020 is somewhat unique as an election year because the composition of the new Congress—and ultimately control of the Senate—won’t be decided until two Senate run-off elections in Georgia are held Jan. 5.

The fate of the Senate is important because control by one party versus the other would likely result in diametrically opposed political environments. If Democrats control the White House and Congress starting Jan. 20, it’s believed they could implement a much more progressive legislative agenda, and possibly reverse Trump’s tax cuts.

On the other hand, if Republicans retain control of the Senate, prevailing opinion suggests the next couple years will be characterized by the same type of gridlock observed since the 2018 midterms. This scenario is viewed as more bullish for the markets.

In the near term, however, the U.S. economy needs more assistance as the country continues to grapple with the coronavirus pandemic. The Republican-led Senate has stood firm in recent months on a package worth $500 billion.

However, Joseph Stiglitz, the Nobel Prize-winning economist at Columbia University, suggested recently that another $2 trillion in pandemic relief is needed as soon as possible.

“The delay in providing the stimulus almost surely will increase the amount of money necessary to restore the economy,” Stiglitz said. “Digging yourself out of a deep hole is much more expensive than preventing a decline into a deep hole—another instance in which the aphorism an ounce of prevention is worth a pound of cure is applicable.”

The $2 trillion figure put forward by Stiglitz mirrors the amount the Democrat-led House of Representatives has been pushing for.

Flaring tensions over the stimulus underscore the importance of the Jan. 5 Senate run-off elections to the financial markets. That’s also likely why volatility in the VIX for the January contract remains more firmly bid than the December contract.

To learn more about trading the term structure of the VIX, readers may want to review a recent installment of Market Measures on the tastytrade network when scheduling allows.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.