Trading the Small Stocks 75 Index

In the United States, the most widely followed stock market indexes are the Dow Jones Industrial Average, the S&P 500, the Nasdaq and the Russell 2000.

The Small Stocks 75 Index (SM75), introduced by the Small Exchange, provides yet another important window into the overall performance of the U.S. stock market. Consequently, it serves as an important complement to the Dow Jones, the S&P 500, the Nasdaq and the Russell.

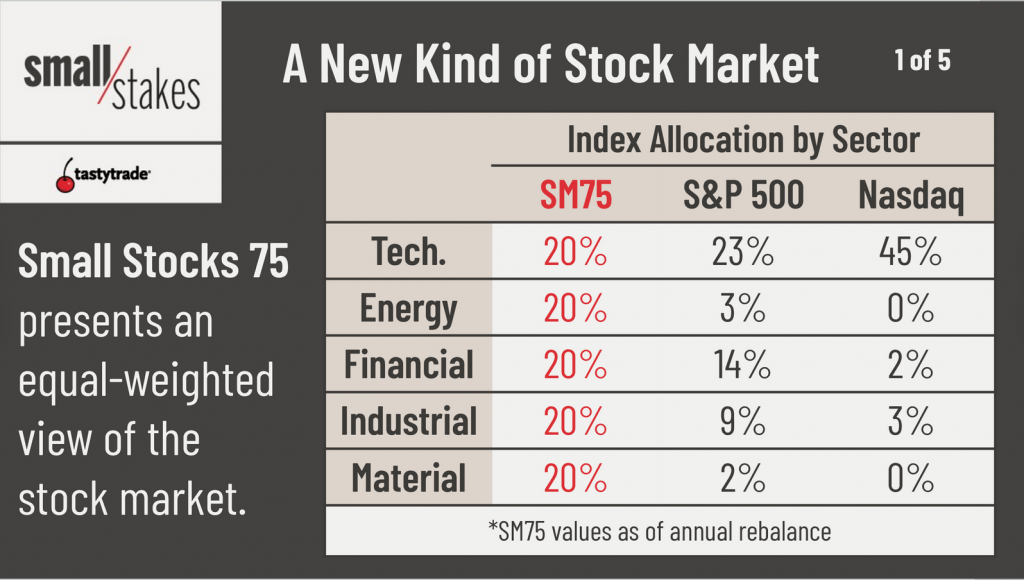

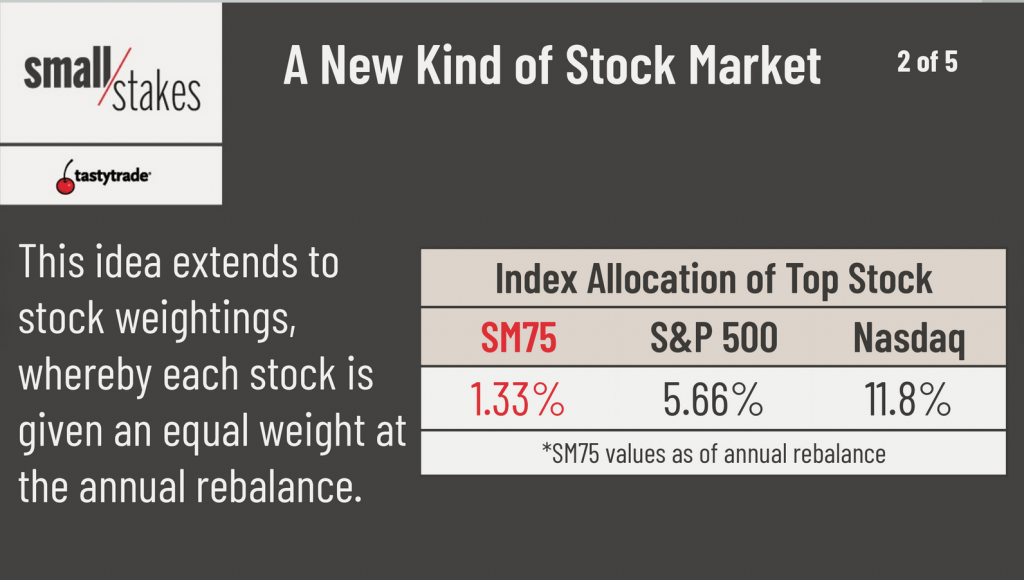

SM75 analyzes millions of data points in thousands of stocks to find the most active companies in the technology, industrial, energy, financial and material sectors. The Small Stocks 75 currently breaks down as follows:

The composition of the Small Stocks 75 Index also takes into consideration volatility, market capitalization and liquidity, which translate into an index of mostly large-cap stocks that are liquid and on the move. While the index is highly correlated to the S&P 500, it represents a new opportunity for speculators and hedgers alike—as well for market participants who simply want to monitor a different slice of the broader stock market.

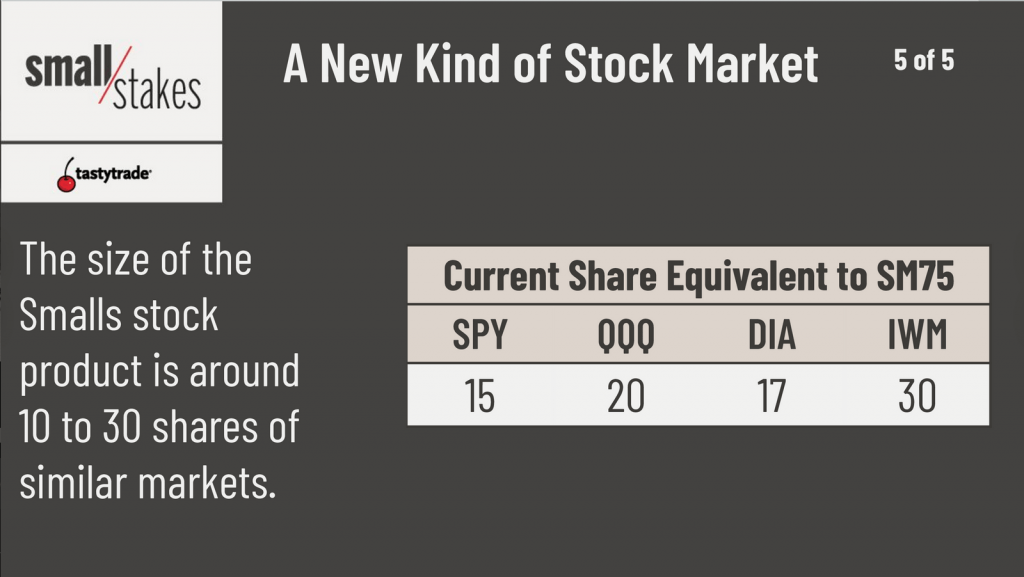

As its name infers, the SM75 offers a lower degree of exposure for investors and traders who may be looking for a more minimal footprint in their index exposure. Of course, traders looking for larger size can also utilize the Smalls by simply trading more contracts.

Small Stocks 75 also offers capital efficiency relative to other choices in the marketplace. For example, when trading an equity index ETF, such as SPY, the average investor needs to set aside 50% to 100% of the trade’s total value in cash. SM75, on the other hand, only requires 3% to 6% of the product’s value.

Similar to the rest of the Smalls, SM75 prices move in increments of 0.01, with each tick representing a dollar. Trading hours in Small Stocks 75 are weekdays from 8:30 a.m. to 4:00 p.m. Central Time, with a universal expiration on the third Friday of every month, when all Smalls settle to cash.

For further context, the term “stock market” is a general term used to collectively refer to all markets and exchanges where the shares of publicly traded companies are issued and traded.

One could refer to the global stock market, including all exchanges and markets on the planet, or to a stock market in a specific country or region of the world. For example, the U.S. stock market, or the Chinese stock market.

Stock market indexes, on the other hand, represent a subset of the broader stock market and are used to measure and track the performance of that specific subset.

While stock market indexes do provide insight into the performance of the greater “stock market,” one can see how the composition of a given stock market index will largely dictate the type of information provided.

For example, because the Dow Jones Industrial Average Index is composed of 30 of the largest and best-known American companies, the performance of the index won’t necessarily reflect the performance of the overall U.S. stock market.

In that regard, stock market indexes provide insight into a specific slice of overall stock market performance, as opposed to a comprehensive report on the stock market as a whole.

It’s arguable that the somewhat narrow view provided by stock market indexes is the reason why most investors and traders typically follow more than one.

To learn more about the recent launch of the Small Exchange, readers can visit the Small Exchange homepage, or review this short overview of the Small Exchange and associated product offerings.

Ongoing discussion on the Smalls and their place in the broader financial markets can also be accessed by tuning into the Small Stakes series on the tastytrade financial network.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.