Trading the Summer Lull in Market Volatility

Market volatility has steadily declined throughout 2021, but such lulls tend to be seasonal — meaning an expansion in the CBOE Volatility Index (VIX) could materialize in late summer or fall.

The CBOE Volatility Index (VIX) isn’t trading at all-time lows this summer, but for some, it’s likely starting to feel that way.

The VIX closed trading before the July 4, 2021 holiday right around 15.

For context, the all-time low in the VIX is about nine, while the all-time high is above 82. Considering that range, it’s safe to say that current volatility readings in the market are on the low side.

Additional volatility readings support the notion that “fear” has left the marketplace—at least temporarily.

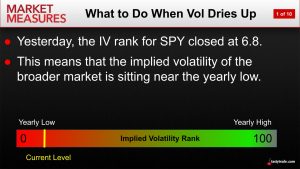

For example, according to tastytrade’s volatility metric “IV Rank,” implied volatility in the SPDR S&P 500 ETF Trust (SPY) has plummeted to a 52-week low. The IV Rank for SPY currently stands at 7, as shown in the image below.

As a reminder, IV Rank (aka Implied Volatility Rank) reports how current levels of implied volatility stack up against the most recent 52 weeks of data.

For example, imagine that implied volatility has ranged between 30 and 60 for hypothetical stock XYZ over the past year. If implied volatility is currently trading at 45, then the IV Rank for XYZ would be 50%—right in the middle of its one-year historical range.

On the other hand, if implied volatility was 60 in XYZ, then its IV Rank would be 100%. And if implied volatility was 30, then IV Rank would be 0%.

Options traders often look for opportunities to sell options and volatility when IV Rank is above 50%—depending on a trader’s outlook, trading approach and risk profile.

Circling back to the SPY, one can see how an IV Rank of 7% might not be that inspiring as it pertains to short premium positions.

One should also keep in mind that a dip in volatility during summer isn’t abnormal. Previous research conducted by tastytrade suggests that volatility has historically contracted in early summer, before expanding once again in September and October.

And while some volatility traders elect to purchase options premium when IV Rank plummets below 20%, there are pitfalls to that approach, too. The problem with long options is that they are constantly fighting against theta decay—or the reality that as time passes, options naturally lose value.

That begs the following question—how can traders adjust when volatility hits a lull?

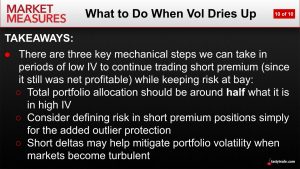

Fortunately, this precise topic was covered on a recent episode of Market Measures on the tastytrade financial network. And according to information explored on the show, there are several important steps that traders can take to tighten risk management controls during lulls in the VIX, while still remaining active in the markets, as outlined in the slide below.

Of course, trading small isn’t just for low volatility environments. Staying small and nimble can be recommended in any trading environment, because it can afford traders/investors the ability to capitalize on highly attractive opportunities when they materialize.

But trading small—especially for short premium traders—is particularly prudent in low volatility environments, because market participants never want to get caught on the wrong side of a market-wide expansion in volatility.

Along those lines, it may also be useful to utilize “defined risk” short options strategies in low volatility environments. Defined-risk means that the maximum loss of a position is known prior to trade deployment. And by defining risk, market participants can avoid the potential pain associated with a sudden updraft in market volatility.

Lastly, short options traders may also want to maintain a short delta portfolio lean in their portfolio. This is prudent because when volatility rises, market direction is usually down.

In such scenarios, short options traders that don’t have a portfolio-level hedge often feel pain not only from expanding volatility, but also direction. By establishing a short delta hedge, market participants can help protect themselves from corrective market conditions.

Readers seeking to learn more about the short delta portfolio hedge philosophy may want to review a previous installment of Options Jive which explores this topic in greater detail.

To stay active in low volatility environments, investors and traders can also employ other tactics to stay engaged—even if one’s active daily trading volume is reduced. Some of these tactics include:

- Exploring new sectors, products and strategies

- Identifying what’s moving

- Identifying pockets of the market with high IV Rank

- Staying wary of the long volatility trap

For more information on trading during lulls in the volatility, readers can review the complete episode of Market Measures—What to Do When Vol Dries Up when timing allows.

To follow everything moving the markets, readers can also tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST—at their convenience.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.