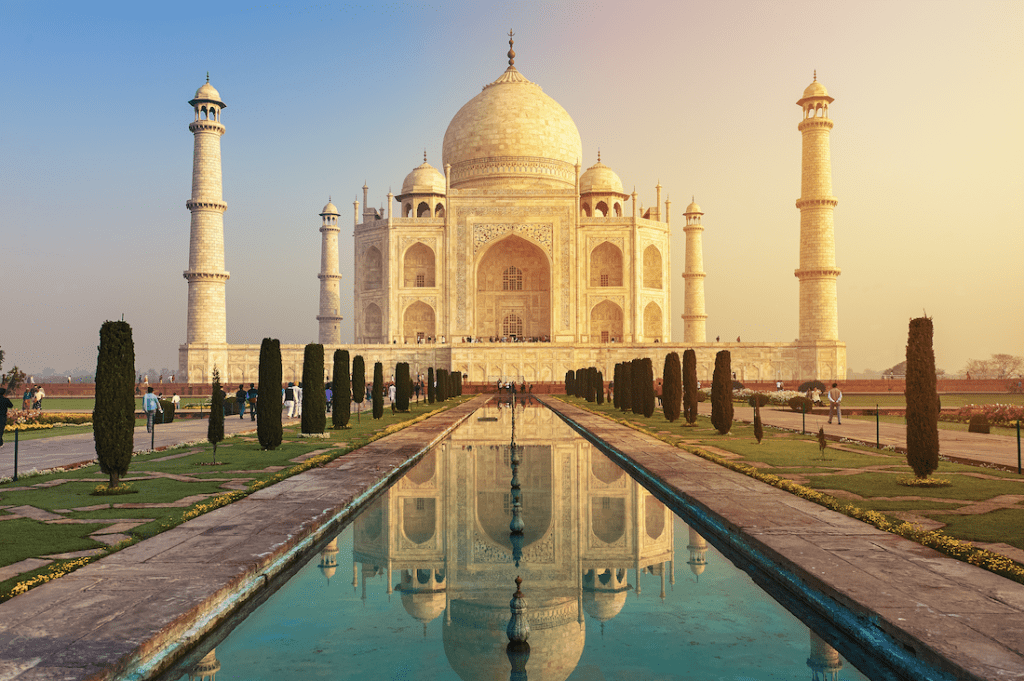

Trading the World’s Fastest Growing Economies: India, Bangladesh and Vietnam

The COVID-19 pandemic and the U.S.-China trade war have shaken up the global economic order, with countries such as Bangladesh, India and Vietnam now representing the world’s fastest-growing economies.

During the last several decades, China has dominated the conversation when it comes to global economic growth.

Back in 1985, China possessed the ninth-largest economy in the world. Today, China has the second-largest economy in the world, and is forecasted to overtake the United States in the number one slot as soon as the year 2030.

China, therefore, will remain a key player on the world’s economic stage for many years to come. However, as a result of the ongoing COVID-19 pandemic, and the U.S.-China trade war, the global economic gameboard has experienced a bit of shake-up in the last couple of years.

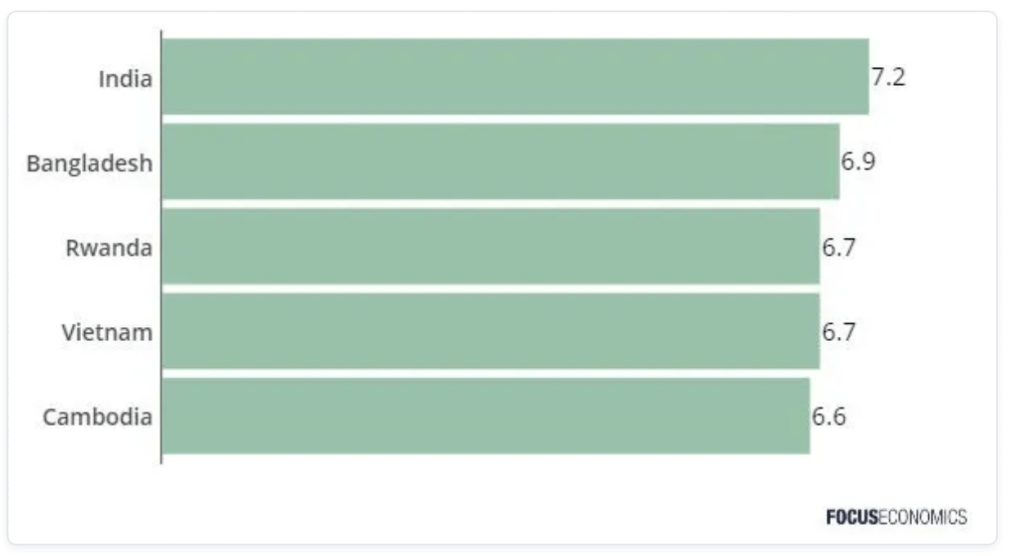

And current market date suggests that India, Bangladesh, Rwanda, Vietnam and Cambodia are poised to benefit during the foreseeable future. As illustrated in the chart below, FocusEconomics projects that these five countries will be the fastest growing economies in the world over the next five years (2021-2025).

Fastest-Growing Economies in the World (Projected, 2021-2025)

Based on early returns in 2022, the above forecast already looks prescient. Halfway through 2022, the International Monetary Fund (IMF) has projected that India will be the world’s fastest-growing economy in 2022, notching an annual growth rate of 8.2%. That’s a full percentage point above the forecast shown above!

India’s impressive growth story can’t be tied back to one thing in particular, but moreover due to a wide variety of economic improvements. Some of the country’s new prosperity is due to the fact that tens of millions of Indians have been pulled out of poverty in recent years, which has greatly contributed to a more productive workforce., and increased domestic consumption.

Additionally, the services sector—particularly information technology and telecommunications—has expanded exponentially in the last decade. The fact that many Indians speak fluent English has contributed greatly to this expansion, especially when it comes to the outsourcing of IT and telecom services to India from other countries.

Not surprisingly, some of the projected best-performers during the next five years have been gaining momentum for some time. As highlighted in the tweet below, the four countries with the highest average annual growth rates over the last 25 years include China (9.2%), India (7%), Vietnam (6.8%) and Bangladesh (5.9%).

Notably, growth in the Chinese economy is expected to be fairly subdued in 2022, with the IMF projecting a 4.4% growth rate for the Middle Kingdom.

China has pursued a so-called “zero COVID” policy during the last couple of years, which means the government locks down a region, or a city, when COVID infections get above the accepted threshold. These rolling lockdowns have served as a significant headwind for the Chinese economy since COVID-19 was first identified in Wuhan, China back in late 2019.

Economies on the Rise: Bangladesh and Vietnam

As a reminder, little-known Bangladesh is situated just east of India. The current borders for Bangladesh were defined around the same time that India and Pakistan were partitioned—back in 1947. However, the sovereign nation of Bangladesh wasn’t officially born until 1972, in the wake of the Bangladesh Liberation War.

From roughly 1947 to 1972, Bangladesh was known as “East Pakistan.” And during this period, the current nation of Pakistan was referred to as “West Pakistan.” Now “East Pakistan” and “West Pakistan” are known as Bangladesh and Pakistan, respectively.

These days, textiles, garments, and shoes make up the largest share of Bangladeshi exports—accounting for roughly 85% of the country’s total exports in 2020. Rapid growth in these sectors helps explain why Bangladesh has emerged as an economic leader on the world stage. But ongoing development in the country’s services sector has also been a big contributor.

As observed in the aforementioned data, Vietnam’s economy has also been a big mover in recent decades. And based on FocusEconomics’s five-year projections, Vietnam’s momentum isn’t expected to slow down anytime soon.

Political stability in Vietnam during recent decades has allowed the country to market its skilled labor force—and relatively low wages—to attract large amounts of foreign direct investment (FDI). Today, those investments have germinated into two burgeoning industries: electronics and garments.

Moreover, the timing of the U.S.-China trade war also served as a strategic advantage for Vietnam. Like China, the country is located in southeast Asia, and represents a logical choice for companies looking to move out of the Middle Kingdom—especially those that can leverage the existing electronics and garment supply chains that are already in place in the country.

For this reason, Vietnam is often cited as one of the biggest beneficiaries of the U.S.-China trade war, along with Mexico. One concern for Vietnam is the fragile health of the country’s current leader—Nguyen Phu Trong—who serves as the General Secretary of the Communist Party of Vietnam. The holder of this office is generally known as the “supreme leader” of Vietnam.

Unlike China, Vietnam’s handling of the COVID-19 crisis has been viewed globally as highly effective, which has allowed the country’s increasingly export-orientated economy to operate in a relatively seamless fashion.

For investors and traders, the rapid pace of development in India, Bangladesh and Vietnam are strong indicators that companies from these countries could one day be listed on global exchanges, including in the United States. That was certainly the case with China during the last decade, as its growing economic influence translated into hundreds of new listings on foreign exchanges.

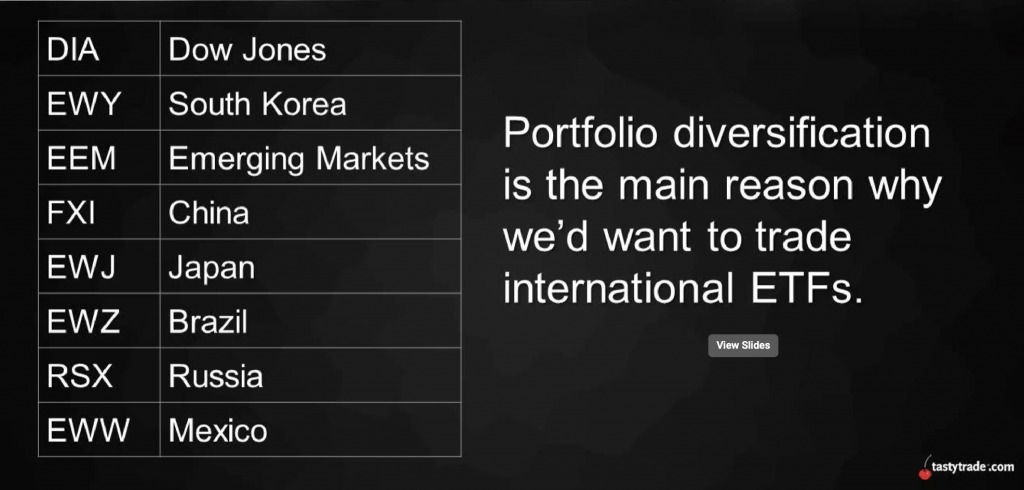

For the time being, market participants can look to country-specific ETFs for exposure to the world’s fastest-growing economies. Two key country ETFs for India and Vietnam include the iShares MSCI India ETF (INDA) and the VanEck Vietnam ETF (VNM). Furthermore, it’s expected that a Bangladesh-specific ETF will be available at some point in the near future.

For additional exposure to India, investors and traders can also consider the iShares India 50 ETF (INDY) and the iShares MSCI India Small-Cap ETF (SMIN). To learn more about country ETFs, readers can check out this episode of Market Measureson the tastytrade financial network.

To follow everything moving the financial markets, tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.