How This Sell-Off Stacks Up

Stocks declined in value more quickly this year than ever before

Volatility had been slowly declining in the markets for the last 11 years, but then the coronavirus-fueled downturn of 2020 struck like a bolt of lightning. Here is some perspective.

Generally, sell-offs in the equity markets cause volatility to increase because markets tend to go up more slowly than they go down. In other words, the velocity of equity market moves is faster to the downside than the upside, and those rapid down moves translate into higher volatility.

Because the S&P 500 moved roughly 30% to the downside in the four weeks before this was written, the question arises of how quickly volatility expanded. And how does this sell-off compare with previous ones?

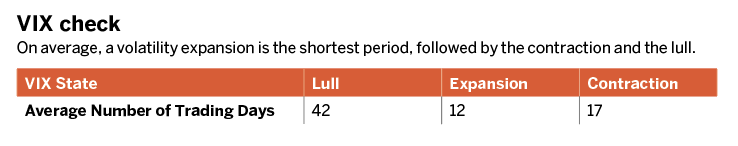

A lull is defined as any period when VIX is below 18.5. The expansion period starts when VIX goes above 18.5. The contraction period starts at the recent peak, where the expansion period ends, and ends when VIX goes below 18.5. (See “VIX check,” below.)

On average, the expansion period lasts the shortest, followed by the contraction period and the lull period—where volatility does nothing—which lasts the longest.

The sell-off at the end of February 2020 caused volatility to expand for 17 days.

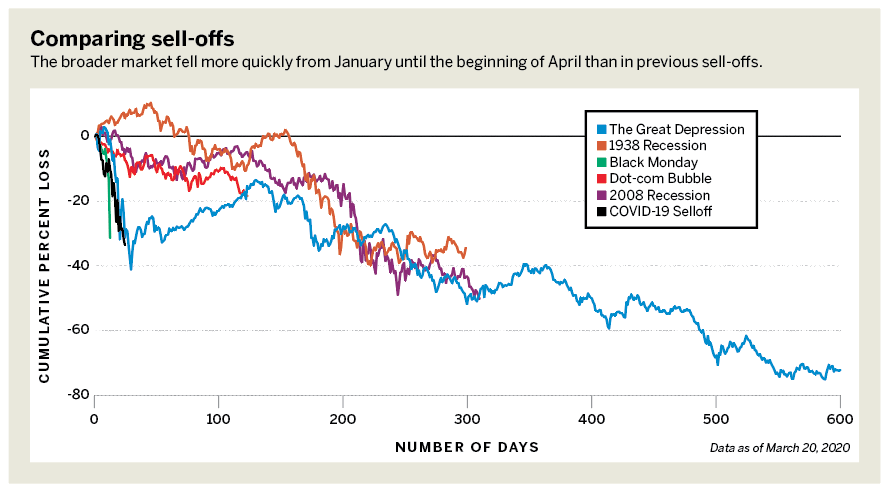

So how severe was this sell-off compared to history’s other famous declines? Let’s take a look at “Comparing sell-offs,” (below).

The speed of the 2020 sell-off, meaning the time it took the market to fall a certain percentage, is faster than any sell-off in history. That’s indicated in the graph because the 2020 sell-off has a steeper descent than any other sell-off.

That could be why volatility in the market has expanded to 2008 levels. The market is down only 30% from the 2020 highs, compared with a decline of roughly 50% at the bottom in 2009, but the severity of the sell-off is much more intense in 2020. The severity of sell-offs—not just the downward movement in the market—leads volatility higher.

Anton Kulikov is a trader, data scientist and research analyst at tastytrade. @antonkulikov97