Recovery Calls for Covered Calls

The fast and furious COVID-19 downturn provides the perfect prelude for this options strategy

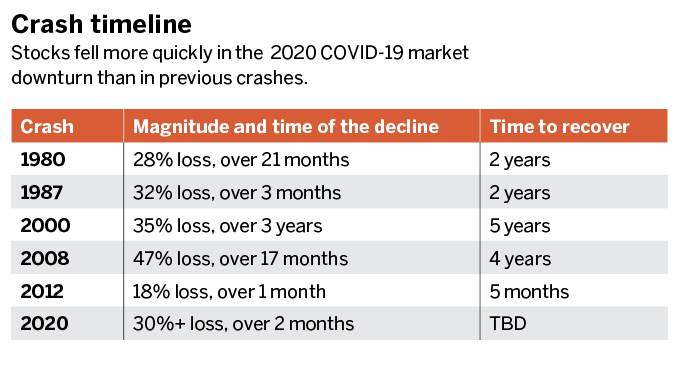

What made the 2020 COVID-19 market downturn unusual wasn’t the magnitude—the markets have been down more than 30% before. Instead, it was the speed. The plunge occurred in two months, while previous declines have occurred over several months or even more than a year. (See “Crash timeline,” below.)

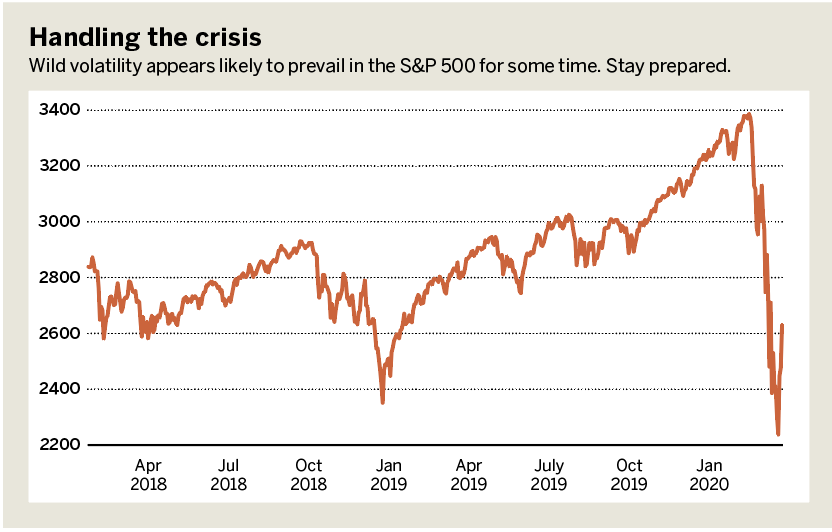

To play any recovery in the S&P 500, consider the information found in “Handling the crisis” (below, below).

The E-mini S&P 500 futures (/ES) might be too large for many accounts—a 200-point move in the S&P 500 Index equates to a $10,000 move in the futures. Micro E-mini S&P 500 futures (/MES) are the /ES’s little brother, at 1/10th the size, and move a respectable $1,000 per 200 points, but the lack of options makes it less of a deal for covered call writers.

Instead, consider 100 shares of SPY along with a covered call approach. Not only are prices at a discount, but fear has created opportunity in the options, thus making the covered call a theoretically advantageous strategy.

For example, at the beginning of the year, a covered call would protect the writer only 1% or 2% to the downside over the course of one month. Today, with volatility far outside the norm—and likely to stay outside for several months—the covered call strategy works especially well. A few months ago, an out-of-the-money call could be sold for $200, but as this is written they are selling for $1,200, raising the possibility of an increased cash flow.

Michael Rechenthin, Ph.D., aka “Dr. Data,” is the head of data science at tastytrade. @mrechenthin