Spreading for Risk Reduction

Traders can spread risk with calendar spreads, pairs trades and options

Short naked options are a preferred strategy among experienced traders because of their high probability of profit, ease of management and positive theta. But these strategies also have a significant drawback: large buying power requirements.

Because of their large theoretical risk, selling naked options requires a significant initial capital outlay. Consider a position in the Chinese E-commerce giant Alibaba (BABA). Selling the 240-strike call option requires $3,000 in buying power requirement, while buying the 210 put option, which has the same directional risk (delta), requires only $300. To reap the benefits of short options strategies but reduce the buying power requirement, traders can consider spreading.

Traders have many ways to spread risk. They do so in the futures market with calendar spreads, which involve buying the front month and selling the back month. Traders spread risk with pairs trades by buying and selling related securities simultaneously—such as gold and silver. And options traders spread risk by buying a further out-of-the-money option against their short option. All of these spreads reduce risk.

At the time of this writing, Alibaba is sitting on all-time highs since its initial public offering in 2014, up nearly 60% over the past year. At these levels, one can’t help but wonder if it’s overdue for a small price correction. One way to lean short would be to sell a call. The 240-strike call option expiring in February would bring in a roughly $300 credit and could make money in a variety of situations, including Alibaba sitting at its current price level, decreasing in price, and increasing roughly 7% but not penetrating the 240 strike. Compare that strategy with buying the 210 put option, which only makes money if Alibaba sells off.

To skirt the large capital requirement and maintain similar trade profitability profiles, traders can consider spreading their risk with an additional long call option. Instead of just selling the 240-call, they can sell the 240-call while simultaneously buying the 250-call, which turns the short call into a short call spread. Spreading risk with the long call brings the buying power requirement down from $3,000 to $850 while maintaining similar profitability characteristics.

Spreading the risk with a long call lowers the buying power requirement but also reduces the potential max profit. While the naked call nets a credit of roughly $300, the call spread only brings in $150. For traders with smaller trading accounts, the 50% reduction in profit potential compared with the 71% reduction in buying power requirement may be worth considering. Having more but smaller positions enables traders to diversify without pushing their capital comfort zone.

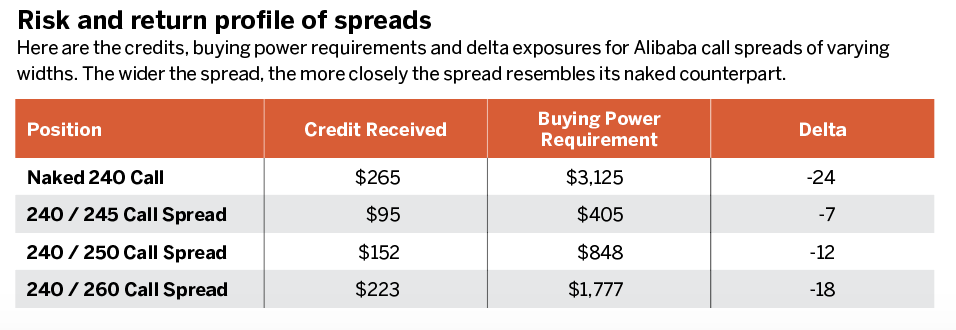

Additionally, the flexibility of options helps traders adjust the width of the spread to fine-tune risk and return. The wider the spread, the more closely the trade resembles the naked position, which results in a larger credit and a larger buying power requirement. The narrower the spread, the more slowly the position’s profit and loss will change, which results in a lower credit and a lower buying power requirement.

These spreading mechanics aren’t limited just to naked calls and puts. They can also be used to turn strangles into iron condors, and ratio spreads into broken-wing-butterflies. When capital requirements become too burdensome, consider spreading to slow down a position’s profit and loss and reduce initial capital outlay.

Michael Gough enjoys retail trading and writing code. He works in business and product development at the Small Exchange, building index-based futures and professional partnerships.