Trades

CNK: Movie Moves

By Doug Busch

|

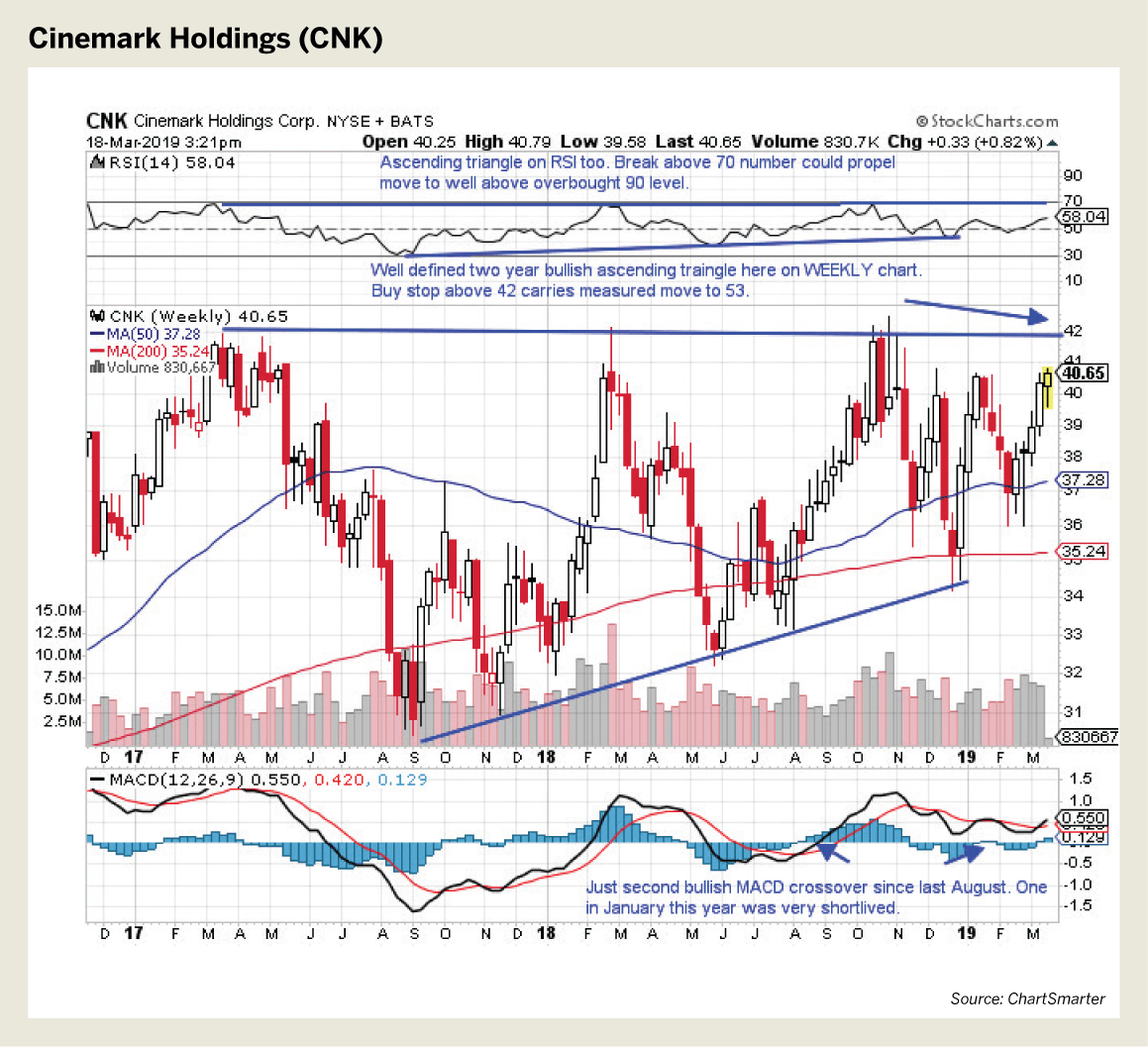

Cinemark Holdings (CNK) is up 14% year-to-date and 4% during the last one-year period. Already sporting an attractive dividend yield of 3.3%, Cinemark is looking to extend its winning streak to its longest in 13 months. While this stock has had issues just above $40 since 2015, a decisive break could see a powerful move all the way up to $53.

Douglas Busch, CMT, trades U.S. equities using technical analysis with an emphasis on Japanese candlesticks. @chartsmarter

Light This Candle

-

AMZN: Prime Sell

By Doug Busch

|Candlestick chart analysis for intermediate-term trading As the third-largest Nasdaq and S&P 500 component, Amazon (AMZN) has a significantly large influence over market direction. At 22%, it is the top… -

CGC: High Volume Trade

By Doug Busch

|Candlestick chart analysis for intermediate-term trading Canopy Growth (CGC) trades an average of $162 million worth of stock a day (see pg. 50). This figure provides a good way of… -

TTWO: Take-TwoTransactions

By Doug Busch

|Candlestick chart analysis for intermediate-term trading Take a look at this daily chart of Take-Two Interactive Software Inc. (TTWO). It’s evident that price is about to break above the 200-day… -

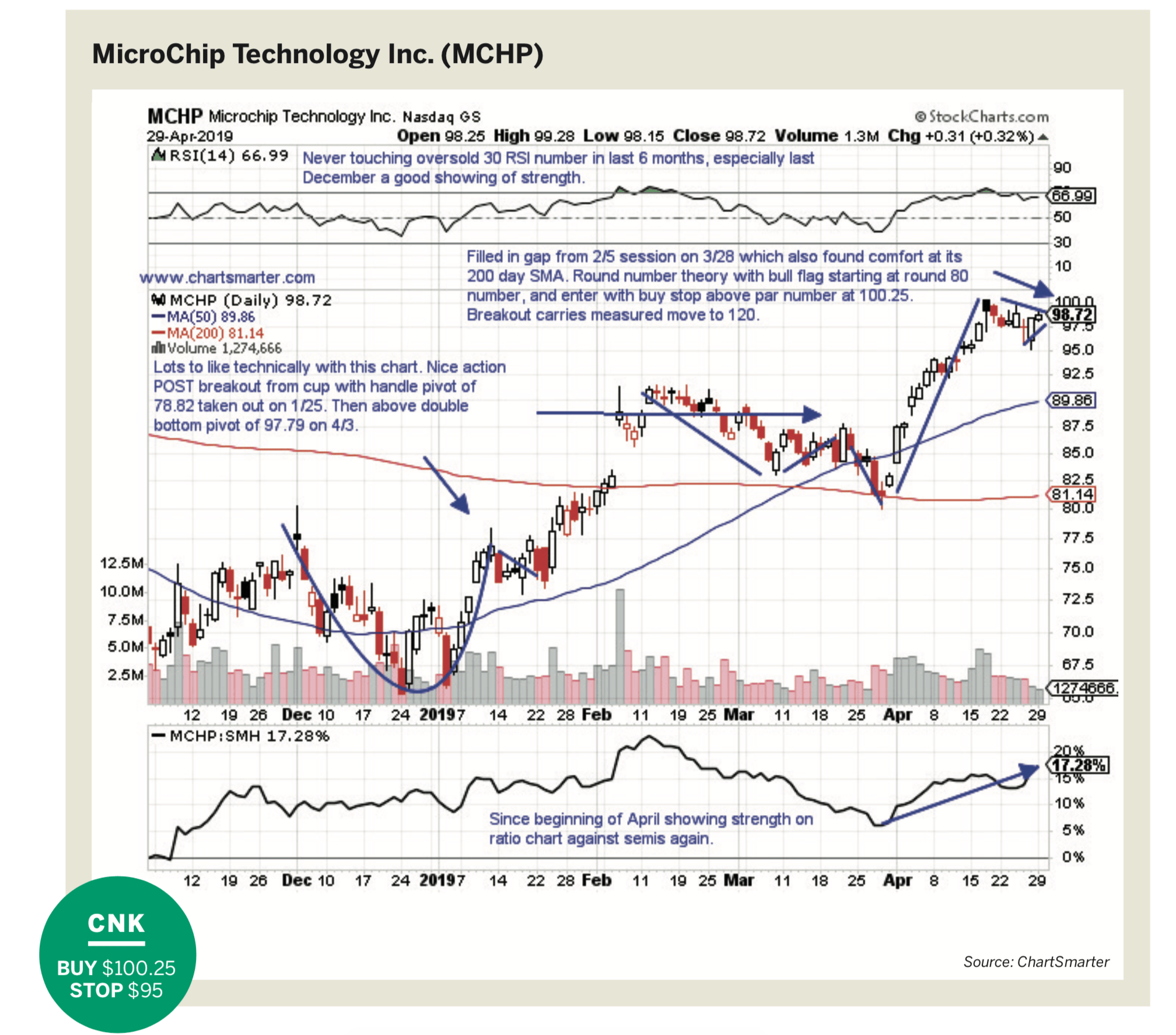

MCHP: Option This Breakout

By Doug Busch

|MicroChip Technology Inc. (MCHP) is offering a best in breed semi growth play with a dividend yield of 1.5%. -

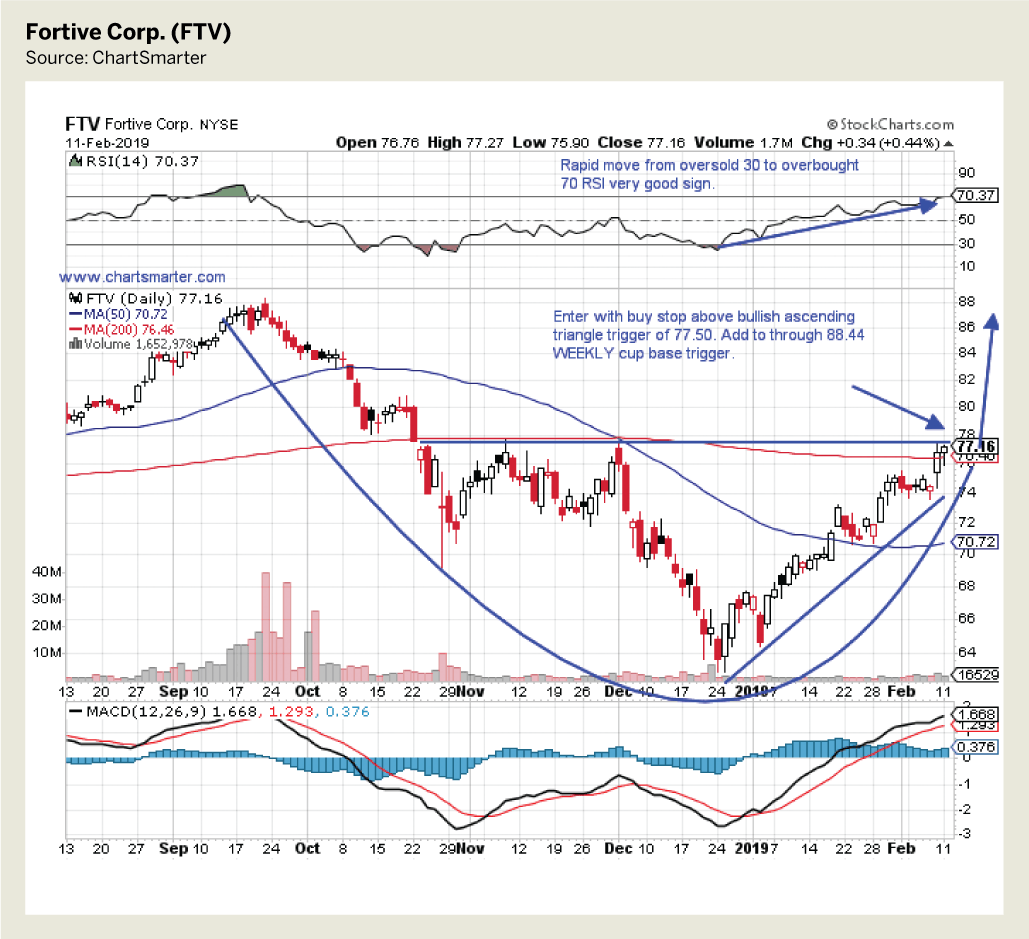

FTV: Gearing for breakout

By Doug Busch

|Fortive Corp. (FTV), a July 2016 spin-off from Danaher (DHR), is an industrial growth company that designs, manufactures, and markets engineered products, software and services worldwide for the transportation and…