SMCI: Overextended, But a Potential Stock Split Could Push Shares Higher

Shares of Super Micro Computer (SMCI) are up 180% so far in 2024, and could rally further if the company announces a stock split

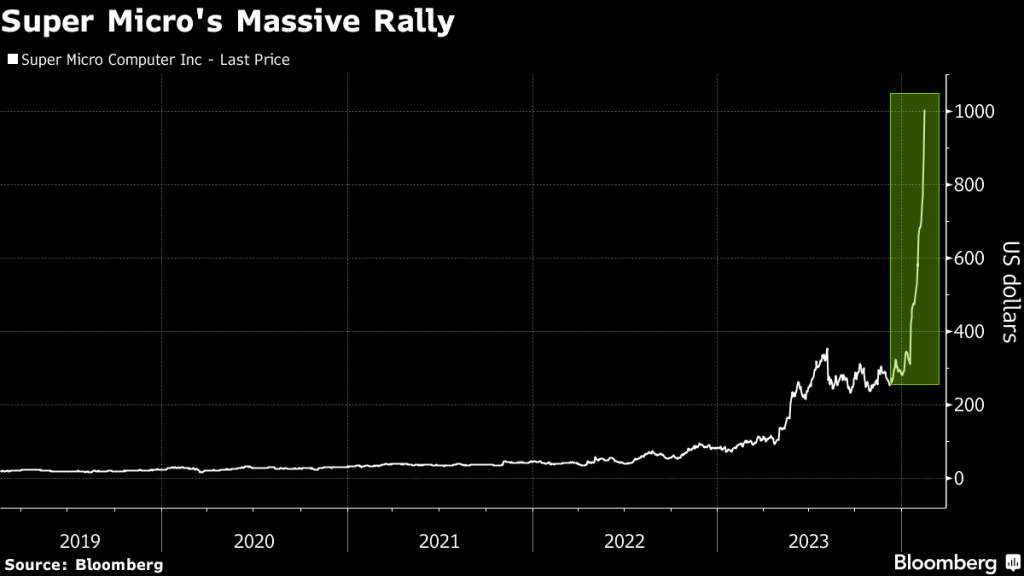

- Shares of Super Micro Computer Inc. (SMCI) have rallied by approximately 180% year-to-date.

- As of mid-February, SMCI stock is trading for approximately $800/share.

- Supermicro hasn’t previously conducted a stock split, but in the wake of the recent rally, a 10-for-1 split is looking increasingly likely.

- Based on an overextended price/earnings ratio, Supermicro’s valuation remains rich, and any boost from a stock split announcement might be viewed as a potential selling opportunity.

In the last couple of weeks, Super Micro Computer Inc. (SMCI) has emerged as not only one of the most important stocks in the market, but also one of the most riveting narratives in the emerging artificial intelligence (AI) sector.

The company reported a strong surge in revenues and earnings during the fourth quarter of 2023, which has contributed to a parabolic move in the company’s shares. So far in 2024, shares of SMCI are up roughly 180%.

Considering that SMCI’s performance has eclipsed even that of Nvidia’s over the last five years, it’s no great surprise that Supermicro has become a key focus on Wall Street. Demand is surging for AI-related products and services, and Supermicro has found itself at the center of a perfect storm, much like Nvidia.

Based on recent events, one of the most important near-term catalysts for SMCI could be the announcement of a stock split. At current prices, that would likely equate to a 10-for-1 split, which would drop the price of a single share back to more palatable levels.

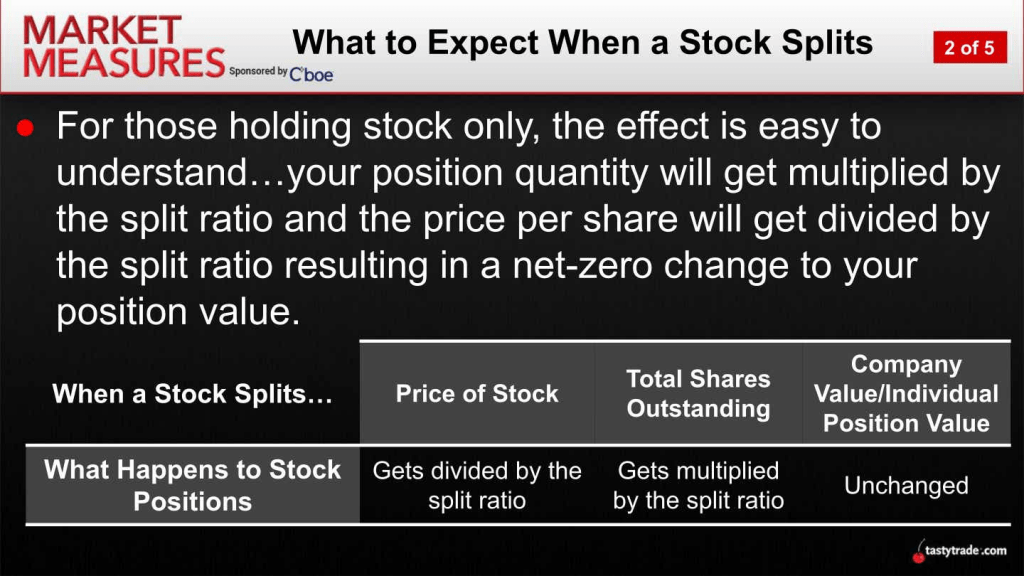

Stock splits occur when companies break up existing shares to create a higher number of lower-value shares. The intent of a split is usually to make shares more affordable to a wider pool of market participants, which can improve the liquidity of the shares in the marketplace. If it occurs, this would be Supermicro’s first-ever stock split.

Not long ago, the high-flying manufacturer of the popular weight-loss drug Ozempic split its shares. Last autumn, Novo Nordisk (NVO) split its shares 2-for-1. With a 2-for-1 stock split, investors receive one additional share for each share they already own. So investors holding 100 shares of NVO now own 200 shares. After the split, each share trades for half of what it did before the split.

Leading up to the 2-for-1 split, Novo Nordisk was trading at roughly $200/share, which means they were priced at around $100/share post-split. After a 20% rally in early 2024, NVO stock now trades for about $120/share. With a market capitalization of roughly $425 billion, Novo Nordisk is one of the most valuable companies in the European market.

If Supermicro conducts a stock split, it would be executed in much the same fashion. Recently, SMCI shares have traded between roughly $800 and $1,000/share, which indicates the company might opt for a 10-for-1 split. That means existing shareholders would receive nine extra shares of stock for each share they already own. On the official split date, the underlying share price of SMCI would be divided by 10.

With SMCI currently trading about $800/share, that means the post-split share price for a single share of stock would be $80 ($800/10 = $80). Importantly, the total value of an investor’s position remains the same after the split, as does the overall market capitalization of the company.

However, with shares now priced at more affordable levels, the market for SMCI shares could see increased interest from retail traders. With more shares available for trading, liquidity would undoubtedly improve, as well.

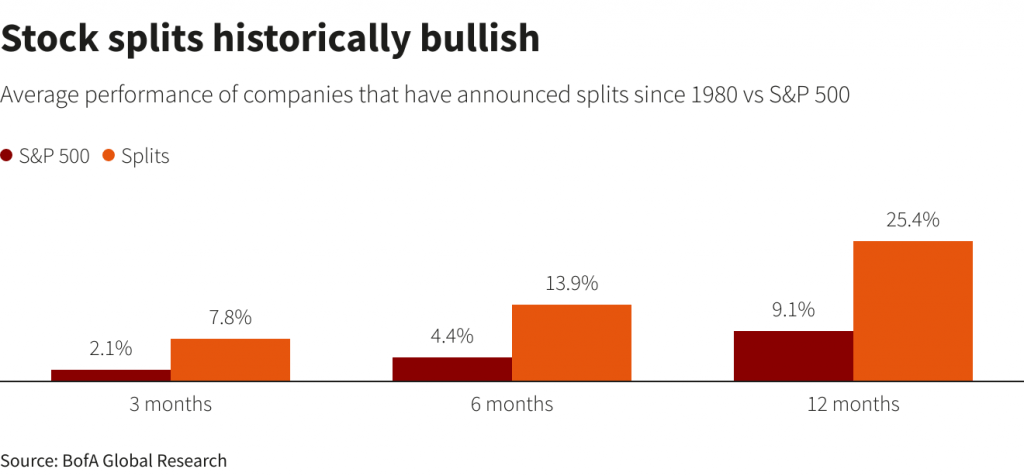

Stock splits can be bullish, at least in the short term

Looking beyond the mechanics of the stock split, such an announcement could also be bullish for the underlying shares of Supermicro. In recent years, other big-name tech companies such as Amazon (AMZN), Apple (AAPL), Nvidia (NVDA) and Tesla (TSLA) all saw their shares rally in the wake of their respective split announcements.

Of those, the most recent was Amazon’s 20-for-1 stock split, back in June of 2022. After Amazon announced plans for the split, the stock proceeded to rally by about 22% between March 9 and March 29.

However, 2022 wasn’t a great year in the markets, and the stock ultimately fell back to earth leading up to the official split date on June 6.

Nvidia, for its part, announced a 4-for-1 stock split on May 21 of 2021, and shares in the chipmaker rallied by roughly 35% in the lead-up to the official split date on July 20. Along those lines, shares of Tesla rose by an incredible 81% in the three weeks between the announcement of a stock split (Aug. 11, 2021) and the official split date (Aug. 31, 2021).

That said, one can’t assume that shares of Supermicro are guaranteed to rally as a result of a stock split announcement. If broader market sentiment turns bearish—due to a slowdown in the economy or some other reason—shares of SMCI could easily move lower between the day the split is announced and the official split date.

However, if the current bull run continues, and SMCI announces the split in a favorable trading environment, the company’s underlying shares could easily experience a boost. It should be noted that Nvidia could also announce a stock split in 2024, considering that the company’s shares are now trading well above $700/share. If that happens, a 10-for-1 split appears likely.

Supermicro’s valuation remains a moving target

As stated previously, the pre-split and post-split market capitalization of Super Micro Computer remains the same. The split doesn’t technically impact the company’s market capitalization, or its underlying valuation. That means from a fundamental standpoint, a potential stock split wouldn’t necessarily make the shares more attractive.

From that perspective, investors and traders entering new positions in SMCI after a potential split announcement (or at any time, for that matter) should ensure they are comfortable with the company’s overall valuation before doing so.

As we pointed out in a recent analysis, Supermicro’s price/earnings ratio (P/E ratio) is currently overextended, particularly as compared to its peers in the same industry. Moreover, it’s difficult to estimate a fair valuation for Supermicro at this time, due to the recent surge in revenue and earnings.

Importantly, Supermicro operates in a different niche of the AI sector than Nvidia. Supermicro is an infrastructure company that specializes in data center-focused hardware and software. Due to the company’s innovative approach and long-term partnership with Nvidia, it has found itself in an enviable position amidst the current AI revolution.

In the last quarter of 2023, SMCI saw its revenues increase by more than 100% as compared to the year prior, which provides a clear illustration of just how dramatically the company’s fortunes have improved in a very short period. The next quarterly earnings report for SMCI will be of particular interest, because investors and traders will be able to better assess whether that level of growth is sustainable through 2024, and possibly beyond.

One thing Supermicro has going for it right now is that the company has already started the process of growing its production capacity, which means it is poised to leverage rising levels of demand, and boost its bottom line earnings. The company recently indicated that it expects to effectively double its production capacity when its new manufacturing facility in Malaysia comes online later this year.

That’s a critical factor because when demand surges for a given product or service, supply-side issues can often complicate a company’s ability to capitalize upon their good fortunes. Assuming that demand remains firm, Supermicro’s revenues and earnings should continue to grow at a robust rate in 2024 and 2025.

One complication at this time is that it’s difficult to accurately forecast the company’s future growth rates. That’s one of the reasons the stock is going bananas, because estimating a high-confidence valuation for Supermicro at this time is basically a speculative endeavor, steeped in subjective—and low confidence—assumptions.

It’s also hard to predict whether some of Supermicro’s competitors, such as Dell Technologies (DELL) and Hewlett Packard Enterprise (HPE), might see an in-kind surge in demand for their data center solutions. If they do, the current market share in the industry may not change much. But if they don’t, and Supermicro can significantly grow its market share in the industry, then a higher earnings multiple might be justified.

Dell, for its part, saw stronger than expected demand for its AI-focused servers in the fourth quarter of 2023. Dell indicated that revenues linked to its AI servers grew by about 10% last quarter. Along those lines, Hewlett Packard Enterprise announced late last year that demand for its data-focused AI solutions had increased by about 25%.

Both Hewlett Packard and Dell offer AI-capable server solutions that can pair effectively with Nvidia’s chips, indicating that Supermicro’s competitive position isn’t nearly as strong as Nvidia’s—the latter holds a virtual monopoly in the AI chip market. For the time being, that means SMCI’s inflated P/E ratio, which is now above 60, remains the elephant in the room. In comparison, the P/E ratio of the broader server industry is closer to 28.

At present, Supermicro has indicated that its revenues will grow by about 11-12% in Q1 of 2024, as compared to the last quarter of 2023. Unless Supermicro blows that forecast out of the water, shares could be due for a sharp pullback, bringing the company’s valuation back in line with the industry average.

On the other hand, if SMCI produces another record quarter, and indicates that full-year revenue and earnings will be higher than previously expected, shares could react positively. By consistently beating its own earrings guidance, Supermicro could also help justify the current sky-high P/E.

It should be noted that Supermicro may also opt to conduct a secondary offering, to raise capital for new investments. For example, if management at Supermicro is currently eyeing a potential acquisition, the chances of a secondary offering might be a little stronger. But at present, the company has more than $700 million in cash on hand, which means there isn’t necessarily a pressing need for capital.

All told, investors and traders should continue to tread carefully in regard to initiating new positions in Supermicro, especially those that are averse to volatility. As illustrated by the 20% drop on February 16, shares of SMCI are subject to large, unexpected gap moves.

Recent news that insiders have been cashing out is another important signal. And one can’t overlook the fact that Supermicro was conspicuously absent from Nvidia’s recent disclosure of its AI-focused investments.

A potential stock-split announcement could result in further upside for shares of SMCI, but at the end of the day, the company will need to justify its current valuation through consistently impressive earnings results. If it can’t do that, the risk of a sharp pullback increases substantially.

To follow everything moving the markets in 2024, including the options and futures markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.