Market Uncertainty and the Fear Gauge

The great thing about stock options is that they provide so much insight into market sentiment. For example, when uncertainty is rising in the stock market, that is generally indicated by rising options prices.

That means investors and traders can track options prices to gain insight into perceived risks in the markets. An easy way to monitor such indicators is through the CBOE Volatility Index, better known by its ticker: VIX.

The VIX, which is calculated using options prices in the S&P 500 index, has averaged about 19 throughout its lifetime. During 2020, the VIX actually set its highest-ever closing level, at 82.69. And during the last several months, the VIX has consistently traded between 25 and 30.

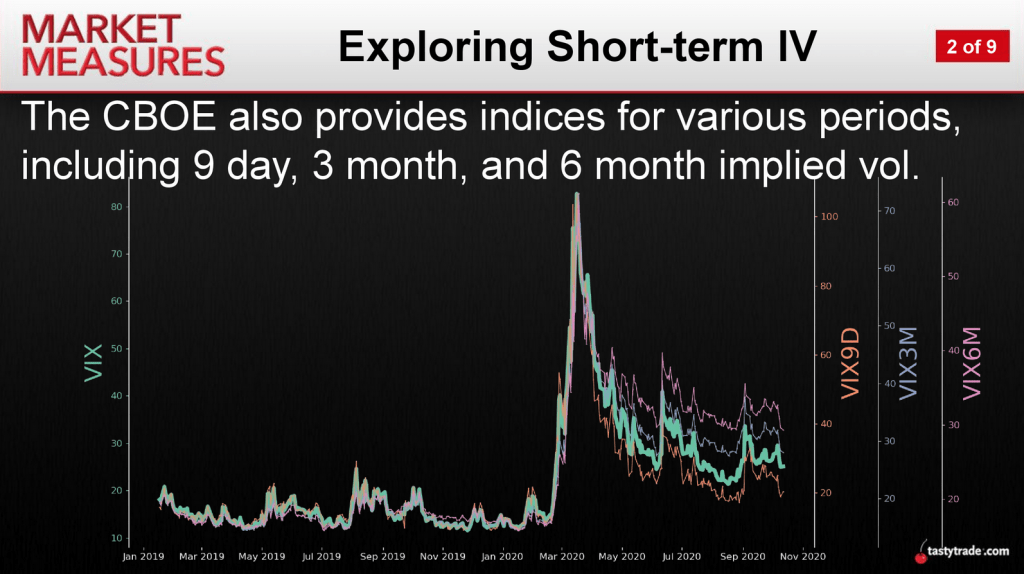

It’s important to keep in mind that the VIX tracks near-term volatility expectations looking forward roughly 30 days. But there are additional VIX products that traders can monitor to expand their view of the volatility timeline.

For example, nine-day volatility (i.e. shorter-term volatility expectations) can be monitored via the VIX9D, whereas three-month and six-month volatility (i.e. longer-term volatility expectations) can be tracked via the VIX3M and VIX6M, respectively. A wider view of the volatility timeline, using those additional symbols, is illustrated in the graphic below.

One can see how an expanded view of volatility, using these additional metrics, provides even more robust insights into market sentiment. At present, these volatility metrics are currently trading at the levels indicated below:

- VIX nine-day: 24

- VIX 30-day: 28

- VIX three-month: 29

- VIX six-month: 29

As one can in the above data, the current expectations for volatility are relatively flat going out in time. These levels might also be characterized as “elevated.”

The market’s expectation for consistently elevated market volatility going out into the future is in all likelihood linked to uncertainties associated with the ongoing COVID-19 pandemic. If an end to the pandemic ever becomes clear, one would expect that longer-term volatility metrics would likely decline.

An expanded view of the volatility timeline, using metrics such as these, is commonly referred to as the “volatility term structure.” The volatility term structure can be flat, as it is now, or it can be increasing or decreasing going out in time.

The term “contango” refers to a volatility term structure in which expectations for volatility increase going out in the future (i.e. six-month VIX is greater than three-month VIX). This is actually referred to as the “normal” volatility term structure because uncertainty generally rises the further one goes out in time.

The reverse situation is referred to as “backwardation.” When the volatility term structure is “backwardized,” that means future volatility expectations decrease going out into the future.

Backwardation in volatility expectations can materialize when near-term volatility explodes and traders expect that at some point in the future, things will normalize again (i.e. volatility will contract). For example, when the VIX spiked above 80 in March, the volatility term structure was in backwardation—because three-month and six-month volatility were lower than the normal 30-day VIX.

Another situation that can create a backwardized volatility term structure is when an important event is expected to occur in the near term. Leading up to this event, the VIX might be elevated, but looking further out into the future, volatility expectations might be more muted.

Depending on one’s outlook, strategic approach and risk profile, it’s possible that investors and traders can use an awareness of the volatility term structure to optimize their trading approach, or how they risk-manage their portfolios.

The tastytrade financial network has conducted several studies on volatility term structure, and readers are encouraged to review this information when timing allows:

- Market Measures: Exploring the Volatility Term Structure

- Options Jive: The Term Structure of Volatility

- Research Specials: Trading the VIX Term Structure

To follow everything moving the markets, readers can tune into TASTYTRADE LIVE weekdays from 7 a.m. to 4 p.m. Central Time.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.