Using LEAPS Options to Play the 80% Correction in Lithium Prices

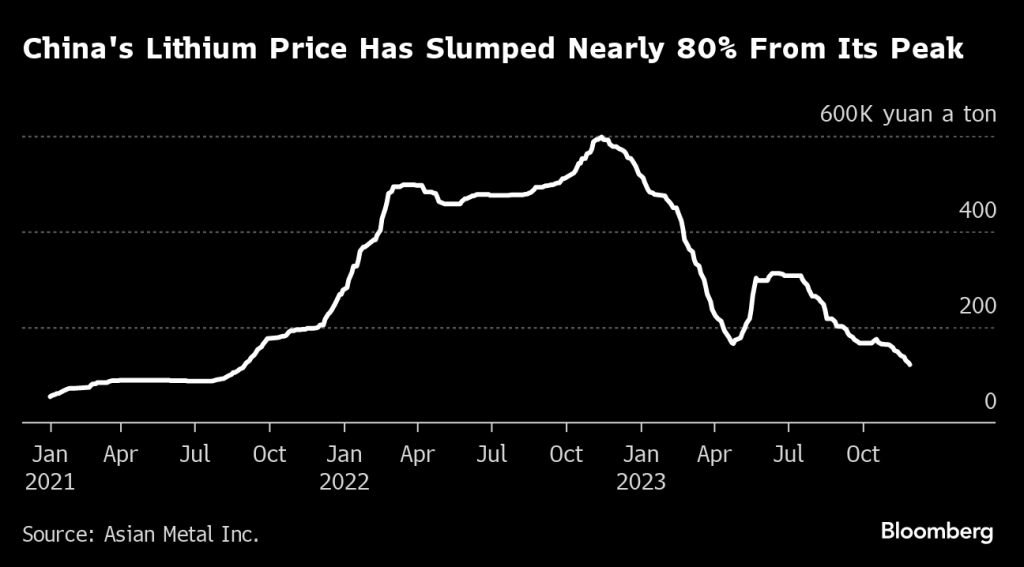

After an 80% price correction in 2023, the lithium market appears poised for a rebound, especially if the global economy grows at a faster than expected pace in 2024

- Rising global inventories of lithium have weighed heavily on prices in 2023, pushing futures down more than 80% year-to-date.

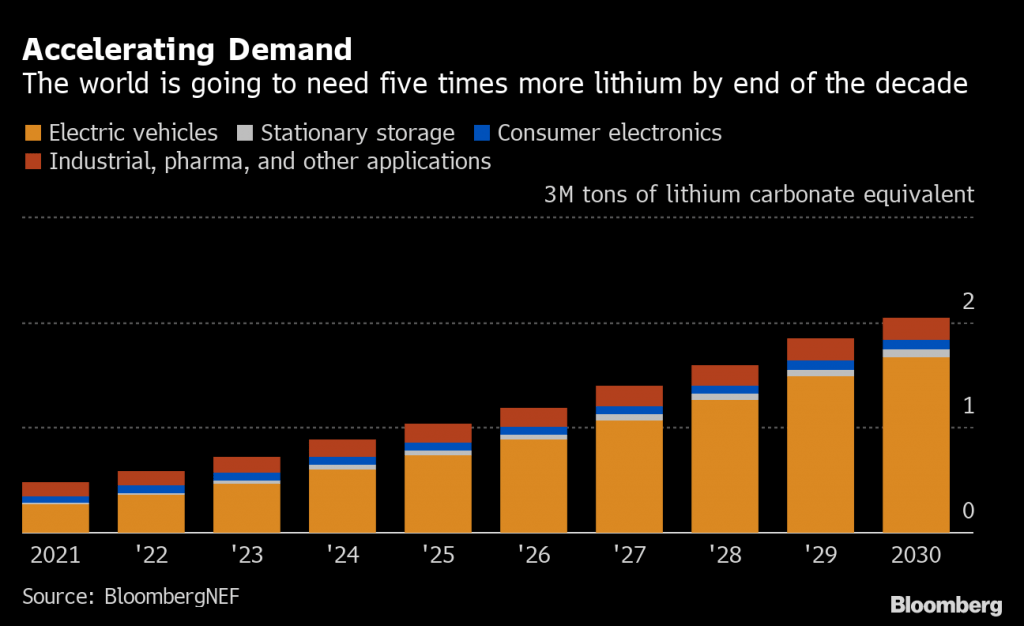

- The largest single consumer of lithium carbonate is the automotive industry, due to metal’s heavy use in the batteries of electric vehicles (EVs).

- Investors and traders bullish on the lithium market can consider using futures, equities or options to play a rebound in prices, including longer-dated LEAPS options.

In the commodities universe, the supply vs. demand narrative is always paramount.

Look at the cocoa market, which has been besieged by shortages during the last couple of years. The price of cocoa has skyrocketed in 2023, blowing through its previous all-time high.

On the other end of the spectrum, lithium prices have gotten destroyed in 2023. Year-to-date, lithium prices are down roughly 80%, dropping from over $80,000 per ton all the way below $15,000 per ton.

In the case of lithium, it appears that excess inventories have weighed heavily on prices. According to one lithium producer in China, “overseas [customers] are cutting their orders because they cannot use up the amount they purchased under long-term contract.”

Interestingly, the collapse in lithium prices follows closely on the heels of an epic rally.

Lithium prices started climbing back in 2021 as the emerging electric vehicle (EV) sector started eating into available supplies. At that time, annual lithium production wasn’t robust enough to keep pace with the skyrocketing demand for EVs, and their lithium-heavy battery packs.

But the lithium industry has been working hard to remedy that, and looks to have overcome the supply deficits that plagued the market in 2022. Next year, global lithium production is expected to top 1.4 million tons, which would be 40% more than what was produced in 2023.

On top of increased supply, the global economy has cooled off somewhat in recent months. As a result, end-users of lithium are still working through their existing inventories, as opposed to signing new supply contracts.

For the lithium niche of the financial markets, that means a stronger than expected economic rebound in H1 2024 could boost lithium prices in the new year. Ideally, that would involve increased demand for electric vehicles, because the EV sector is the largest single end-user of lithium carbonate.

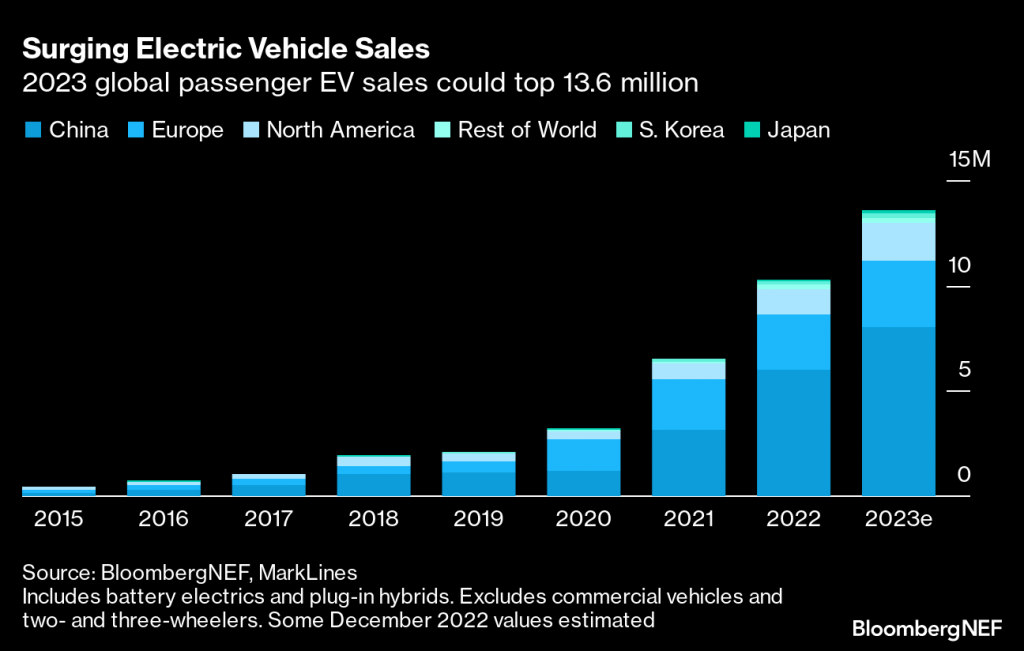

Sales of battery-electric vehicles (BEVs), which are powered by lithium batteries, have been growing rapidly in recent years.

Sales of BEVs are expected to rise this year by more than 30% as compared to last year, climbing to 14 million total units. By 2030, that figure could balloon to 30 million units annually, if not more.

According to current estimates, lithium production is expected to outstrip demand in 2024. However, those projections assume that economic growth remains anemic. As a result, lithium prices could easily rebound if global economic growth is stronger than expected next year, helping to boost the demand for EVs.

How to play a rebound in lithium prices

Market participants seeking to play a rebound in lithium prices have several choices when it comes to potential trade/investment vehicles.

In general, these choices include futures, stocks and ETFs. However, one could also pair one of the aforementioned securities with options, as well. For example, using futures options or longer-dated equity options, which are known as Long-term Equity Anticipation Securities (LEAPS).

Lithium-focused futures

One way to profit from an appreciation in the price of lithium would be to take a long position in a lithium futures contract (LC:COM). Futures contracts obligate the buyer to purchase a specified asset, such as a commodity (e.g., oil, gold, wheat), at a predetermined price and date in the future.

When taking a long position in the lithium futures, the investor/trader basically agrees to buy lithium at a specified future date at the current contract price. If the price of lithium increases as expected, then the value of that contract also rises.

To realize a profit, the trader needs to sell a futures contract at a higher price than the purchase price, benefiting from the price difference multiplied by the contract size.

In the futures market this is called offsetting. By taking an equal and opposite position in the same contract, you effectively eliminate your exposure to the market and close out the trade. It’s important to match the specific contract, expiration date, and quantity to ensure a proper closeout of the position.

Futures can be a great vehicle for taking long and short positions in commodities. That said, not all market participants are comfortable with the futures market. Unlike traditional investments like stocks or bonds, futures contracts are highly leveraged, meaning that a small price movement in the underlying asset can lead to significant gains or losses.

On top of that, futures contracts have expiration dates, and traders must either roll their positions into new contracts before expiration, or close them outright with an offsetting position. This process requires continuous attention to market conditions and contract expirations, which may not suit investors/traders that don’t have the time to allocate to this level of active management.

Lithium-focused stocks and ETFs

Another way to access exposure to the lithium market is through the equity market, using single stocks and/or ETFs.

Commodity-focused stocks and ETFs often trade in the same direction of the underlying commodity that they are associated with. For example, when oil prices rally, oil stocks often rally in kind.

However, that’s not always the case, because bearish market sentiment can at times weigh on the broader stock market, pushing stock prices lower. As such, there can be instances when a given commodity is rallying in price and the associated stock sector is falling in value.

That said, those instances aren’t common. Over the long term, equities levered to a particular commodity will generally move in the same direction as that commodity. That’s certainly been the case with the Global X Lithium & Battery Tech ETF (LIT) in recent years.

During 2021 and 2022, shares in LIT rallied along with the lithium futures market. For example, from April 2020 through November 2022, lithium prices rallied by more than 1,300%. Over that same period, shares in LIT appreciated by nearly 400%.

Likewise, since peaking in November of last year, lithium futures prices are down roughly 80%. Over that same period, LIT has dropped by 48%. In 2023, LIT is down 30% in kind with the lithium correction, while the S&P 500 is up closer to 25%.

These patterns clearly illustrate that LIT is more closely levered to the price of lithium than it is to the broader stock market. As such, it’s virtually assured that any increase in the underlying price of lithium would trigger an associated rally in LIT.

In addition to lithium-focused ETFs, investors and traders seeking to play a rebound in the price of lithium can also consider single stocks operating in the lithium industry, particularly miners/producers.

One of the world’s best-known lithium producers is Albemarle Corporation (ALB). The company is headquartered in the United States and trades on the New York Stock Exchange. With a market capitalization in excess of $17 billion, Albemarle is not only the world’s most valuable publicly-traded lithium miner, but it is also the world’s largest producer of lithium on an annual basis.

Albemarle owns and operates lithium extraction/processing facilities in Australia, Chile and the United States. The vast majority of the world’s lithium is currently produced in Australia and Chile, but China has been climbing the ranks, and now ranks third.

Much like the Global X Lithium & Battery Tech ETF, shares in Albemarle are highly correlated with the underlying price of lithium. When lithium prices rallied by over 1,300% between April of 2020 and November 2022, shares in ALB appreciated by roughly 525%.

Since lithium prices reversed course in November 2022, and fell by 80%, shares in ALB have corrected by more than 50%. Last November, the stock traded for over $325/share. Today, ALB trades for closer to $150 per share.

Notably, Albemarle is also the single largest holding in the Global X Lithium & Battery Tech ETF (LIT). At present, the ALB position in LIT accounts for roughly 9% of the ETF’s total assets.

ALB and LIT share a strong, positive correlation. Over the last three months, the average daily correlation between ALB and LIT is 0.70. That degree of positive correlation indicates that the two underlyings typically move in the same direction, and to a similar degree.

As such, investors and traders seeking to play a rebound in lithium prices could undoubtedly consider long positions in LIT or ALB as a way to do so.

Watch How I Would Use LEAP Options to Grow My Portfolio to learn more.

Lithium-focused LEAPS options

In addition to futures, stocks and ETFs, investors and traders can also consider an options-focused position to play a rebound in lithium prices. For example, buying calls in Albemarle Corporation (ALB) or the Global X Lithium & Battery Tech ETF (LIT).

The primary risk with options is somewhat similar to that of futures, because options have definitive expiration dates. That means if an investor or trader tried to play a rebound in lithium prices using a near-term option (60 days or less), there’s a chance that lithium prices could trade sideways (or lower) during the life of the option.

As a result, investors and traders active in the options markets might instead consider Long-term Equity Anticipation Securities (LEAPS), in favor of weekly or monthly options. LEAPS are basically identical to regular weekly and monthly equity options, but they possess longer expiration dates. LEAPS expire 12 months from the trade date, or later.

For investors and traders seeking to play a rebound in the price of lithium, LEAPS options may therefore represent a viable choice, depending on one’s outlook and risk profile. At present, both ALB and LIT offer LEAPS options that expire in January of 2025 and January of 2026.

There are two primary advantages when it comes to LEAPS, especially as it relates to the current opportunity in the lithium market. First, LEAPS options don’t expire for a year. That means if an investor/trader bought a LEAPS option in ALB or LIT, there’s a long runway for that particular trade to produce a positive result.

Moreover, LEAPS options provide the investor with the right to control the stock for an extended period at a fraction of the cost of owning the underlying stock outright. Along those lines, consider this hypothetical example with stock XYZ priced at $100 per share:

- Buying Stock in XYZ: To own 100 shares of stock XYZ, one would need to invest $10,000 (100 shares x $100/share). This position clearly requires a significant upfront capital outlay.

- Buying a LEAPS Option in XYZ: Alternatively, one could purchase a LEAPS call option on XYZ. For example, a one-year LEAPS option with a strike price of $110. This option might cost $5 per contract (representing 100 shares). The total cost would therefore be $500 (100 shares x $5/contract x the number of contracts = $500).

The outlay of capital to control 100 shares of XYZ is vastly reduced when using a LEAPS call option. For a $500 capital outlay, the investor/trader controls the same amount of stock in XYZ as a 100 share stock position—the latter of which requires $10,000 in capital.

One limitation of the option position is that it will expire in 12 months, while the stock position theoretically lasts forever. That means if the stock fails to rally above $110/share prior to expiration, the option position will expire worthless, and the investor/trader loses his/her entire $500 investment.

That said, the stock position isn’t riskless, either. If XYZ were to dramatically correct in price, then the long stock position would suffer significant losses as well. All told, there are risks in both positions, and each investor/trader must evaluate which position matches up better with their outlook, strategic approach and risk profile.

At present, both ALB and LIT offer LEAPS options that expire in January of 2025 and January of 2026.

For more background on LEAPS options, check out this installment of Options Trading Concepts Live on the tastylive financial network. To follow everything moving the markets, including the options markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.