Platinum Looks More Attractive Than Gold Heading into 2024

Platinum has lagged gold in 2023, pushing the gold/platinum ratio toward an extreme, and making platinum look relatively inexpensive in gold terms

- Gold prices surged to a new record high in 2023, but platinum prices have lagged gold, and are down 10% year-to-date.

- This divergence has pushed the gold/platinum ratio toward a historical extreme, making platinum prices look relatively inexpensive in gold terms.

- To capitalize on this situation, investors and traders can consider pairing short gold with long platinum, or opting for a pure long platinum position.

Gold (/GC) hasn’t exactly been on fire in 2023, but it did set a fresh all-time high this year and is currently up about 10% on the year.

One of gold’s closest cousins—a precious metal known as platinum (/PL)—has actually declined in value this year. Year-to-date, platinum prices are down about 10%.

Much like gold and silver, gold and platinum share a close, historical trading bond. Traditionally, the two metals have traded with a relatively strong, positive correlation. Meaning they typically trade in the same direction, and often to a similar degree.

Clearly, that correlation has broken down somewhat in 2023, as the prices of these two precious metals have diverged. Currently, platinum trades for about $975/ounce, while gold trades for closer to $2,050/ounce.

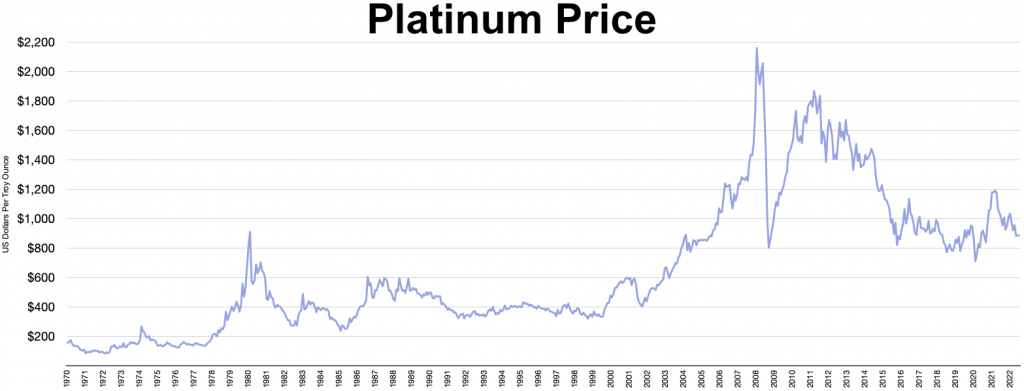

Interestingly, the all-time high in platinum is around $2,200/ounce, which is almost identical to gold’s all-time high. However, platinum currently trades about 55% below that, as illustrated below.

Platinum set its all-time high of $2,200/ounce back in 2008 due to a supply deficit in the market. Over the last five years, however, platinum hasn’t traded above $1,300/ounce. That means platinum prices are currently trading about 25% below their 5-year high.

In comparison, gold prices have trended toward all-time highs in 2023. On Dec. 3, gold set a fresh all-time high of about $2,150/ounce. Today, gold trades just below that, at $2,050/ounce.

Trading the gold/platinum ratio

Due to the strong historical correlation between gold and platinum prices, many investors and traders track the gold/platinum ratio. Extremes in this ratio often serve as a signal that one of the metals is priced too high, or too low.

The gold/platinum ratio is very similar to the gold/silver ratio, which is another key gauge that market participants use to track prices in the precious metals universe. The gold/silver ratio reports how many ounces of silver are required to buy a single ounce of gold.

Along those lines, the gold/platinum ratio reports how many ounces of platinum are required to purchase a single ounce of gold. And much like the gold/silver ratio, the gold/platinum ratio can be tracked over time, providing additional context on the relative prices of each metal.

At present, more than two ounces of platinum are required to purchase a single ounce of gold. The actual figure is 2.1 ounces ($2,050/$975 = 2.10). Looking at the long-term relationship between these two metals, the current level in the gold/platinum ratio suggests that gold prices are relatively expensive in comparison to platinum.

During the last 10 years, the gold/platinum ratio has ranged between roughly 0.80 and 2.50. That means at one point, less than one ounce of platinum could purchase an ounce of gold. At the other end of the spectrum, about 2.5 ounces of platinum were at one point required to purchase a single ounce of gold.

In relative terms, one can see how 0.80 represented a zenith in the price of platinum, while 2.50 represented the nadir. Today, gold prices have outperformed platinum, which is why the gold/platinum ratio has trended back toward that end of the spectrum.

Investors and traders track the gold/platinum ratio to filter for potential opportunities to pair gold and platinum against each other. Alternatively, some market participants might opt to purchase platinum outright when prices are historically weak versus gold, as they are today.

At this juncture, the current level in the gold/platinum ratio would theoretically call for a short gold, long platinum pair. A position that would produce a profit if the gold/platinum ratio were to trend back to its historical average of roughly 1.65, from its current level of 2.10.

On the other hand, some market participants might elect to wait for the gold/platinum ratio to swing even further toward an extreme. For example, waiting until the ratio reaches 2.40 (or above) to deploy the short gold, long platinum pairs trade.

Supply-demand considerations

Another important factor to keep in mind when it comes to the platinum market is the supply-demand dynamic. Last year, miners produced 190 tons of platinum globally, whereas total gold production was closer to 3,100 tons.

The vast majority of platinum is mined in Canada, Russia and South Africa. However, South Africa is the largest global producer by a wide margin. Traditionally, that means supply disruptions in South Africa can have a big impact on the price of platinum.

That was certainly the case back in 2008, when supply shortages pushed platinum prices to all time highs.

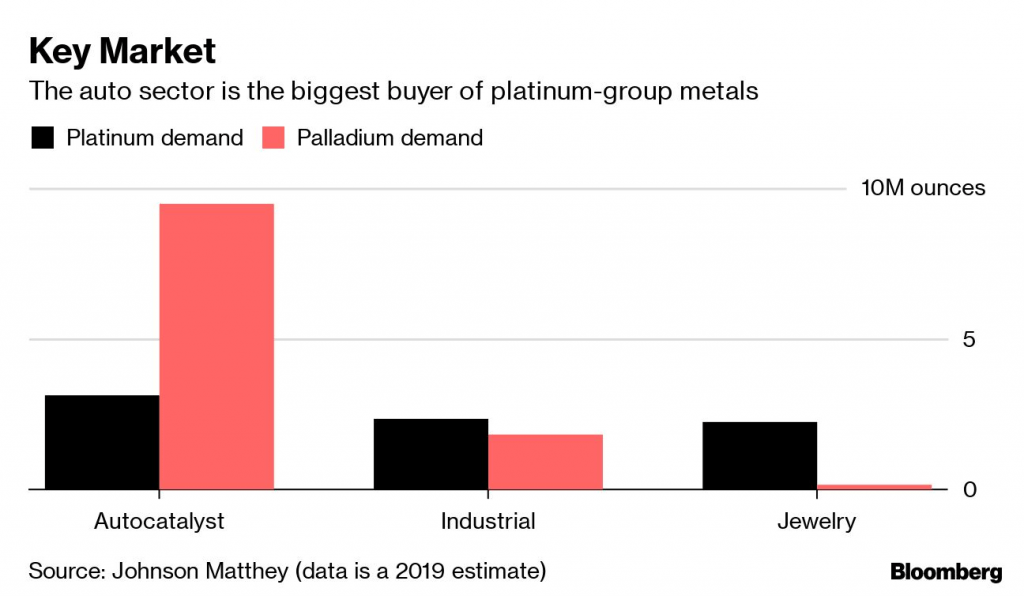

In terms of demand, the automotive industry is traditionally the largest consumer of platinum, primarily because it’s a key component in catalytic converters.

Catalytic converters are an integral part of the exhaust systems in gas-powered vehicles—they help to reduce harmful emissions by converting pollutants like carbon monoxide (CO), nitrogen oxides (NOx) and hydrocarbons into less harmful gasses.

In 2023, reduced demand from the automotive industry has certainly weighed on the price of platinum. That situation has been driven by slowing automobile sales, as well as increased interest in battery-electric vehicles (BEVs)—the latter of which do not require catalytic converters.

On top of that, supplies of platinum remain robust. All told, that means an economic rebound in 2024 would help push platinum prices higher, because that would almost certainly lead to increased demand for automobiles.

On the other hand, if gold prices continue to soar, platinum could also benefit from increased demand from the jewelry industry. That’s because when gold gets prohibitively expensive, some jewelry manufacturers often shift to lower cost options, and that could be the case with platinum in 2024.

Platinum is highly valued in the jewelry industry due to its beauty, rarity and durability. It is often used to make high-quality items such as rings, necklaces, and watches. Moreover, rhodium is extracted from platinum, and rhodium is another metal that’s coveted by the jewelry industry.

Considering all of the above, investors expecting an economic rebound in 2024 may lean toward a straight long platinum position. On the other hand, long-time participants in the precious metals market might favor a short gold versus long platinum pair. This trade structure benefits from a reversion to the mean in the gold/platinum ratio.

To access the gold and platinum markets, market participants typically use futures or ETFs. In the case of the latter, traders tend to gravitate toward the SPDR Gold Trust (GLD) and the Physical Platinum Shares ETF (PPLT), which have the most assets under management, and trade with the highest daily volume.

To learn more about trading the precious metals markets, readers can check out this installment of Options Jive on the tastylive financial network.To follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.