Trading a Bear Market With Zero-Day Options

New tastylive research highlights how zero-day options, O DTE, puts can be used to express a bearish outlook.

Market data shows that trading volume in zero-day options has surged in recent months.

Zero-day options exist for only a single trading session, and are often referred to as “options with zero days-to-expiration (DTE)” or simply “0 DTE.”

The addition of 0 DTE options means that investors and traders can now access options that expire today, tomorrow, next week, next month or even next year. Based on rising open interest in 0 DTE options, there’s demand in the financial markets for this added flexibility.

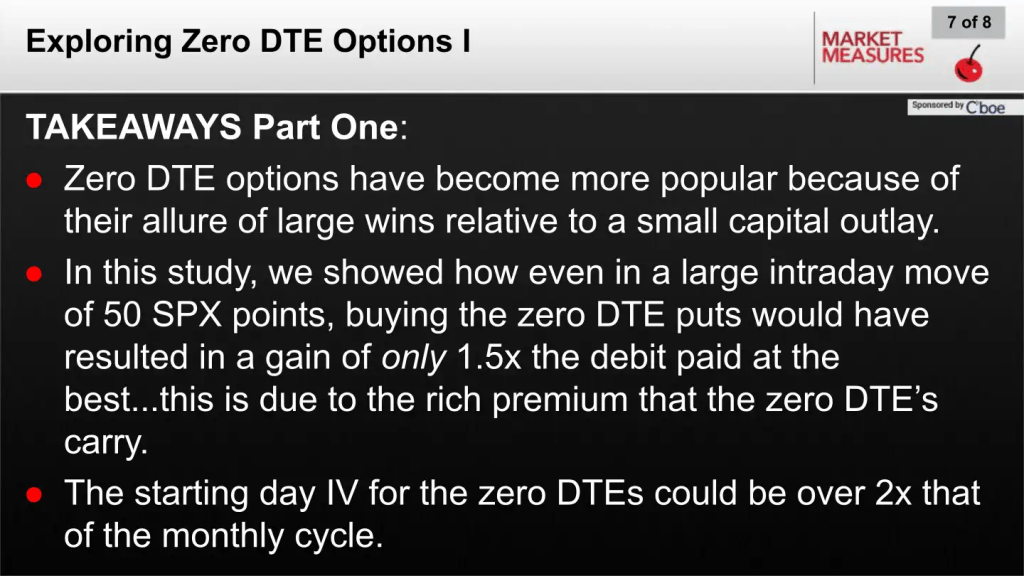

Depending on one’s unique trading strategy, 0 DTE options may be the right choice to express a specific market outlook. However, investors and traders should keep in mind that the costs and risks associated with 0 DTE options can be higher as compared to weekly and monthly options.

0 DTE research

The tastylive financial network recently unveiled new research on 0 DTE options, which covers the potential benefits and drawbacks of zero-day options.

In short, this research revealed that the implied volatility associated with 0 DTE options is significantly higher than the implied volatility of regular monthly options, on average. That suggests buyers of 0 DTE are paying an added premium for these options—all else being equal.

Moreover, the research also showed that the gamma risk associated with short 0 DTE options can be substantially higher than the gamma risk associated with regular monthly options.

As such, each and every participant in the options market should closely analyze the overall value proposition of 0 DTE options before deploying these products in their portfolios.

However, for those that have already ascertained that 0 DTE options fit their strategic approach and risk profile, there’s some additional tastylive research that may help investors and traders refine their approach to trading 0 DTE options.

0 DTE options: Selecting a strategy and strike price

The only difference between a 0 DTE option and a regular weekly or monthly option is the reduced time until expiration. Theoretically, that means the full spectrum of options trading strategies may be applied to zero-day options.

Practically, however, zero-day options aren’t being heavily utilized for sophisticated trading approaches. Instead, most market participants are using 0 DTE options to play one-day moves in the market using index ETFs like the SPDR S&P 500 ETF Trust (SPY), which now offers 0 DTE options for every single trading day on the calendar.

In most cases, these options are being used to deploy concentrated directional risk using naked calls or naked puts. For example, loading up on out-the-money (OTM) calls to try and ride a sharp upside rally in the S&P 500.

That approach can produce outsized gains with minimal capital at risk. However, it’s also a low-probability approach. A multitude of small losses can eventually equate to a significant loss in capital.

Regardless, for those looking to deploy a bearish position in 0 DTE options, new research from tastylive suggests that OTM puts may offer the strongest value proposition when it comes to risk versus reward. And of those puts, the 25-delta put appeared the most attractive.

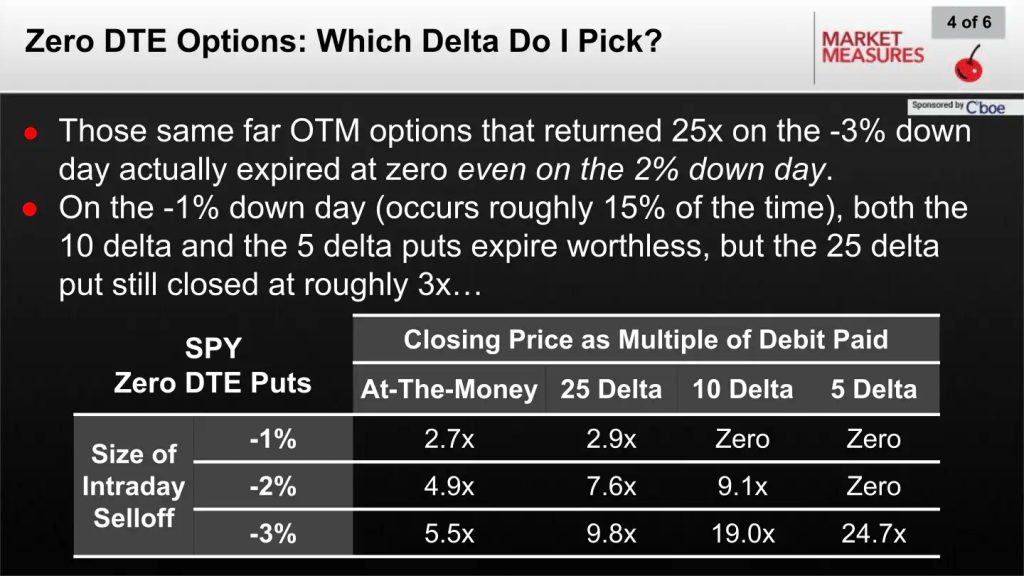

This research is based on several market studies that examined the potential risks and rewards of buying OTM puts on days when the market dropped between 1-3%. To evaluate which put was optimal, tastylive analyzed the relative performance of puts with 25-delta, 10-delta, and 5-delta.

When the market drops by 3%, low delta puts can produce outsized gains. For example, the 5-delta put can produce a profit that’s 25 times greater than the initial debit (i.e. the initial price paid for the option position) when the market moves down by 3%.

However, 3% moves in the market are relatively rare, and over the period examined, only occurred about 1% of the time.

On the other hand, the 25-delta put produces a profit that’s nearly 10 times greater than the initial debit when the market drops by 3%, on average. But the 25-delta put also produces a profit on days that the market moves by only 2%, or even 1%. In comparison, the 5-delta put results in a loss when the market moves by only 1% or 2%.

The potential risks and rewards associated with each of the three OTM puts—5-delta, 10-delta, and 25-delta—are illustrated in the graphic below.

The above data suggests that when trying to optimize risk and reward, investors and traders trying to play a downside move in the market may be best served using the 25-delta put.

Participants in the options market may want to review the complete episode of Market Measures on the tastylive financial network for more background on strategy and strike selection for 0 DTE options.

Looking beyond 0 DTE options, previous research conducted by tastylive has shown that 45 DTE tends to be very efficient when it comes to short options positions.

To learn more about the overall 45 DTE value proposition, check out this installment of TastyBites. In addition, this episode of Market Measures also provides more context on trading 0 DTE options versus 45 DTE options.

To follow everything moving the markets, tune into tastylive, weekdays from 7 a.m. to 4 p.m. CDT.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastylive or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.