Covered Strangles

A short strangle is a neutral strategy that profits when the stock stays between the short strikes as time passes, as well as whether there are any decreases in implied volatility. The short strangle is an undefined risk option strategy.

Directional Assumption: Neutral

Setup:

- Sell OTM Call

- Sell OTM Put

Ideal Implied Volatility Environment: High

Max Profit: Credit received from opening trade

How to Calculate Breakeven(s):

- Downside: Subtract total credit from short put

- Upside: Add total credit to short call

With strangles, remember that there’s truly undefined risk in selling a naked call. Focus on probabilities at trade entry, and keep the risk/reward relationship at a reasonable level.

Implied volatility (IV) plays a huge role in the strike selection with strangles. The higher the IV, the wider the strangle can be while still collecting similar credit to a strangle with closer strikes that is sold in a lower IV environment. To keep the strikes closer to the stock price, a higher IV environment yields a larger credit, as IV is essentially a reflection of the option prices.

The target timeframe for selling strangles is around 45 days to expiration. That balances shorter and longer timeframes.

Source: LEARN CENTER at tastytrade

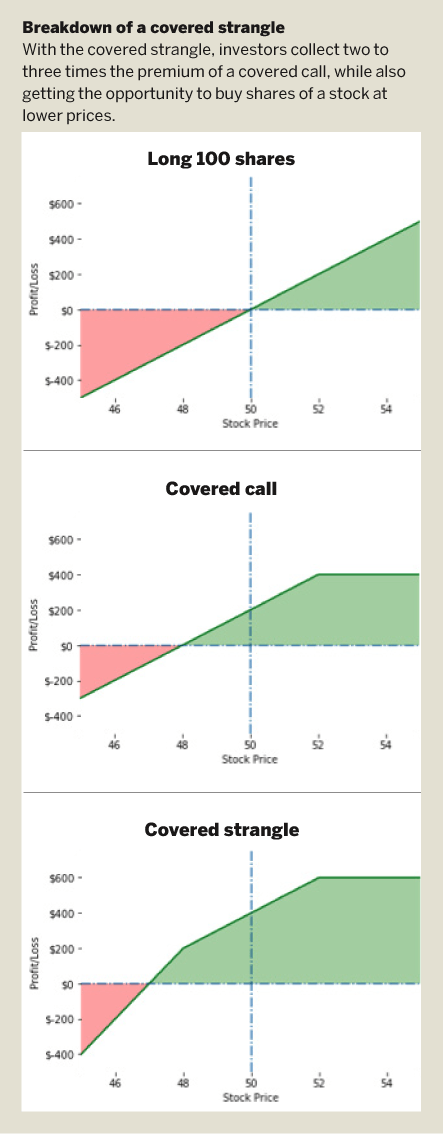

For most buy-and-hold investors, a selloff in the market acts like a double-edged sword, meaning that portfolios lose value but a nice buying opportunity arises. With the strategy known as the covered strangle, investors collect two to three times the premium of a covered call strategy, while having the opportunity to accumulate shares of a stock at lower prices.

A covered strangle is simply taking a covered call – long stock plus a short call – and adding an out-of-the-money short put. Broken down, it looks like the example on the right.

So where’s the risk? Ideally, investors use this strategy for a stock they like and want to acquire. The risk is in having the stock called away if the short call gets breached or being put more stock if the short put gets breached.

But remember, investors are going to be short out-of-the-money calls and puts, mean- ing that if the stock gets called away, they are going to profit on both the stock and the put they’ll be able to buy back at a better price. If the stock price goes down and the investor ends up getting put more stock, the investor will reduce the cost basis by buying the stock at a lower price than the initial position and, as a bonus, the now-worthless short call will buffer some of the losses because the stock price is going down.

Finally, the best part of the covered strangle is if the stock does nothing. The investor still prof- its because the short call and short put expire worthless. Then the investor collects two to three times more premium than if they had just a covered call. That’s because out-of-the-money put trades, on average, are twice as expensive as calls of the same delta value in equity products like SPY, QQQ, DIA and IWM.

So to enhance a stock position that one likes, look to the often-overlooked but versatile covered strangle. Investors begin with the same exposure as a long stock, and they have protection if the stock moves on both sides. And if the stock does nothing, the investor is rewarded with significantly more premium than with a standard covered call.

Anton Kulikov is a trader, data scientist and research analyst at tastytrade.