Managing Directional Risk

While many traders focus on statistics-based volatility positions that leverage the mean reversion philosophy, it’s important to recognize that even these types of exposures can be subject to a degree of directional risk—especially aggregate directional exposure at the portfolio level.

The question is whether or not there’s a good way to manage that risk, or whether traders should guide it directionally so that it’s optimal for a given market approach and outlook. Traders who’ve been thinking about refining their thinking on this subject, can view a new episode of The Skinny on Options: Abstract Applications on the tastytrade financial network.

But first a little background on hedging, at both the position and portfolio level:

In the world of options, portfolio hedging is somewhat similar to the delta-neutral philosophy, which involves hedging a given options position “flat delta” using the underlying stock. Those who embrace delta-neutral trading are typically seeking to reduce directional exposure (i.e. risk) in the portfolio, while attempting to isolate the true purpose of volatility trading—mean reversion.

The main difference is that delta-neutral hedging usually occurs at the symbol level, while beta-weighted hedging is deployed at the portfolio level (i.e. hedging the net beta of the overall portfolio). Theoretically, traders could adopt a hybrid approach that incorporates elements of both.

At a high level, beta-weighted portfolio hedging enables traders to approximate delta risk across multiple positions (i.e. the portfolio), and then estimate an appropriate hedge of any unwanted risk exposure using an index, preferably one highly correlated to the underlying positions in question. For example, if a portfolio was net long 500 deltas (according to beta-weighting), then an investor cold theoretically deploy 500 short SPY deltas to reduce that directional risk.

Beta-weighted hedging gets its name because “beta” itself measures the systematic risk of a given underlying or portfolio. “Beta-weighting” therefore represents an attempt to quantify this risk, while “hedging” is the action/tactic used to minimize it.

Because underlying prices in the portfolio are constantly on the move, that in turn means the investor should monitor beta risk of the portfolio in case adjustments are needed. This is similar to trading delta-neutral, which also requires ongoing adjustments.

Circling back to the aforementioned episode of The Skinny on Options, the hosts point out how traders must first ascertain what posture they want to take in the market at the portfolio level. This could range from very bullish to slightly bullish, or very bearish to slightly bearish, or even market neutral (i.e. as flat as possible from a directional perspective).

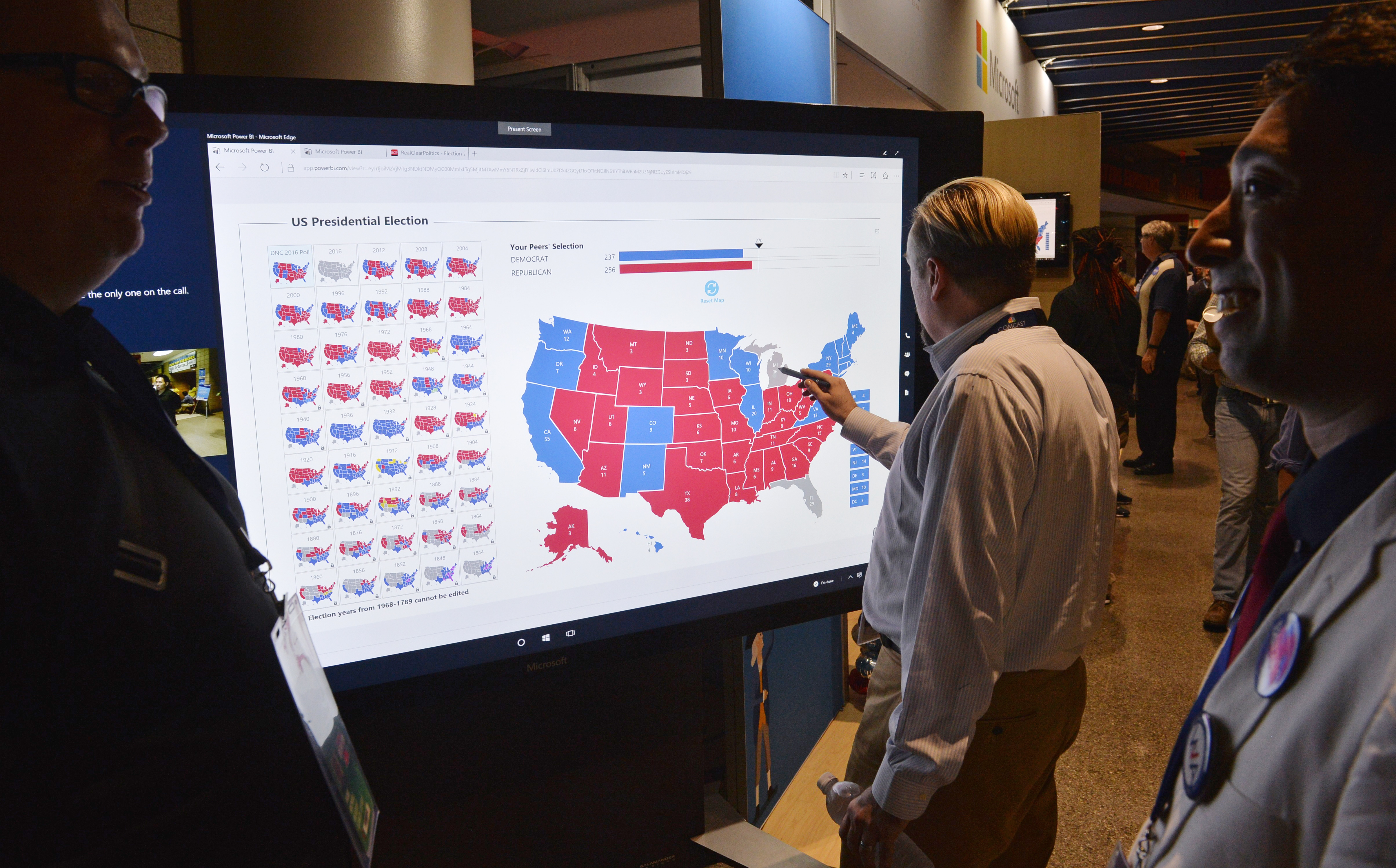

Depending on the result of this analysis, the next step is to determine how much aggregate directional risk exists in the current portfolio. Many trading platforms (such as tastyworks) offer functionality that enables traders to view the beta-weighted risk of a given portfolio. For more information on how to ascertain the beta-weighted risk of a portfolio, see a previous installment of Market Measures on the tastytrade network.

After identifying the degree and type of directional risk one wants to deploy in the market, traders can then consider what adjustments might be needed in their portfolio. For example, if a trader has decided to deploy a slightly bearish market posture, but is currently positioned market neutral, they might decide to add additional short deltas to the portfolio.

As outlined on the show, traders can draw upon three primary approaches when making such adjustments. These range from the deployment of a completely new position, to closing an existing position, to adjusting an existing position. Traders can draw upon any of these three tactics to achieve the end goal of transforming the directional risk in the portfolio to match the trader’s outlook.

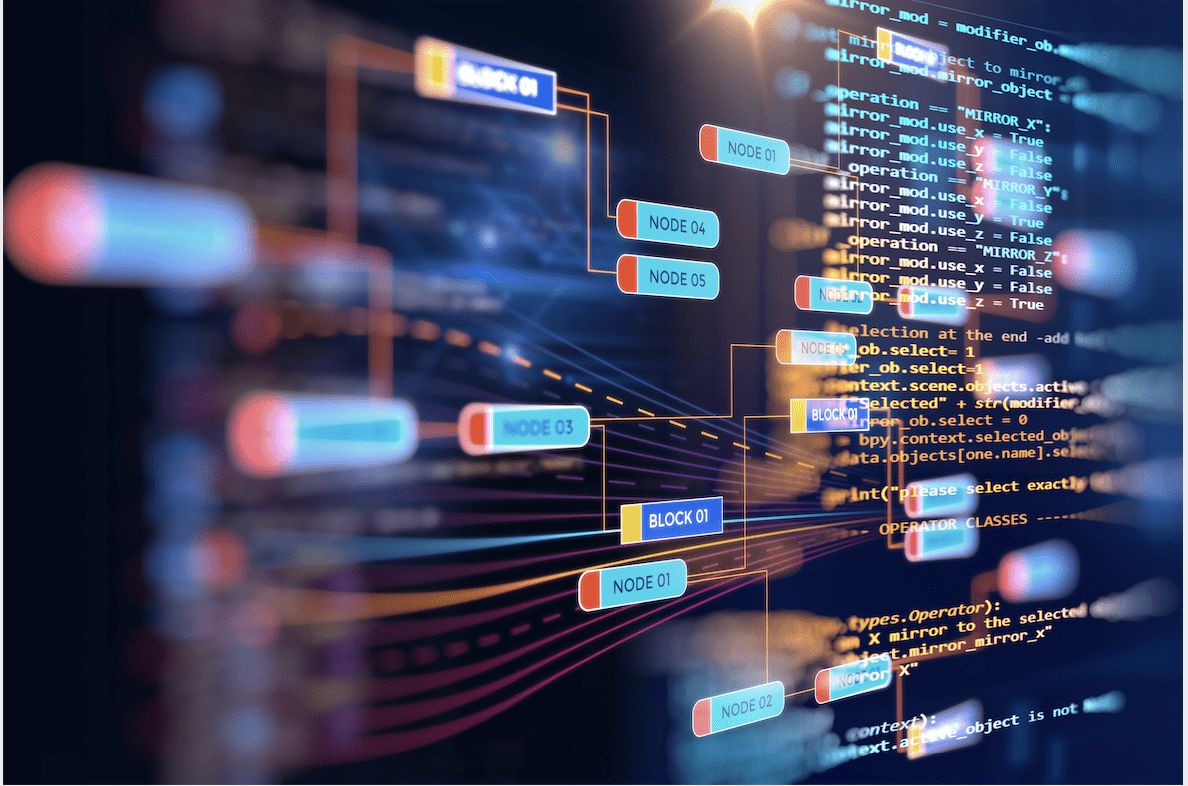

The graphic below highlights the three approaches and provides some examples.

While this slide illustrates methods of adding short deltas to the portfolio, there is another slide included in the episode which provides examples for adding long deltas.

As one can see in the above graphic, traders can use a variety of methods to address aggregate directional exposure in their portfolios. And while the exact method/tactic will vary, the most important thing is that this risk dynamic is actively addressed.

The last thing anyone wants is to experience the shock of seeing a big negative move in the portfolio P/L which is associated with a risk that was never actively accepted or managed.

To learn more about beta-weighted hedging and directional risk at the portfolio level, traders can review the complete episodes of Market Measures and The Skinny on Options: Abstract Applications when scheduling allows.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.