Trades

6 Looks at Energy Stocks

|

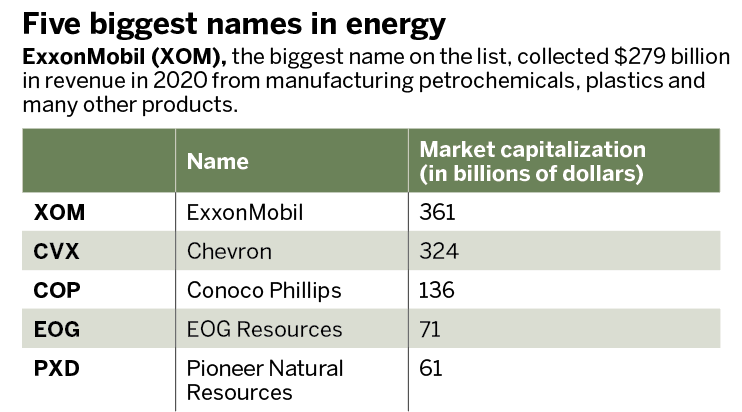

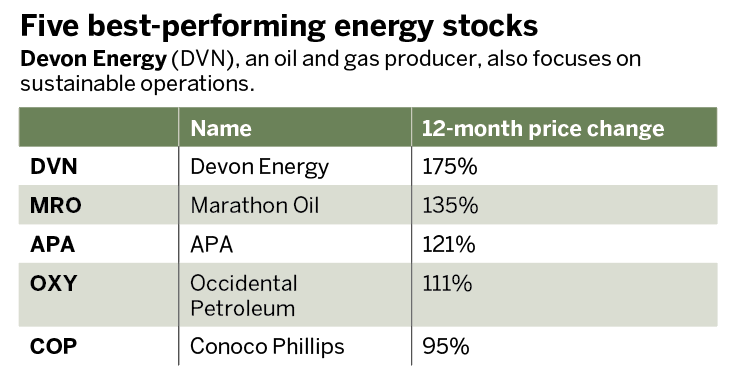

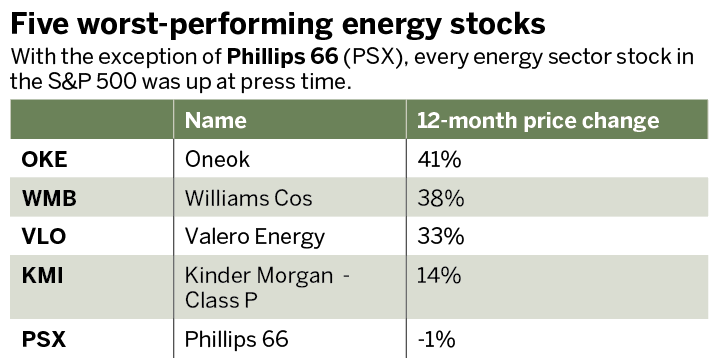

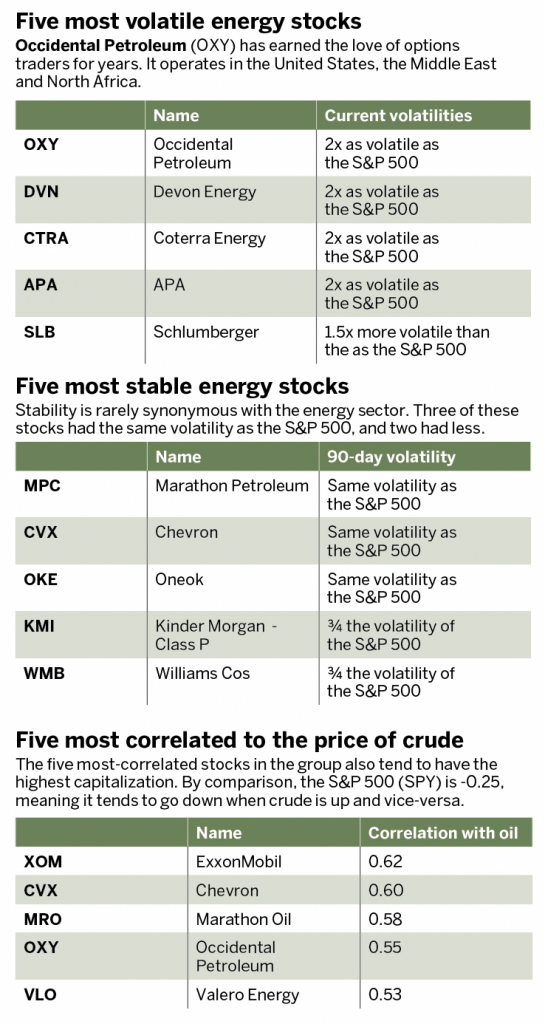

Crude oil prices of more than $100 a barrel are boosting stock prices in the petroleum sector, but the effect on the S&P 500 is limited because the commodity accounts for fewer than 5% of the companies in the index.

Many portfolios are heavily invested in the S&P 500, so a lot of traders have very little exposure to the energy sector. Where should traders start if they want to gain more exposure to energies?

Here’s the lay of the land.

Subscribe to Cherry Picks, a free quantitative newsletter for current and armchair quants, which is short for quantitative analysts. Every week the publication provides trade ideas for stock, options and futures traders.

It also provides the latest insight into earnings, trade opportunities and market moves.

Cherry Picks

-

When Airlines Stocks Resume Flight

|Because of coronavirus fears, the only seats filled these days are the ones in front of TVs. With very few people traveling, airline stock prices have declined an average of… -

Two Ways Back In

|Perhaps some traders are looking to “tiptoe” back into the market and make some cautious purchases. Anyone seeking lower-volatility assets could consider two exchange-traded fund (ETF) sectors: Consumer Staples (XLP)… -

How Gold Fits

|Investors often tout gold as a strategy during market declines. It sounds ideal because a precious metal like gold should withstand shocks to the economic cycle, right? Well, not always.… -

Three Roads to China

|Some stocks offer more exposure in Chinese markets than their names suggest. Here’s a sampling of opportunites. Alibaba A Chinese holding company with a range of products and companies, Alibaba… -

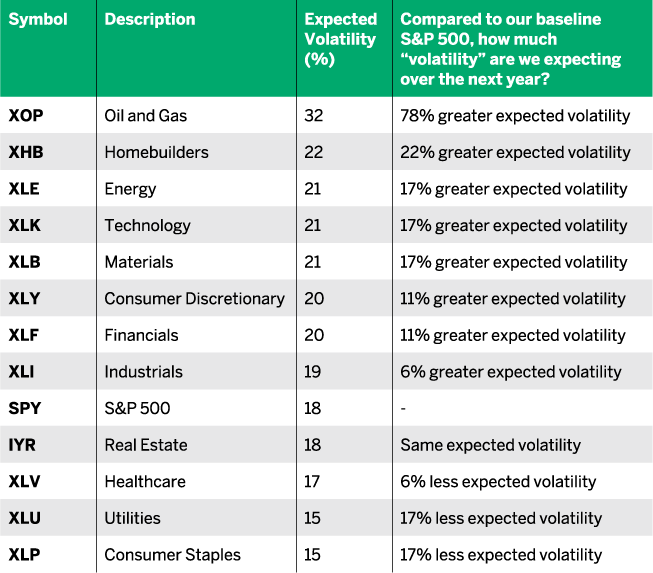

Volatility by Sector

|RIPE AND JUICY TRADE IDEAS Traders think of Biotech as the most volatile sector, but it wasn’t in 2019. Last year, the most volatile sector by far was Oil Services,… -

Sector Ignorance

|RIPE AND JUICY TRADE IDEAS Most investors own one or more of the Dow Jones, S&P 500, Nasdaq or Russell 2000 indexes. Common ways to buy into them are through… -

Worst-Case Scenarios Call for Covered Calls

|Fear of losing money sidelines too many would-be investors. They’re afraid they sell at the bottom. So, what would be the worst-case scenario if someone bought at the peak and then… -

The VIX Cheat Sheet

|Interested in knowing how much the S&P 500 is expected to move? This cheat sheet will help! But first, get the last sale of VIX or type “VIX” into your… -

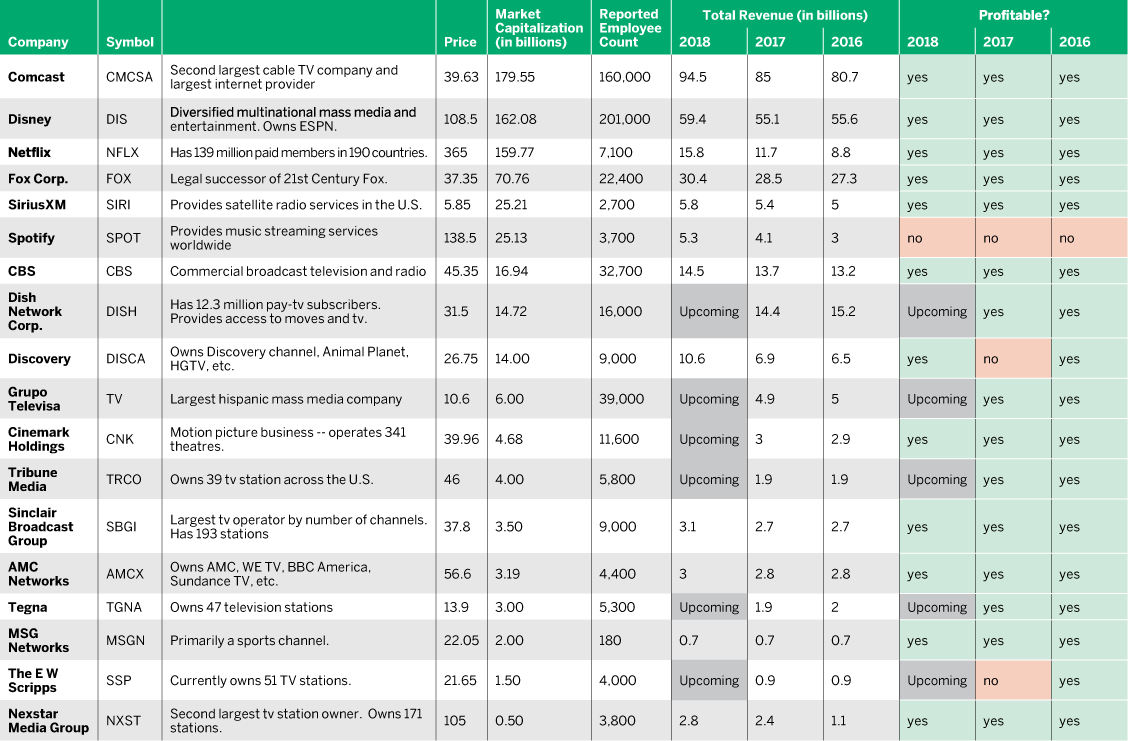

The Top Cannabis Stocks

|With legalization of pot gaining traction across the country, it’s no surprise that cannabis stocks are becoming more popular. The list of publicly traded cannabis companies below is sorted according… -

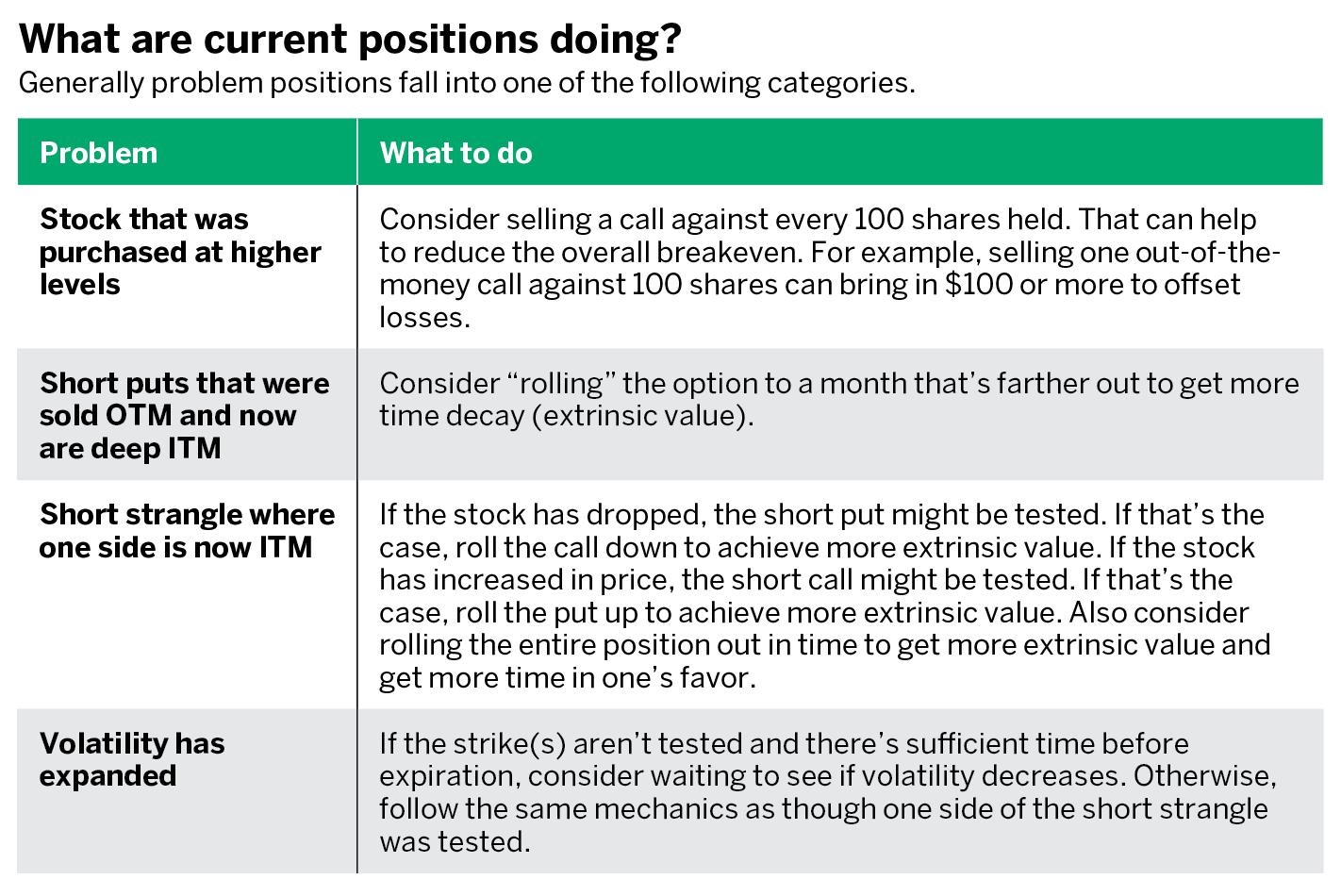

Reassessing Options in a Down Market

|In drawdowns as when the Nasdaq, Dow Jones and S&P 500 recently found their way down 10%, 7% and 6%, respectively, from their prior peaks of a few months before,… -

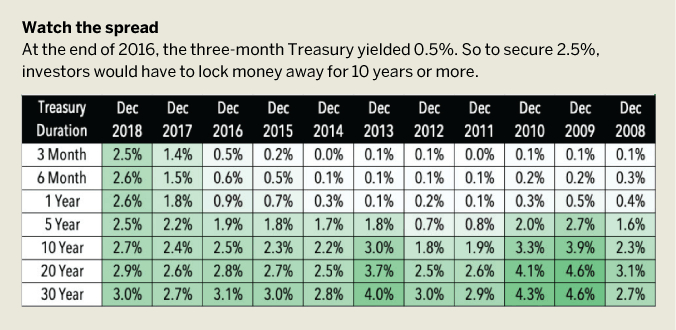

Shorter-Duration CDs Offer Higher-Yield Opportunity

|With the Federal Reserve increasing the overnight interest rate, shorter-duration treasuries have increased in yield. That “flattening of the yield curve” means three-month CDs now have yields comparable to considerably…