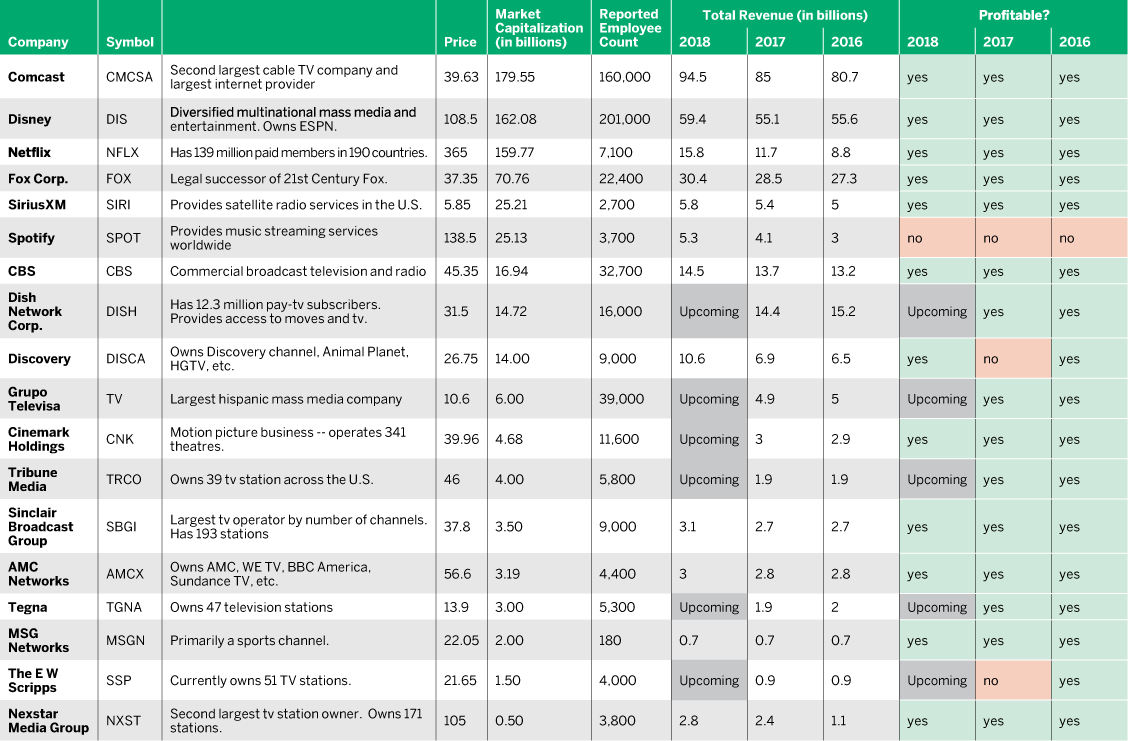

12 of the Most Boring Stocks

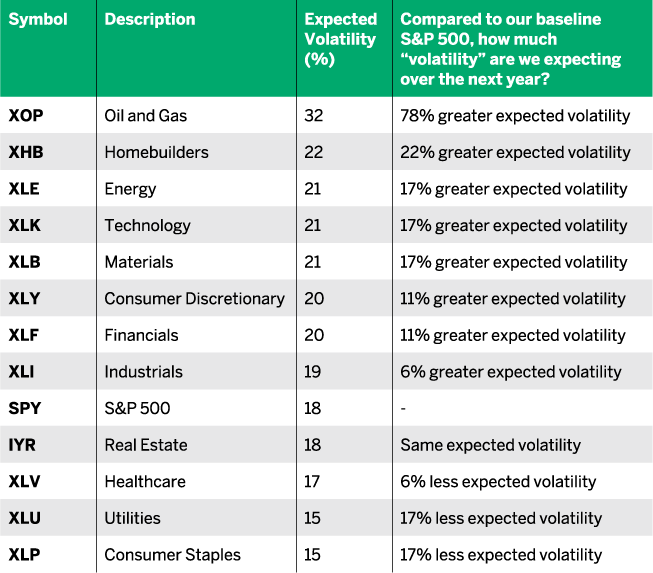

Traders are not a monolithic group. Some have a high risk tolerance, while others are more risk averse. Those with higher risk tolerance would probably prefer to trade TSLA, while those that are more risk averse would lean toward XLU.

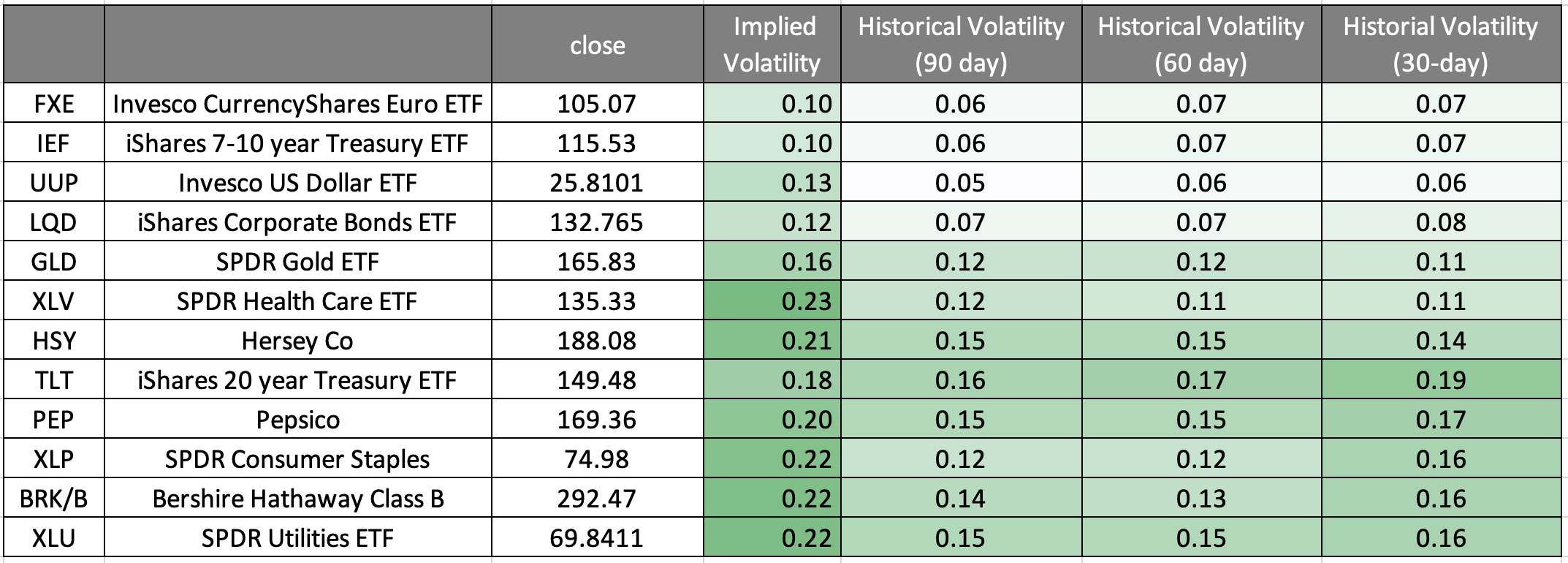

Here are 12 of the most “boring” stocks and ETFs as measured by a combination of historical and implied volatility. All have options, so it is possible to reduce theoretical risk by selling calls against positions held.

Historical Volatility is simply a measure of how much the stock has moved with respect to price. This is different from Implied Volatility which is a measure of how much the stock is expected to move with respect to move going forward.

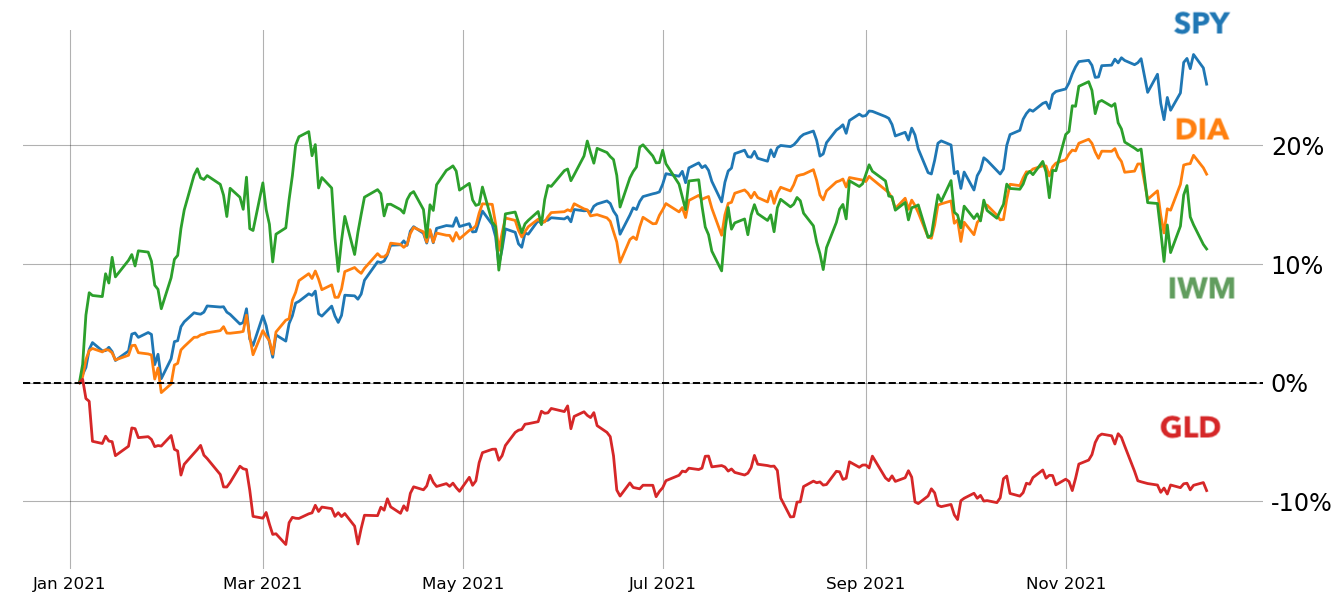

2021 so far

Here are the ETFs returns for the S&P 500, Dow Jones, Russell 2000 and Gold from the beginning of the year to now.

The free weekly Cherry Picks newsletter from tastytrade is stuffed with market research studies, data-driven trade ideas, and unique insights from the geekiest of geeks. Conquer the market with confidence … get Cherry Picks today!

Cherry Picks is written in collaboration with Michael Rechenthin, PhD, Head of Research and Development at tastytrade; and James Blakeway, CEO of Quiet Foundation, a data science-driven subsidiary of tastytrade.