Tactics for Short Options When Correlations Converge

The correlations that exist between different financial instruments have shifted during the COVID-19 crisis. Correlation measures the degree to which securities/assets move in relation to each other.

For example, when two underlying securities are positively correlated, that means they move in the same direction to varying degrees. When two securities are negatively correlated, that means they move in opposite directions to varying degrees. If no correlation exists between two securities then the relationship is often described as “zero” correlation.

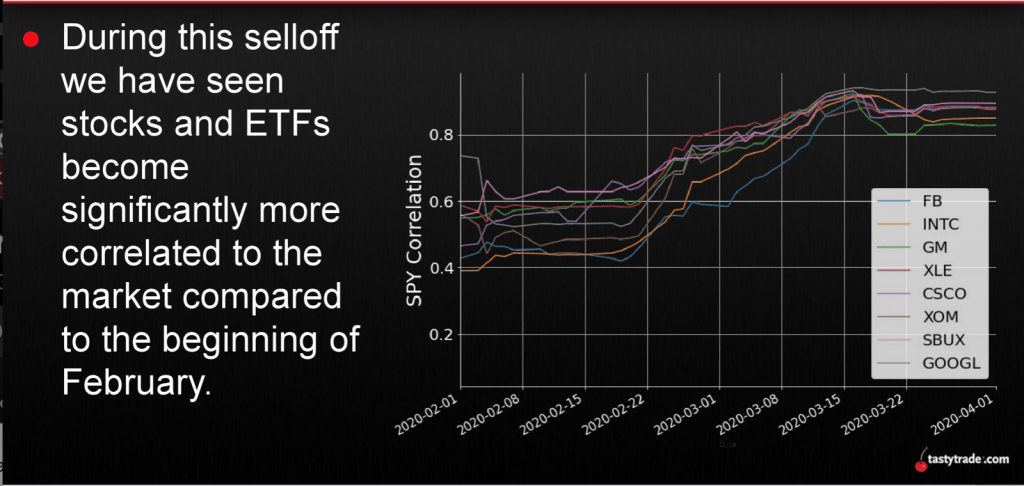

When fear enters the marketplace, correlations have historically tended to converge at more extreme levels, as illustrated in the chart below:

Correlations increase during selloffs because different asset classes and assets within them tend to get viewed through the same lens when panic sets in: “a place to raise cash.”

One market statistic that helps emphasize just how much correlations have changed during this particular crisis relates to an asset class that was barely on the radar during the last Financial Crisis: cryptocurrencies.

Prior to 2020, cryptocurrencies such as Bitcoin exhibited very little correlation to other asset classes. However, during the current market correction, Bitcoin’s correlation with stocks, bonds, and commodities has increased significantly.

And while Bitcoin’s new behavior may represent a fresh dynamic, the fact that single stocks are becoming increasingly correlated to broader market indices is something consistently observed in past corrections.

In “normal” markets, single stocks can be relatively less correlated to more diversified holdings such as indices and exchange-traded funds (ETF) because they are more susceptible to “unsystematic” risk, such as stock-specific risk. Such risks include unexpected announcements like negative litigation, takeouts, drug approvals, and other occurrences that can catalyze big moves in the underlying stock.

However, in distressed trading environments, all equities become more susceptible to “systematic” risk—the type of bigger picture events that can affect the market as a whole. In this case, the spreading coronavirus has inflated systematic risk across the board, which can be observed via inflated option premiums, such as a spiking VIX)

Due to the current market conditions, there’s an argument to be made that options traders, especially those looking to sell elevated levels of implied volatility, might want to look to indices and ETFs in the current environment, as opposed to single stocks.

The reasoning behind this assertion is quite simple – if option premiums are elevated across the board, and all underlyings are moving in a more correlated manner, wouldn’t traders prefer to take exposure in securities with less “net” risk (e.g. indices and ETFs) as opposed to underlyings like single-stocks, which theoretically possess a higher degree of risk, both systematic and unsystematic?

Based on previous research conducted by tastytrade, the answer to this question points to “yes,” depending of course on one’s unique trading outlook, strategic approach, and risk profile.

On a previous installment of Options Jive, the tastytrade team walks viewers through an overview of the CBOE Implied Correlation Index and its relationship to the VIX.

A historical market study is then presented on the show which helps illustrate the respective performance of selling premium in single stocks during periods when marketwide correlations were low as compared to periods in which marketwide correlations were high.

The data from this study indicated that short premium in single-stock exposures tended to perform better when correlations were lower, and that indices and ETFs might therefore be preferred in fast-moving markets.

Due to the complexity of this material, it’s recommended that traders review the complete episode of Options Jive focusing on the aforementioned topics when scheduling allows.

This research may help investors and traders better navigate the current market environment, which has been dynamic, to say the least.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.