A Better Way to Put It

Protective puts are popular, but traders have more cost-efficient ways of hedging their positions

Losses hurt. Experiments indicate that avoiding a $5 loss carries twice as much psychological power as experiencing a $5 gain. Traders who overstress about loss avoidance actually create the loss they so much want to avoid.

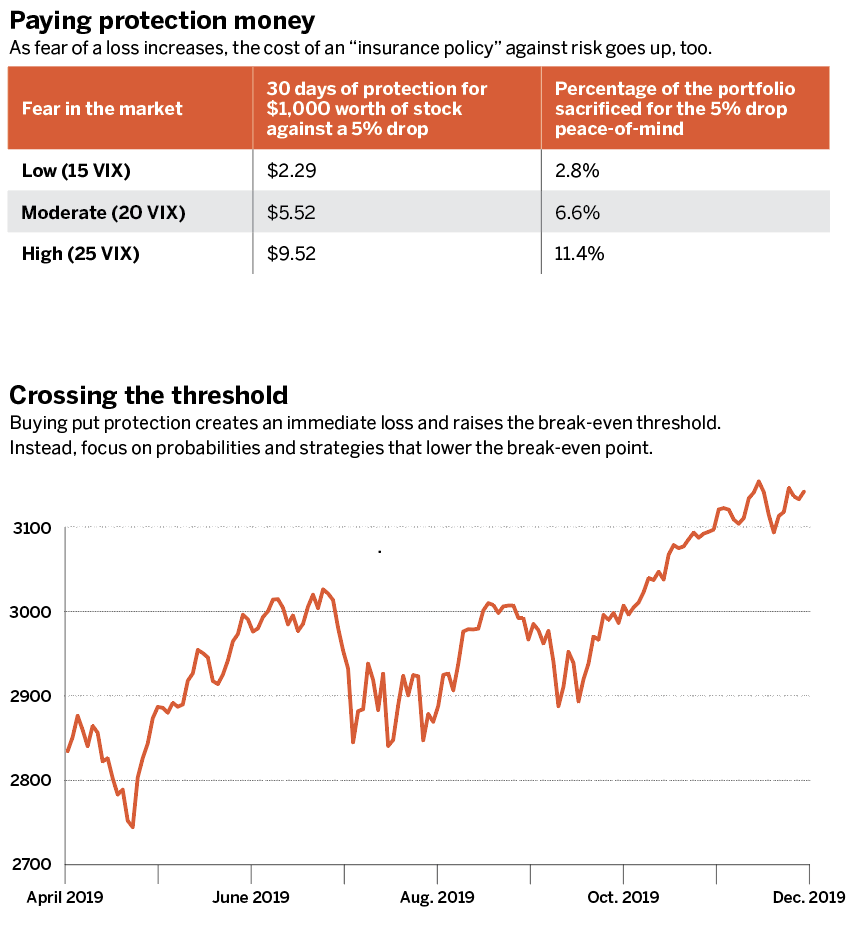

A simple online search for “protecting a portfolio from loss” yields an overwhelmingly large number of recommendations to “buy puts.” A put protects the position against a loss in the account. It’s like an insurance policy to protect against loss. But the strategy doesn’t work long-term. The more fear, the higher the cost of the “insurance.” With a moderate VIX (volatility index) fear level of 20, investors pay roughly 6.6% annually for a 5% drop insurance. Considering the average return in the S&P 500 is 6% during the past 20 years, that means the investor is paying more for insurance than the market returns on a given year.

Thus, an investor trying to minimize a drop in the account locks in a loss by buying the put. And by creating an initial cost through the price of the put, the break-even becomes even higher for the account holder.

Instead of creating a higher threshold for profitability, an investor can lower the break-even point by selling calls against the position held. By managing positions and managing the gains around those positions, an investor can make break-even lower still. (For more on this technique, click here to read the “Advanced Tactics.”)

Michael Rechenthin, Ph.D., aka “Dr. Data,” is the head of data science at tastytrade. @mrechenthin