Tips for Trading Microchips

Semiconductor stocks offer high volatility and extraordinary liquidity

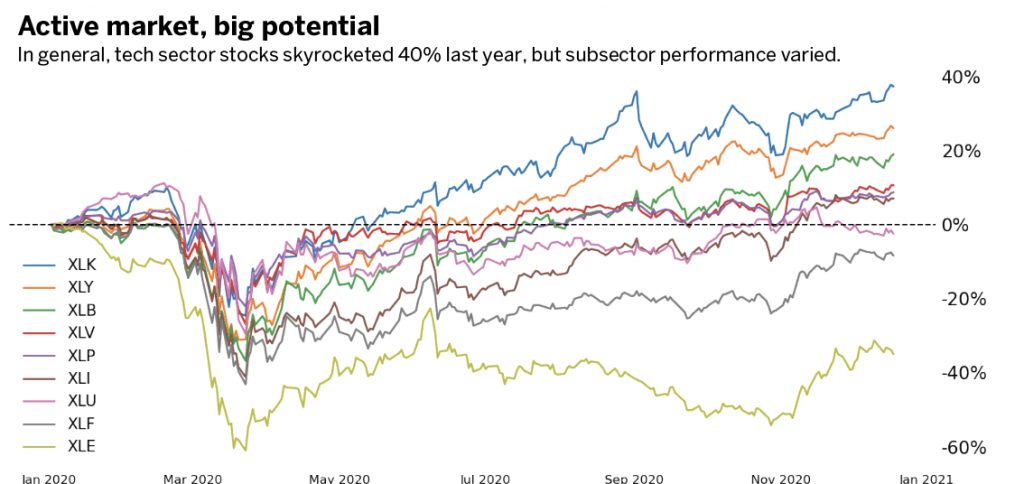

Tech stocks were the market to buy in 2020. While Covid-19 crippled many sectors, technology stocks bloomed with a 40% rally from the start of 2020 to the beginning of this year. (See Active market, big potential, below). But “technology” has become a catch-all term, so let’s dig more deeply into which subsectors and components contributed to this growth.

According to the Technology Select Sector SPDR ETF(XLK), the tech sector has six subsectors: software, IT services, communications equipment, technology hardware, electronic equipment and semiconductors.

Top option

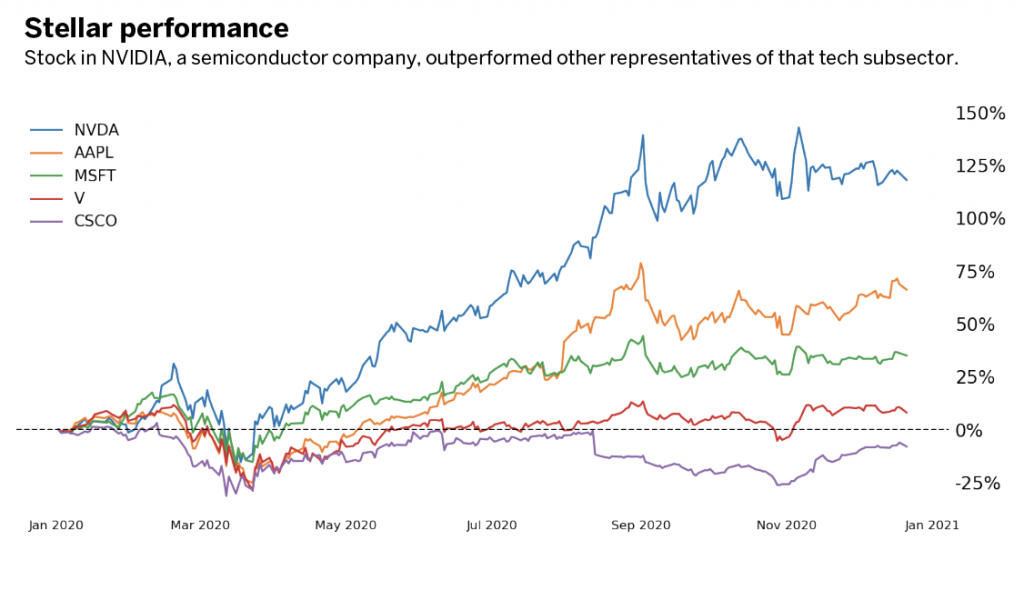

Perhaps surprisingly, the largest component and best-performing single stock from the subsectors was NVIDIA Corp. (NVDA), a semiconductor company. NVIDIA had the greatest performance in 2020 against the other representatives, trading higher by nearly 125%. (See “Stellar performance, below).

Semiconductor stock names may not sound as familiar as Google, Apple or Amazon, but they are frequently ranked as some of the most volatile companies with extraordinary liquidity in their outright, ETF and options markets. It makes them worth putting on a watchlist. The combination of high volatility and deep liquidity makes them favorable candidates for active traders and passive investors alike.

Advanced pick

For single stocks besides NVIDIA, check out Micron Technology (MU) and Advanced Micro Devices (AMD). Or, try gaining exposure through multiple names with an exchange-traded fund, such as VanEck Vectors Semiconductor ETF (SMH). There are also index futures on the Nasdaq or the new Small Technology 60, both of which have exposure to NVIDIA and other semiconductor stocks.

When deciding whether to trade outright stock, options, ETFs or futures, stay product-indifferent while keeping in mind the pros and cons of each. For example, a potential advantage of trading outright single stocks is that they tend to exhibit higher volatility compared with ETFs or index futures.

Not always the right choice

However, that can also be a potential drawback, as single stocks are subject to firm-specific risks—such as an earnings release—whereas funds and index futures provide exposure to many names. So losses in one company may be offset by gains in another.

In addition, consider the cost and movement of each product. ETFs may be explicit with their exposure but tend to be much slower-moving and require a much larger capital outlay than options or futures.

The combination of above-average volatility and robust liquidity makes semiconductor stocks a prime candidate for short-term scalps or passive investment. To capitalize on intraday movement, look to options and futures that provide terrific potential return on capital and the potential for strategy. To invest, consider stocks or ETFs paired with short options that benefit from the greater volatility.

Michael Gough enjoys retail trading and writing code. He works in business and product development at the Small Exchange, building index-based futures and professional partnerships.