Greenbacks & Green Energy

Here’s how to size up equities in the new, sustainable energy companies

Renewables still account for a mere 12.6% of U.S. energy consumption even after decades of harvesting power from the sun, wind, rivers, hot springs and tides, according to the U.S. Energy Information Administration.

But that could change. Businesses are developing alternatives to fossil fuels, the primary source of American energy.

It’s a shift that could mean opportunity for investors. Sustainable energy stocks not only afford an opportunity to diversify a portfolio but also offer the chance to own a piece of the future.

Yet, entering the fray requires careful consideration of a number of factors. Metrics ranging from market capitalization to dividend yield can help investors understand the industry and select stocks that align best with their goals.

When comparing large versus small companies in a young industry like alternative energy, investors should remember that they’re dealing with a different scale than with established energy firms with large market capitalization.

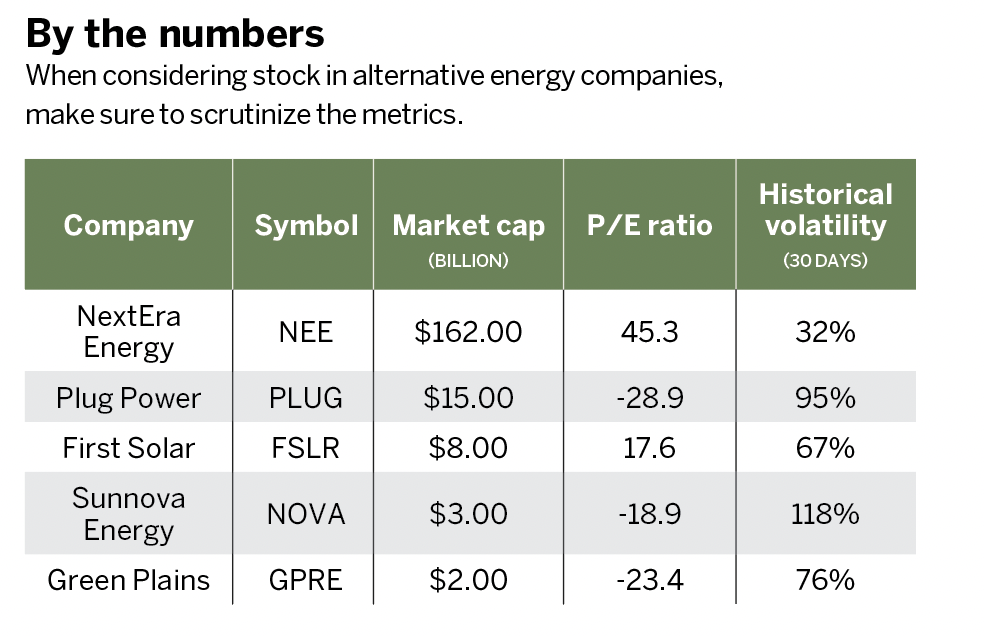

The larger sustainable energy companies, such as NextEra Energy (NEE), Plug Power (PLUG) and First Solar (FSLR), are publicly traded and focus on wind, hydrogen and solar powers, respectively.

Sunnova Energy (NOVA) and Green Plains (GPRE), two of the smaller companies in the alternative energy industry, may offer greater growth opportunities. But beware of the associated risks. Smaller companies have fewer resources, meaning that negative events can have greater impact on their stock prices.

Smaller companies also have greater volatility, meaning they display more frequent price swings than larger companies. Some investors can stomach that risk, but others might prefer a safer investment in stocks with larger market capitalization. The price of stock in NextEra Energy, for example, didn’t show much volatility in the past year.

Also consider the price/earnings (P/E) ratio. That metric helps determine whether a stock is overvalued or undervalued. Compare the P/E ratios of companies in the same industry because each industry has a different range of ratios.

If the P/E ratio is much higher than comparable companies, investors may end up paying more for every dollar of earnings. Value investors search for companies with lower than average P/E ratios with the hope that earnings will increase and thus cause the stock price to rise.

Sometimes, a high P/E ratio may not be a bad thing. It can indicate the market is pricing in greater growth that’s expected in future years.

A negative P/E ratio shows the company has not reported profits, something common for new companies. If a negative P/E persists for years, then it becomes a concern.

The last factor to consider—one that’s important for newer investors or those with smaller accounts—is the current price of the stock. A lower market capitalization does not necessarily mean a lower stock price, and vice versa.

Of these five alternative energy stocks, NextEra Energy and First Solar cost the most per share. Yet a lower price doesn’t necessarily mean

a better value.

Market capitalization is the value the market places on the company. Price may be important in choosing a stock, but it shouldn’t be the only factor.