Trading the Gold-Silver Ratio

Here’s the simplest way to reduce portfolio volatility by pairs trading the two heavy metals

In the world of pairs trading, the gold to silver ratio ranks as one of the most popular trades because of its stable correlation and tendency to diverge in price. What does all that mean to traders? The gold to silver ratio serves as a less-risky way to trade precious metals while engaging in fading short-term price extremes.

Luckily, today’s technology and a wide array of financial products make it possible for anyone to trade the gold to silver ratio, regardless of the size of the account. Let’s explore the simplest method of trading this pair: the price-weighted ratio.

But first, a quick disclaimer: This is just one method of trading this pair, but it also happens to be the simplest way possible.

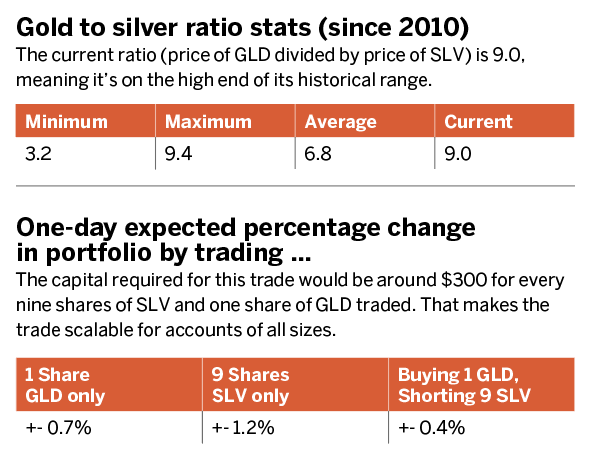

At this writing, the price of the SPDR Gold Trust (GLD), the exchange-traded fund (ETF) that tracks the value of gold, is approximately $149.00. The price of iShares Silver Trust (SLV), the ETF that tracks the value of silver, is $16.50. To trade this pair, divide the price of GLD by the price of SLV and procure approximately nine shares of SLV to one share of GLD. In “Gold to silver ratio,” right, the stats illuminate the history of this ratio for the past 10 years. The current ratio (price of GLD divided by price of SLV) is 9.0, meaning that it’s on the higher end of its historical range.

Next, the trader has to decide which one to buy and which one to short. Because the price of gold is relatively inflated compared to the price of silver, it makes sense to short one share of GLD and buy nine shares of SLV.

Keep in mind that the chance of making money on this trade is the same as trading GLD or SLV outright. The benefit of this trade, however, is that it reduces portfolio volatility by roughly 50% compared to trading GLD or SLV outright. (See “One-day expected percentage change,” below.)

The capital required for this trade would be around $300 for every nine shares of SLV and one share of GLD traded. That makes the trade scalable for accounts of all sizes. A margin account is required for this method of trading the ratio because the investor is shorting stock.

Check out the Advanced Tactics article in this month’s Luckbox for more ways to trade this pair.

Anton Kulikov is a trader, data scientist and research analyst at tastytrade. @antonkulikov97