Beta-Weighted Portfolio Hedging

“Buy the dip” was so 2019.

In 2020, “buy the dip” has been replaced by “trade the churn.”

And if 1,000 point swings in the Dow Jones Industrial Average stick around much longer, there will no doubt be a large exodus of passive investors fleeing into the active trading category, eager to join the party.

Along those lines, one big positive in the current market environment is that the sheer volume of potential trading opportunities has multiplied manyfold with the VIX rocketing above 30.

On the other hand, a downside to the current high-risk, high-reward market environment is that portfolio management can get a lot trickier. This can be especially true for traders holding options portfolios because the risk characteristics of options positions can change quickly when there are big swings in the underlyings.

Investors and traders seeking to reduce volatility in their daily P/L should consider reviewing a new episode of Market Measures on the tastytrade financial network. The focus of this particular episode is portfolio hedging and its potential impact on the volatility of daily P/L across a range of different trading environments.

The concept of portfolio hedging is somewhat similar to the delta-neutral philosophy, which involves hedging a given options position “flat delta,” using the underlying stock. Those who embrace delta-neutral trading are typically seeking to reduce directional exposure (i.e. risk) in individual positions while pursuing the true goal of volatility trading—mean reversion.

The main difference is that while delta-neutral hedging occurs at the symbol level, beta-weighted hedging is deployed at the portfolio level (i.e. hedging the net beta of the overall portfolio). Theoretically, traders could also adopt a hybrid approach that incorporates both.

As outlined on Market Measures, beta-weighted portfolio hedging allows a trader to approximate delta risk across multiple positions and then estimate an appropriate hedge for the entire portfolio using an index (preferably one that is highly correlated to the underlying positions in question).

For example, if our portfolio was long 500 deltas (according to beta-weighting), then 500 short SPY deltas could theoretically be deployed to reduce that directional risk.

Beta-weighted hedging gets its name because “beta” itself measures the systematic risk of a given underlying or portfolio. Beta-weighted hedging is therefore an attempt to reduce systematic risk.

In order to provide further context on the potential impact of beta-weighted hedging on daily portfolio P/L, the Market Measures designed a study that involved a sample portfolio of five different symbols (AAPL, IBM, XOM, JNJ, GS) with a short 50-delta put deployed in each.

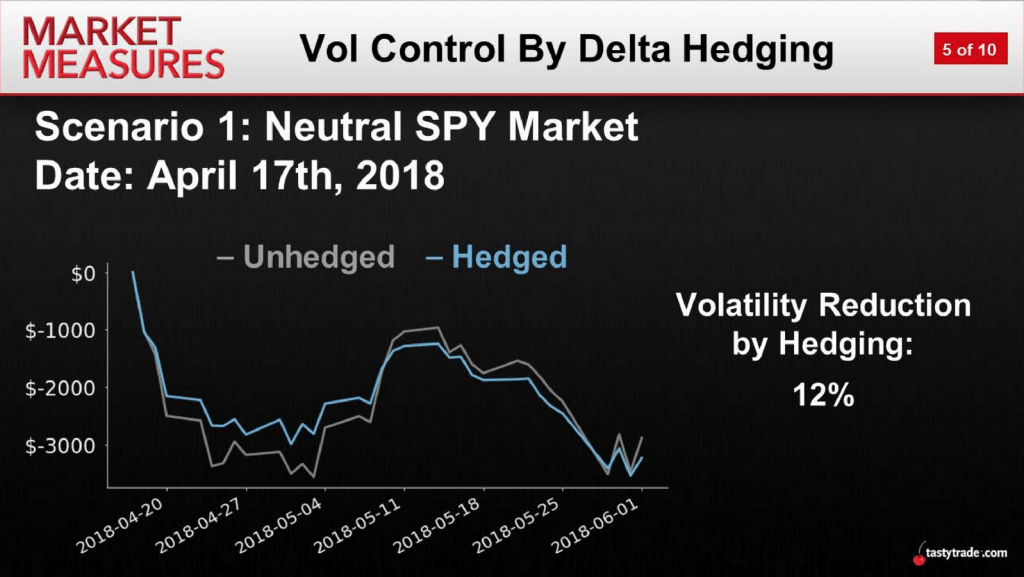

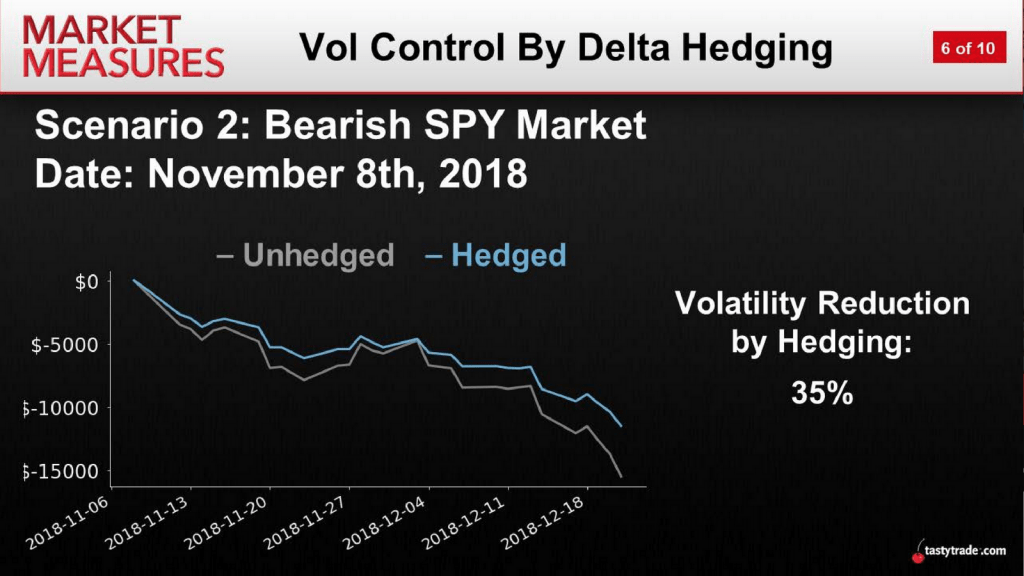

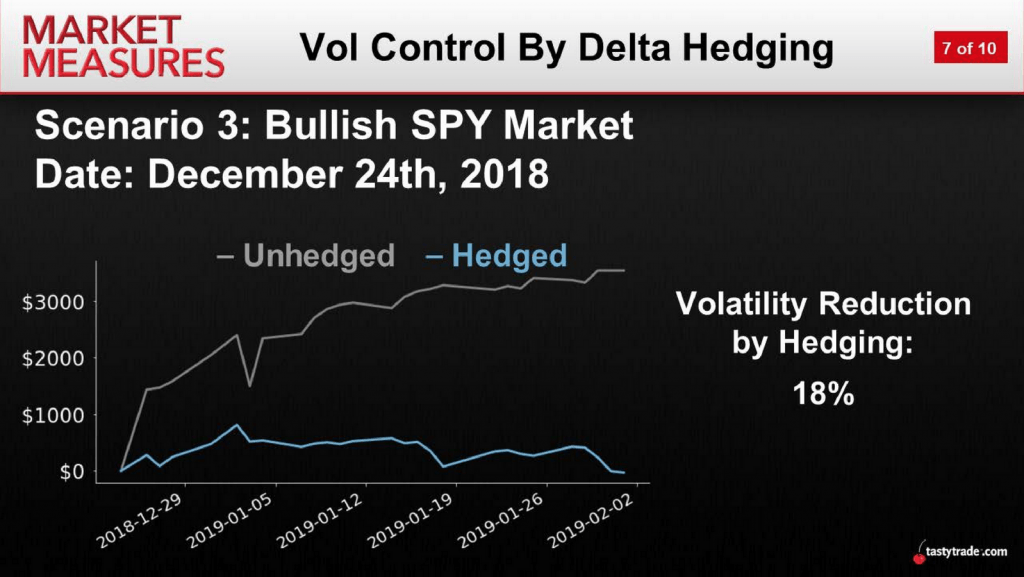

The intent of the study was to backtest the historical performance of this portfolio across three different types of market environments: neutral, bearish and bullish. Moreover, portfolios were backtested using two different hedging approaches—the first in which the portfolio was hedged (beta-weighted), and the second in which the portfolio was not hedged.

The three graphics shown below provide a visual illustration of how the volatility of daily P/L was reduced in all three market environments through the utilization of beta-weighted hedging:

As one can see in the above slides, beta-weighted hedging assisted in reducing the volatility of daily portfolio P/L in each of the three different market environments (neutral, bearish and bullish) included in the study.

As one might have suspected, portfolio hedging was most impactful when utilized in a bearish market, as shown in the second image.

Traders who are considering adding beta-weighted hedging to their own trading approach may want to review the aforementioned episode of Market Measures when scheduling allows.

Another episode from the same series, “Delta Hedging a Portfolio,” may also be of interest. This episode walks viewers through the process of ascertaining the current beta-weighted risk of a given portfolio and deploying the associated hedge.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.