Black Friday Correction: Better to Sell Theta or Vega?

Sharp corrections in the stock market tend to offer fresh opportunities to sell volatility, but is it better to focus on short-duration or long-duration trades in such situations?

Black Friday was especially eventful this year as global stock markets pulled back sharply over fears of a new COVID-19 variant known as Omicron.

And considering the strong historical correlation between price direction and volatility, it was no great surprise to see the CBOE Volatility Index (VIX) rally hard alongside sharp corrections in the major stock indices. The VIX closed trading on Nov. 26 trading 28.62—nearly 50% higher than the closing price on Nov. 24.

For short volatility traders, that type of action was likely an additional reason to be thankful during the traditional Thanksgiving holiday.

But, some investors and traders may have wondered about the best course of action following a sharp pop in the VIX—like whether it would be better to sell short-term options or longer-dated options after a sharp correction?

While the answer to that question depends somewhat on one’s unique market outlook and risk profile, new research conducted by the tastytrade financial network indicates that shorter trade durations have historically produced attractive results during such situations.

Along those lines, that same research also showed that lengthening duration in low volatility trading environments may also be a preferred course of action.

Ultimately, the choice boils down to selling theta (duration) or vega (volatility), so before jumping into the aforementioned research it’s worth reviewing those two terms, briefly.

Theta or Vega?

Theta measures the rate of change in an option’s theoretical value relative to the passage of time. This concept is often referred to as time decay, because all else being equal, options lose value as they get closer to expiration.

For example, if an option is worth $1 with five days until expiration, the theta of that option might be equal to $0.20. That means for each day that passes, the option will theoretically lose $0.20 in value per day.

With that in mind, there are four critical characteristics of theta that all options traders should keep in mind:

- Theta is larger for shorter duration options

- Theta is larger when implied volatility is high

- Theta decay is largest for at-the-money (ATM) options

- Theta’s rate of decay increases as expiration approaches

The above helps illustrate why short-term pops in volatility might best be capitalized upon using shorter duration options.

Alternatively, vega is the Greek measurement that reports how the value of an option changes with increases or decreases in implied volatility. In this regard, vega helps traders understand how sensitive an option is to changes in the speed of the market.

Options with longer-dated maturities have a higher percentage of vega than shorter-dated maturities. Additionally, vega is higher for at-the-money options as compared to out-of-the-money options.

As a result, the profit/loss (P/L) driver for short-term options tends to be biased toward theta, while the P/L driver of longer-dated options tends to be vega.

Modifying Trade Duration Based On Volatility Environment

According to the aforementioned market study conducted by tastytrade, historical data appears to support the bias toward shorter-duration trades following short-term pops in implied volatility.

This conclusion is based on a tastytrade market study that examined the relative historical performance of a short options trading approach using two different trade durations: 30 days-to-expiration (DTE) and 60 days-to-expiration.

For the purposes of comparison, a normal backtest was also conducted in all environments using trades with duration of 45 days. Data from this third backtest was used as a sort of control group for the purposes of comparison with the other two backtests.

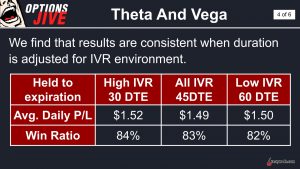

These three trade durations were then backtested across two different volatility environments—when Implied Volatility Rank (IVR) was above 30 (high-volatility environment) and when IVR was below 30 (low-volatility environment).

As such, short strangles (16 delta across the board) in the SPDR S&P 500 ETF Trust (SPY) were consequently backtested using data from 2005-2021, on the following types of positions:

- 60 DTE short strangles when volatility was low (< 30 IVR)

- 45 DTE short strangles in all environments

- 30 DTE short strangles when volatility was high ( > 30 IVR)

The findings from these backtests are highlighted in the charts below.

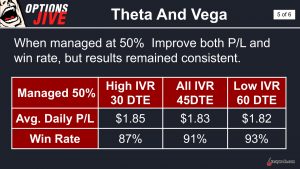

As one can see in the above data, the shorter-duration trades (30 DTE) produced the highest win rates (84%) in high-volatility environments, whereas the longer-dated trades produced the highest win rates (93%) in low-volatility environments.

Accordingly, the above data suggests that traders might consider targeting shorter duration when volatility metrics such as the VIX are elevated.

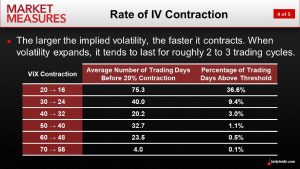

Additional research conducted by tastytrade, which complements the above information, suggests that elevated levels of volatility tend to contract more quickly than normal levels of volatility. This finding may help explain why short-duration options trades achieve targeted levels of performance at a quicker rate, in such trading environments.

The table below highlights the average number of days it has taken for the VIX to decline from indicated levels. As one can see in that table, the quickest rate of decline tends to occur when the VIX is near its zenith.

Readers seeking to review this research in greater detail can use the links below, at their convenience:

For timely updates on everything moving the financial markets, readers can also tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.