Debits, Credits & Probability of Profit

Strike selection plays a big role in the probability of profit for an options position, but Implied Volatility Rank (IVR) also plays a vital role.

The options universe is filled with a plethora of new terms and concepts, and to maximize one’s potential in this arena, it’s important to be aware of them. Awareness of these concepts can also unlock new approaches for investing and trading.

Several commonly used terms to be familiar with—beyond just implied volatility and mean reversion—are premium, credits and debits. And a quick rundown of these terms makes their importance abundantly clear.

Options prices are quoted in the marketplace in dollars and cents. However, those prices are often referred to as “premium,” likely because the options market is often thought of as a type of insurance for stocks.

Along those lines, buyers of options are said to be long premium, and on the other end of the spectrum, sellers of premium are frequently referred to as option writers. The latter nickname also clearly originates from the insurance world.

Importantly, when options premium is purchased, this transaction is typically referred to as a “debit,” because the amount paid for the options is debited from the investor/trader’s account. Alternatively, when an options market participant sells an option, the premium received from the sale is typically referred to as a “credit.”

The terms “debit” and “credit” are also used when trading option spreads, even though such positions usually involve both the purchase and sale of two, or more, different options. In this usage, debit or credit refers to the net result of the combined position.

For example, credit spreads refer to positions in which the investor/trader collects premium when taking into account the net cost of the spread, whereas debit spreads refer to positions in which the trader outlays premium when taking into account the net cost of the spread.

Generally speaking, debit spreads are long premium positions that tend to benefit from rising implied volatility, while credit spreads are short premium positions that tend to benefit from declining implied volatility.

Considering the broader dynamics of options trading, it’s easy to see how premium buyers might want to minimize debits, and how premium sellers might want to maximize credits received.

However, one must also keep in mind that probability of profit (aka “POP”) is inversely correlated to the size of the credit when it comes to short premium positions. For example, a short option writer will generally find that his/her probability of profit will be higher when selling—relatively speaking—smaller credits.

That’s because smaller credits will be received for options that are further away from the current price of the underlying stock—referred to as out-of-the-money options (OTM).

Alternatively, short options with strike prices closer to the current price of the underlying—referred to as at-the-money options (ATM)—will have higher associated credits, but lower associated POPs.

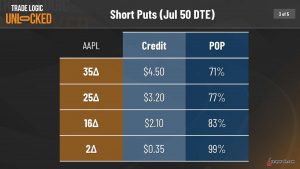

The inverse relationship between credit size and associated probabilities of profit is illustrated in the slide below.

As shown above, one can see that as the strike price of a short option gets further away from the current price of the underlying, the size of the credit received gets smaller. At the same time, the POP for that position theoretically increases, as the strike price of the short option gets further from ATM.

The situation is reversed for long options, as POPs tend to increase as debit sizes increase, and decrease as debit sizes decrease.

But there are other ways that options traders and investors can maximize their probability of profit, and that’s by monitoring implied volatility in individual tickers, as well as the broader market.

Implied volatility, by definition, is another method of quoting an option’s value. Instead of using dollars and cents, implied volatility is expressed as a percentage of the stock price, indicating a one standard deviation move over the course of a year.

For example, imagine stock XYZ is trading for $50, and the implied volatility of an option contract is 20%. This implies there’s a consensus in the marketplace that a one standard deviation move over the next 12 months would lie somewhere between $40 and $60 (because 20% of the $50 stock price equals $10).

In order to track changes in implied volatility, most options traders use Implied Volatility Rank (IVR), or another similar metric. IVR reports on the current value of implied volatility in the market as compared to the last 52 weeks of data.

Using an example, imagine that implied volatility in symbol XYZ is currently trading 45 and that over the last 52 weeks it has ranged between 30 and 50. In this case, IVR would currently be 50%. If implied volatility dropped to 30, then IVR would drop to 0%.

Traders can use IVR to track changes in the market, and filter for attractive opportunities to buy and sell volatility. When IVR hits an extreme—below 20% or above 80%—the associated debits and credits for long premium and short premium positions also theoretically move to an extreme.

That means that investors and traders can use such instances to minimize debits (when IVR is below 20%) and maximize credits (when IVR is greater than 80%) to boost associated probability of profit. That’s why strike price—and the associated size of the debit/credit—isn’t the only factor when it comes to POP.

Circling back to short options, investors and traders can also use IVR to help identify instances when option premiums are rising, and in turn attempt to improve associated probabilities of profit—without trading strikes that are closer to ATM.

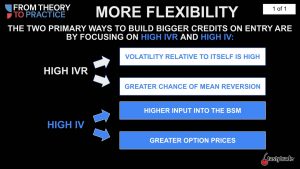

The slide below illustrates how investors and traders can filter for inflated IVRs in the market to maximize credit size (and associated POP) for potential short premium positions.

Alternatively, market participants can also filter for low IVRs in the market to minimize debit size for potential long premium positions. Beyond IVR, investors and traders can also monitor the CBOE Volatility Index (VIX), to track broader market volatility trends.

To learn more about the topics covered in this post, readers may want to review the following programming on the tastytrade financial network:

- Trade Logic Unlocked: All About Short Premium Credits

- From Theory to Practice: Building a Big Credit Bank

- Options Jive: How to Pump Up Your POP

For updates on everything moving the markets, readers can also tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST—at their convenience.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.