Exploiting Election Week Volatility

Stock options can triple in volatility as election day approaches, creating opportunities for traders to sell when prices skyrocket

Expectation of movement in the markets helps determine the price of the options that traders rely on for “insurance.” The greater the risk of loss, the greater the cost of the insurance.

Expectations are measured with implied volatility, and its level can help traders strategize. The period around a binary announcement, like an earnings release or presidential election, can sway levels of implied volatility, presenting trading opportunities for active investors.

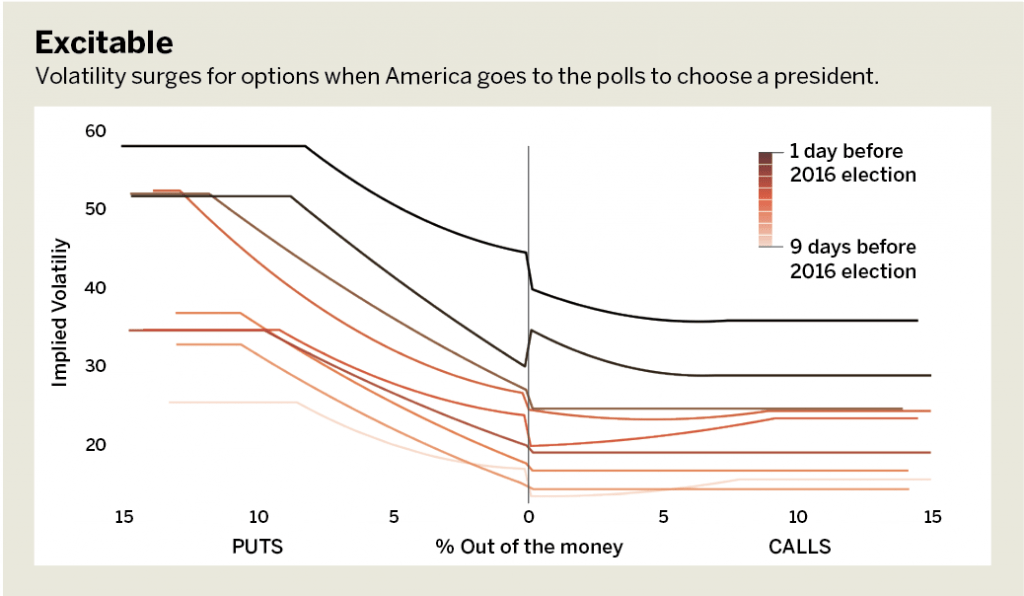

As noted earlier in the Basic Tactics section of Luckbox (p. 47), stock price returns on the day of an election fall within the normal distribution of returns for any given day. But what about options? On the surface, markets may appear quiet, but options traders who dig deeper will discover potential opportunity. Excitable (right) depicts the implied volatility for SPY over several days leading up to the 2016 election. Nine days before election day, the implied volatility of the out-of-the-moneyoptions (the lightest line on the chart) was around 15—close to its long-term average. As the election approached, implied volatility increased every day until it tripled the level of an average day.

Knowing that implied volatility increases, traders can create a strategy to capitalize on richly priced options. One such scheme involves selling exuberant expectations of movement with a directionally neutral bias. Using a short option strategy, such as a straddle, strangle or iron condor, traders can remove their directional assumption of predicting up or down movements in the underlying stock and simply play movements in implied volatility.

Consider the short straddle, which involves selling an out-of-the-money call and an out-of-the-money put. On election day in 2016, traders could sell a SPDR S&P 500 (SPY) straddle expiring the next day for $4.00.

One day later, after the votes were tallied and expectations eased, that same straddle could be bought back for just $2.50, netting a $1.50 profit per contract. The collapse in option prices is attributed to the deflation in implied volatility, not the performance of SPY. To define the risk and lower the buying power requirement, this trade could have been turned into an iron condor by buying further out-of-the-money options.

Because expectations of movement differ for each stock, traders can use a comparative measure like implied volatility rank to gauge the richness of options for a given underlying. Implied volatility rank compares the current IV with levels from the preceding trading year. So, the higher the rank, the more expensive the options prices of that underlying are relative to their history. Keep an eye on implied volatility before this year’s election because opportunities may arise to sell inflated expectations.

Click here to learn more about IV Rank and options.

Michael Gough works in business and product development at the Small Exchange. @small_exchange