First, Diversify

Reduce risk by investing in a variety of stocks, sectors and asset classes

From the beginning of the year until mid-June at press time, the S&P technology sector exchange-traded fund (ETF), comprising 76 stocks, fell 28.2%. The broad S&P 500 ETF (SPY) fell 21.7% in the same time frame. Even though the technology sector accounts for the largest grouping of stocks in the S&P 500, investors exposed to the overall index were hurt less than those invested only in technology. This is the essence of diversification.

Diversification minimizes risk by spreading money across different stocks, sectors and asset classes. A diversified portfolio can help investors weather even the toughest storms because it has assets unlikely to move in tandem. When one asset goes down, the other goes up to balance it out. While it’s not usually a perfect 1-to-1 relationship, diversification can help smooth out the larger losses characterized by drawdowns.

When selecting assets to diversify a portfolio, consider correlation. It measures how two investments move in relation to one another. Let’s say an investor has a portfolio consisting of the S&P 500 ETF SPY, which itself is more diversified than an individual company because it holds 500 stocks across all sectors. This investment can get through sector-specific risks, such as the price of oil dropping, which drags down energy-related stocks.

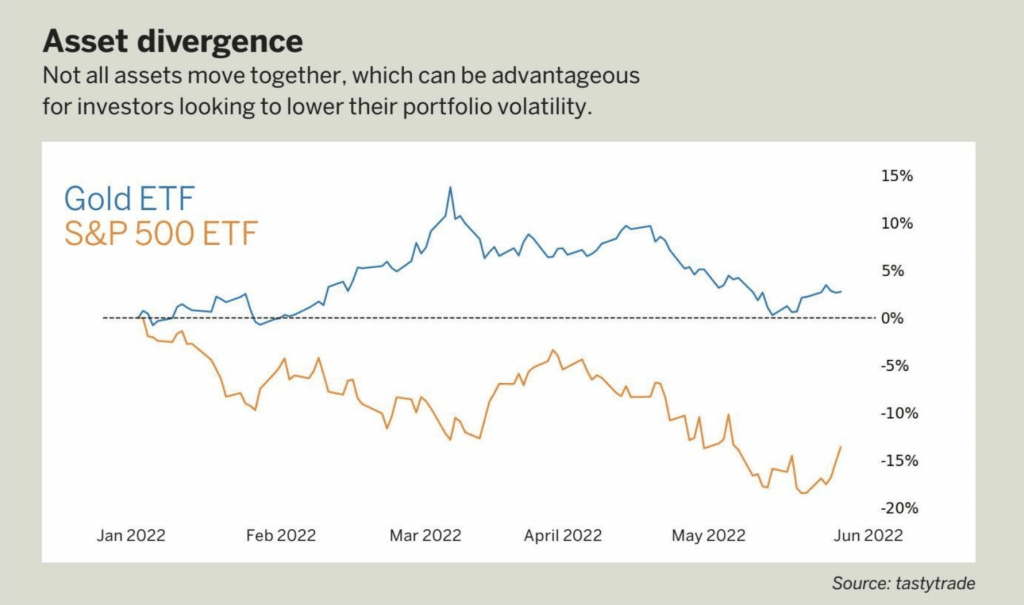

A broad-based ETF, such as SPY, mitigates some of that risk via diversification across sectors like financials and technology. However, there are times when the broader stock market sells off as a whole, and many single stocks and sectors drop 20% or more. That’s when diversification across uncorrelated assets is important. Uncorrelated assets can come in different forms, whether they are bonds and other fixed-income assets or in commodities, such as gold.

While bonds may not be the flashiest investment, they play an essential role in diversification because they have a weak correlation with most other major asset classes. Historically, bonds have a negative correlation with the S&P 500, even as low as -0.8, meaning that when one asset class goes down, the other goes up. In recent years, this relationship hasn’t been as extremely negative but still remains slightly negatively correlated to even uncorrelated at times.

Active investors don’t need to learn the ins and outs of bonds to invest in them but can instead use a bond ETF to gain exposure to the bond market. Take TLT, for example, a 20+ year Treasury Bond ETF. TLT has more than 30 different bond investments, all with varying maturity dates and yields, meaning that investors can get broad exposure to the bond market without hours of research.

Gold is another asset class that can diversify a portfolio because of its weaker correlation with the broader equity market. The relationship between gold and the S&P 500 fluctuates between weak negative correlation and weak positive correlation, remaining between -0.5 and 0.5 for the better part of the 21st century.

We look for this type of relationship because it means the returns on the two asset classes are not likely to move together. Instead of investing in bars of gold and worrying about storing them, look at gold ETFs as a more cost-efficient and simple way to add exposure to a diversified portfolio. GLD is a popular example of a gold ETF because it has custody of gold bars, thus tracking the market price of gold.

There are many ways to diversify a portfolio, but looking for uncorrelated assets is the first step. The next is deciding on the allocation of capital toward each asset. That depends on investors’ risk tolerance and when they will need access to that capital in the form of cash. Investors close to retirement might prefer a more conservative portfolio consisting of a larger portion of bonds and cash.

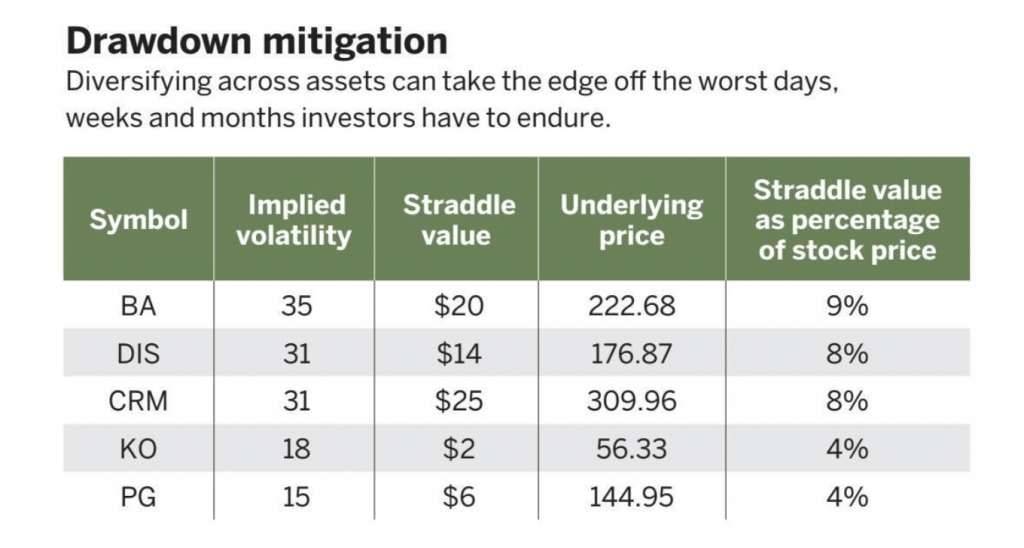

| Younger investors can afford to allocate more toward stocks because they have time to recoup losses. A diversified portfolio of stocks, bonds and gold may allocate 70%, 20% and 10%, respectively. That ensures the portfolio still has enough invested into stocks to reap the benefits of capital appreciation but enough of the portfolio in the uncorrelated assets, bonds and gold, to counteract volatility from the stock market. See Drawdown mitigation to understand how a simple, diversified portfolio helps decrease risk while maintaining returns. |

Eddie Rajcevic, a member of the tastytrade research team, serves as co-host of the network’s Crypto Corner and Crypto Concepts shows. @erajcevic11