Going Long

You are bullish on a stock or sector. You see upside ahead. It's important to understand the probabilities, risks, and costs of the various options.

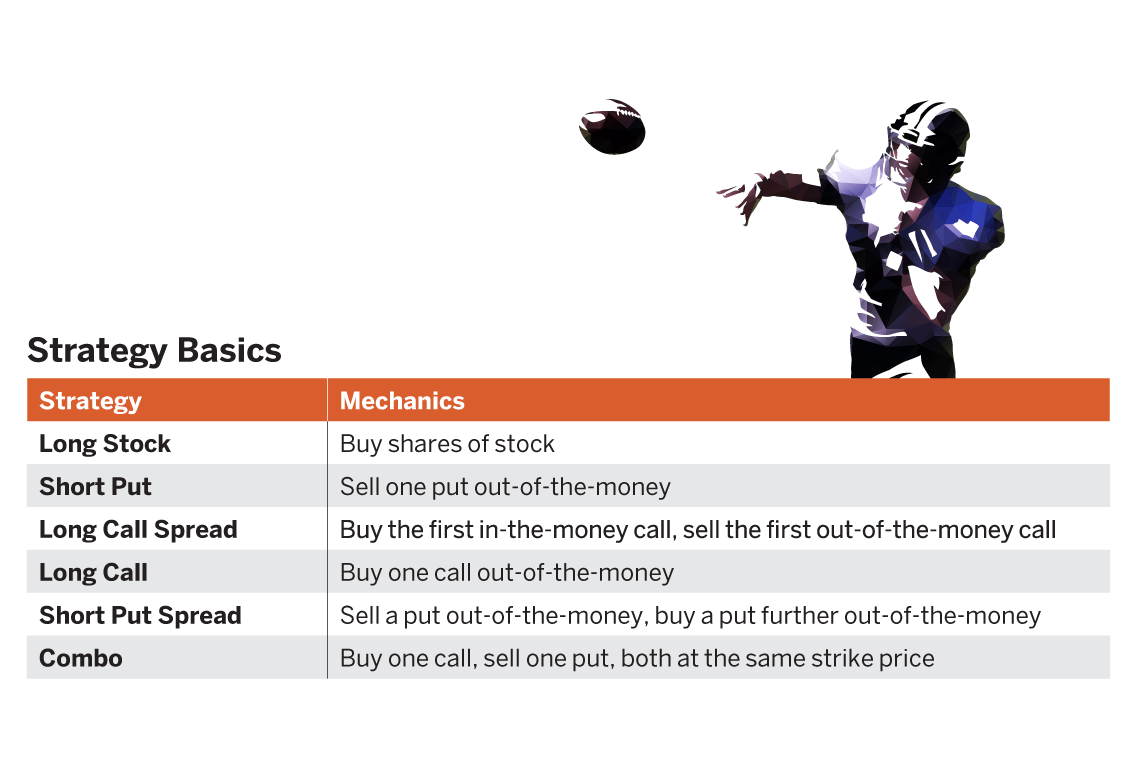

In the complex world of financial instruments, investors have many ways to express bullish assumptions. Here are some ways to get long a particular underlying.

This article won’t delve into the complexities of those strategies. Instead, let’s compare them.

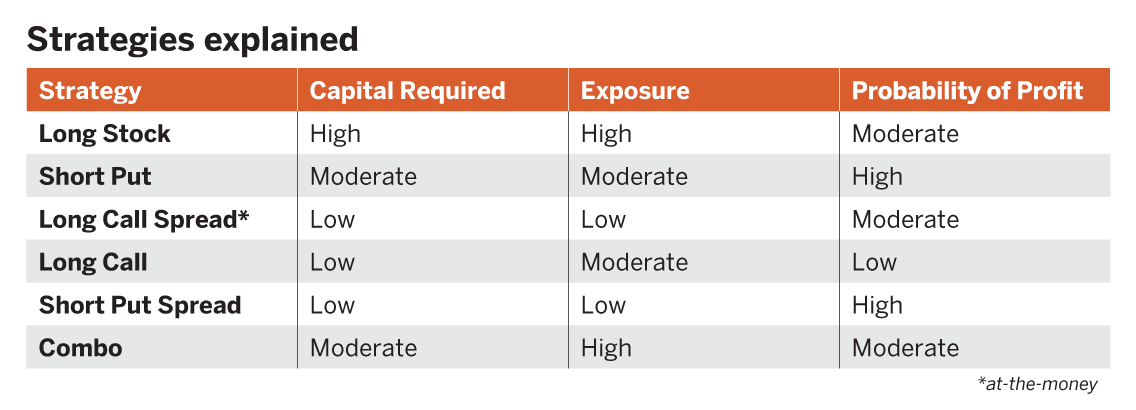

Many strategies share the same directional bias but vary drastically by other metrics. Investors should choose a strategy that fits their criteria and account size.

Some notes: Exposure is simply how high the potential is for risk and for reward. That’s usually measured in share equivalents, meaning that the more shares investors have, the more they can make or lose. Probability of profit (POP) is the chance that the position yields at least $0.01 in profit by expiration. Stocks always have a POP of 50%.

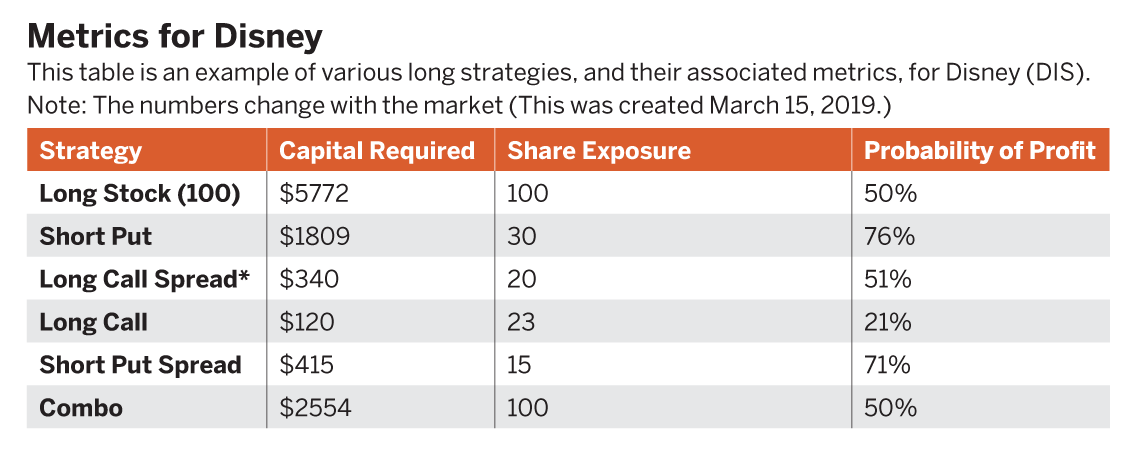

In “Metrics for Disney”, right, we show an example of the various long strategies, and their associated metrics, for Disney (DIS).

There are many ways to go long other than just buying stock. One can adjust their share exposure and probability of profit to suit their needs. If you want a strategy that requires low buying power and a high probability of profit, the short put spread is the way to go. Even the simple strategy of buying stock can be replicated using only half the capital with the combo. Incorporating options into your trading can increase your probability of success while limiting capital and risk exposure.

Anton Kulikov is a trader, data scientist, and research analyst at tastytrade.