How Much Stock Liquidity is Enough? Your Handy Reference Guide

Liquidity often gets overlooked as a strategic tactic in the financial markets, but the utilization of this metric can provide investors and traders with considerable advantages.

For most investors and traders, highly volatile markets are attractive because they present a plethora of new opportunities. But another critical metric market participants need to monitor is liquidity.

After all, the euphoria associated with a profitable position can be short-lived if a trader/investor fails to exit that position at the desired level (i.e. price).

For this reason, liquidity in the financial markets is often defined as the ability to easily convert an asset into cash without significantly affecting the associated market price of that asset.

A high degree of liquidity also helps ensure that pricing in a given market is as efficient as possible—another important factor that contributes to optimal execution.

So what qualifies as an “adequate” level of liquidity? The answer varies slightly, depending on the product. For example, futures markets tend to be highly liquid across the board.

However, liquidity can be more inconsistent in stock and options markets, which is why investors and traders need to monitor this metric closely when evaluating potential opportunities.

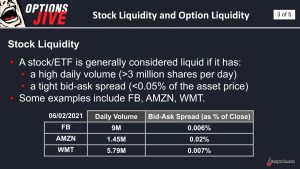

For stocks, the most important metrics to track are average daily volume and the bid-ask spread, as outlined in the graphic below.

As one can see in the above information, the thresholds for “adequate” liquidity in stocks are fairly straightforward. However, things get a little more complicated when examining equity options markets.

For example, while the volume of contracts traded daily in a given symbol can be an important indicator, there are several additional metrics that are equally (if not more) important:

- Robust contract volume (across strikes)

- Robust open interest (across strikes)

- A tight bid-ask spread (<1% of the contract price)

- Numerous liquid strikes per expiration cycle

- Multiple expiration cycles

While each of the above bullet points is important, it’s actually the sum of them that typically creates the ideal environment for robust liquidity in a given options listing.

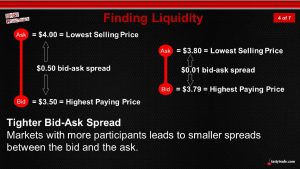

When all of the above bullet points are present, another powerful force usually materializes—the compression of the “bid-ask spread.” This effect usually provides a big advantage for investors and traders.

The bid-ask spread represents the difference between the bid price of an option and the offer price of an option. For example, if the bid for a given option is $0.50, while the ask is $0.80, then the bid-ask spread would be equal to $0.30 ($0.80 – $0.50 = $0.30).

If one assumes the midpoint of the bid-ask spread represents fair value, then the fair market value of this hypothetical option would be $0.65.

That means a trader paying $0.80 to purchase that option (i.e. “lifting the offer”) has already paid $0.15 over fair value to enter the trade—a situation that obviously puts the investor/trader at an instant disadvantage. The same could be said of a trader selling the option on the bid for $0.50 (i.e. “hitting the bid”), which would be $0.15 below fair value.

This example helps illustrate why compressed bid-ask spreads are so critical because they allow investors and traders to execute more easily at the “fairest” market price possible.

As one can see in the above graphic, the bid-ask spread for the sample options market on the right clearly allows market participants to more easily access fair market value when executing trades.

Moreover, it’s also easy to see how a tighter bid-ask spread would theoretically make it easier to exit the trade at a later date. Tight bid-ask spreads simply do not exist when liquidity is suboptimal.

To learn more about using liquidity to one’s advantage in the financial markets, readers may want to review the complete episode of Options Jive. More information on whether volume is predictive of price direction is also available on a previous episode of Tasty Extras.

Continuous updates on everything moving the markets are available via TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.