How Much Volatility Is Too Much?

Risk increases if a stock is too volatile or makes price moves far outside of what’s expected

Options traders often gravitate toward highly volatile stocks. With volatility, they have greater expectations for the stock price and, if played correctly, a greater expectation of profitability.

But if a stock is too volatile or makes price moves far outside of the expectation, that can increase risk substantially. That was true at the end of January and beginning of February, when traders worried about “risk to the upside” instead of the normal “risk to the downside.”

And while the severity of the GameStop (GME) affair shocked everyone, it shouldn’t come as a surprise that smaller-capitalized stocks have a tendency toward increased volatility compared with larger-capitalized stocks. After all, it takes less to increase the value and thus capitalization of a $1 billion company than one that’s 100 times larger. Traders often overlook capitalization and volatility.

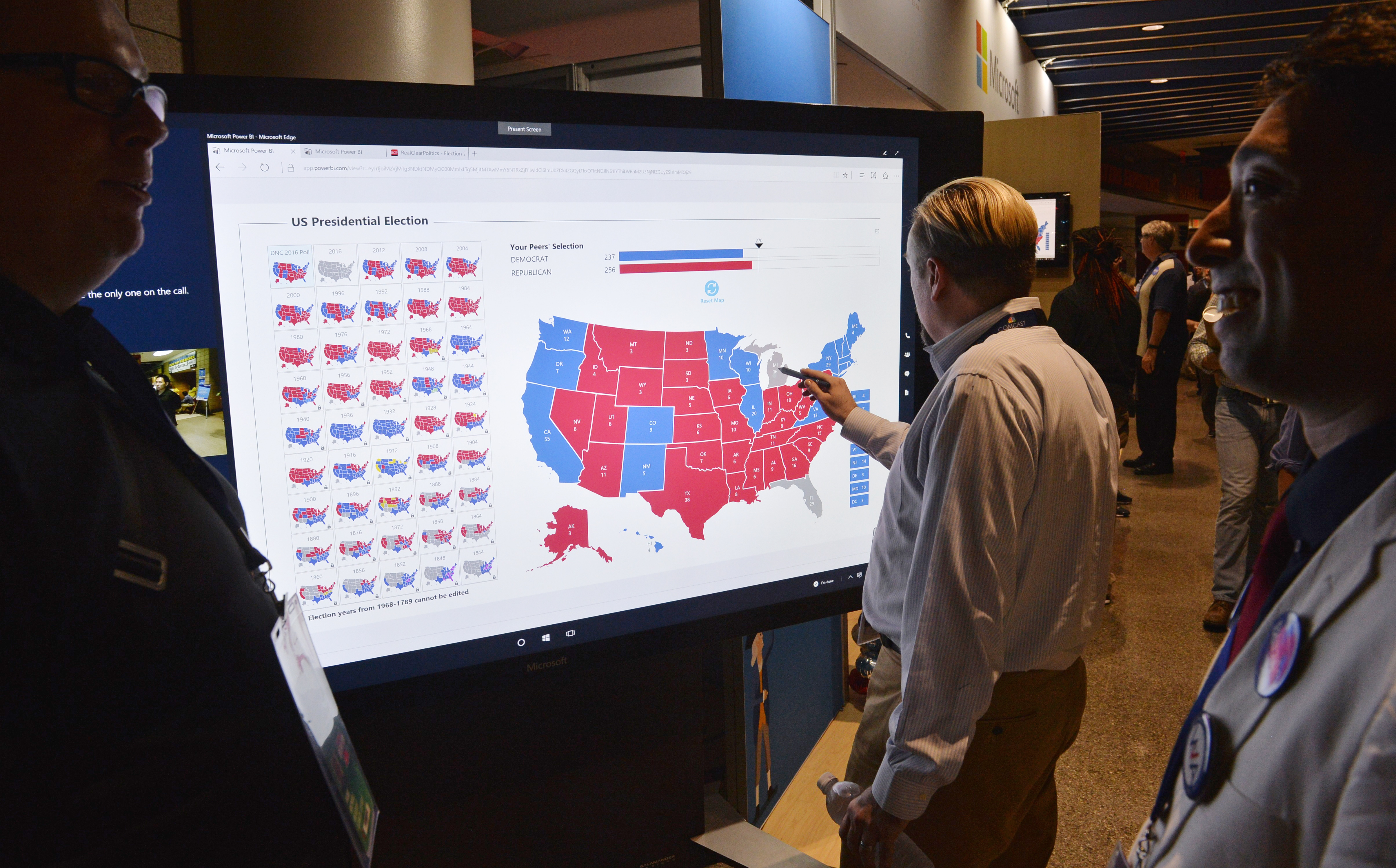

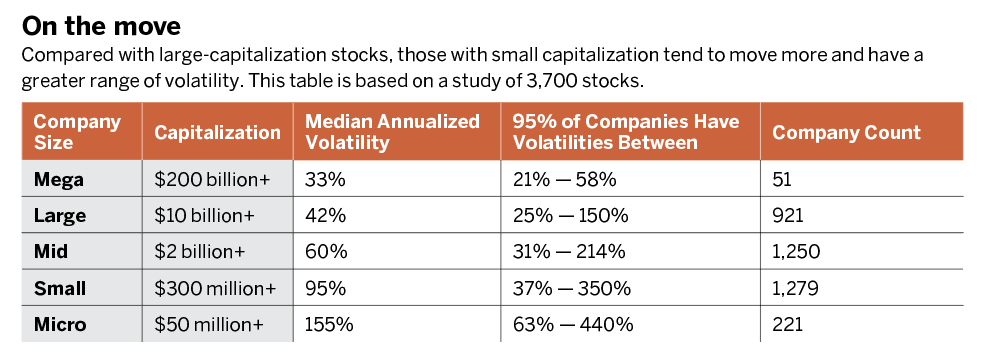

An online search will reveal the capitalization of any stock. A mega-sized company has a capitalization of $200 billion or greater. The median volatility is 33%, which means that a company this size has a tendency to increase or decrease by 33% over the next year. Now look at the ranges of the volatilities: 95% of mega-sized stocks have volatility between 21% and 58%.

Compare that to micro-sized companies. The smaller-capitalization stocks have volatility between 63% and 440% with a median of 155%. With smaller sizes, traders can expect not only a lot of movement but also a larger range of movement.

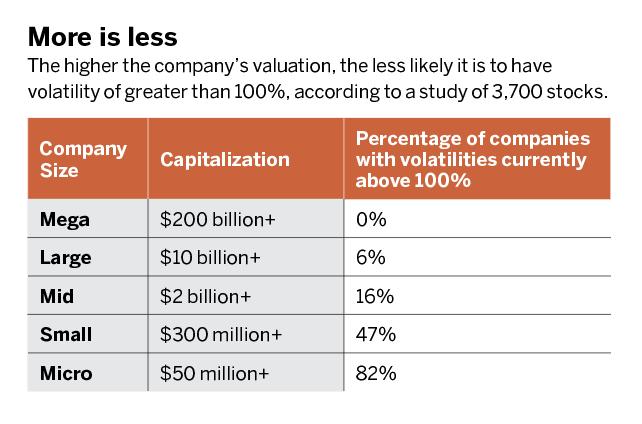

“More is less,” below, shows that none of the mega-cap stocks have a volatility over 100%, whereas 82% of microstocks have volatilities that high. The market is undoubtedly placing significantly more risk on the latter segment.

Because of the greater possibility of swings, many traders prefer to define their risk when trading mid-sized, small and micro-sized stocks—especially to the upside. Suppose, for example, that a trader has a short strangle in Alcoa (AA). According to the risk profile, this position would have unlimited risk above the short call strike. To define the risk —especially in such mid-cap or smaller stocks—buy a call above the short strike.

Short the 20 put and the 25 call. Now, define the risk by buying the 26 or above call. That gives the position minimal or no risk to the upside.

The profitability may be smaller when a trader buys protection to define the risk, but the account will be more likely to absorb a larger move to the upside.

Click here to learn more about the importance of high-implied volatility in small accounts.

Michael Rechenthin, Ph.D., aka “Dr. Data,” is the head of data science at tastytrade. @mrechenthin