Leg Up on Futures Calendar Spreading

Learn the idiosyncrasies of intramarket spreads—trades where an investor simultaneously buys and sells the same futures contract in different expiration months

Professional traders seeking commodity exposure often make futures their preferred investment vehicle because of their capital efficiency, exactness in tracking an underlying spot market and deep liquidity.

But unlocking the benefits of futures can require serious study because each market has its own distinct contract specifications. Bond futures move in different price increments than stock index futures. Oil futures expire one day and natural gas the other. Gold futures are for 100 troy ounces, while silver futures are for 5,000.

Not only are the contracts disparate, they also move significantly more than exchange-traded funds (ETFs), often swinging by as much as thousands of dollars per day. But once traders become familiar with contract nuances, they can scale into using futures with a calendar spread strategy.

Futures calendar spreading involves buying and selling different expiration dates of the same market to profit from the difference in rate of movement between near-term and deferred-term futures contracts. It can be a great way to scale into trading futures because the strategy requires lower margin and exhibits less volatility than buying or selling outright futures. Calendar spreading works by taking advantage of futures term structure, the difference in price between expiration dates.

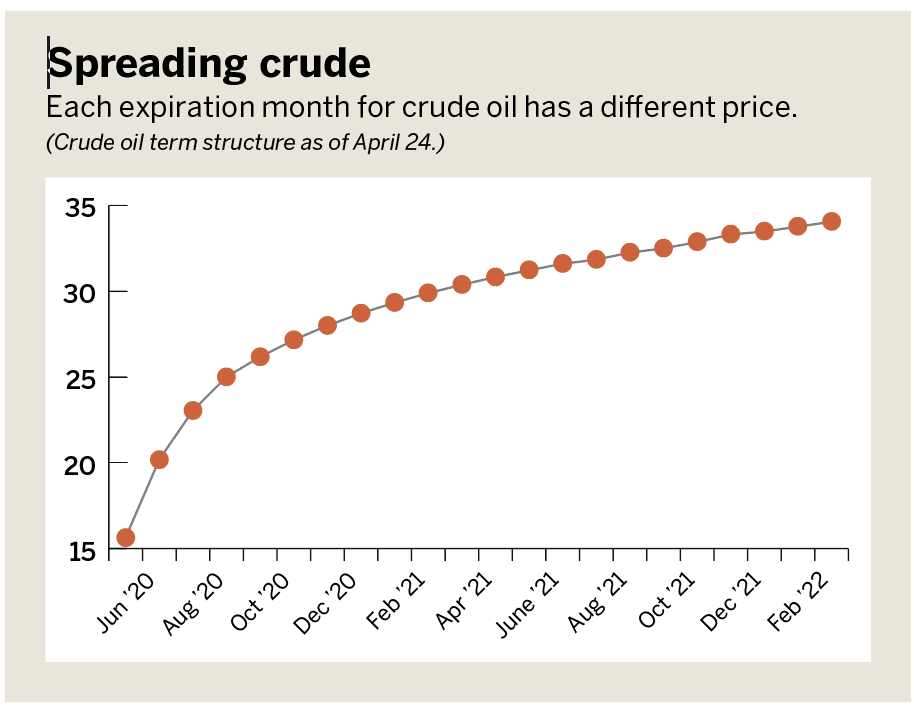

At any point in time, multiple futures contracts are outstanding for a given market. These different prices for each expiration date create a futures’ term structure. Take crude oil, for example, which has contracts expiring roughly every month. Each expiration month has a different price, as depicted in “Spreading crude,” (right).

While in this example crude’s term structure is upward sloping (contango) it can also be downward sloping (backwardation) if supply and demand factors shift. This dynamism creates opportunity for traders looking to buy or sell the spread.

Consider the July-August calendar spread in crude oil. As of May 1, the July crude oil future was trading for $22.29 per barrel while the August contract was trading for $24.20. This difference in price, typically quoted as front price–back price, equals -1.91.

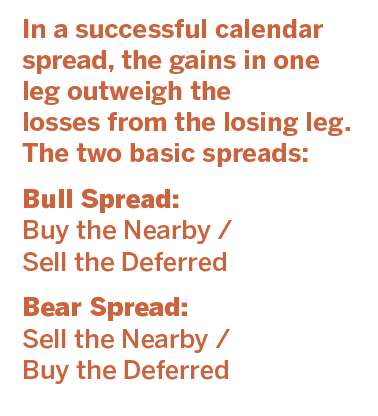

Traders who think the spread will increase can buy it (buy front, sell back). If they think the spread will decrease, they can sell it (sell front, buy back). Similar to pairs trading, calendar spreading helps dampen profit and loss swings as losses in one contract are often offset by gains in the other.

Rather than stretch the use-case of an inefficient exchange-traded fund, traders can maintain pure commodity exposure with futures calendar spreads. These spreads maintain pure commodity exposure but typically show less than a third of the notional movement of buying (selling) the outright future.

This lower volatility requires a smaller initial margin, which results in a greater potential return on capital. Popular products for calendar spreads are corn, wheat, soybeans, crude oil, natural gas and euros because their prices are more sensitive to shifts in supply and demand. To stay engaged with a smaller size, consider futures calendar spreads.

Michael Gough enjoys retail trading and writing code. He works in business and product development at the Small Exchange, building product and professional partnerships. @small_exchange