Options Trading and the Role of Theta

Understanding theta’s role in options trading is nearly as important as mastery of implied volatility and delta.

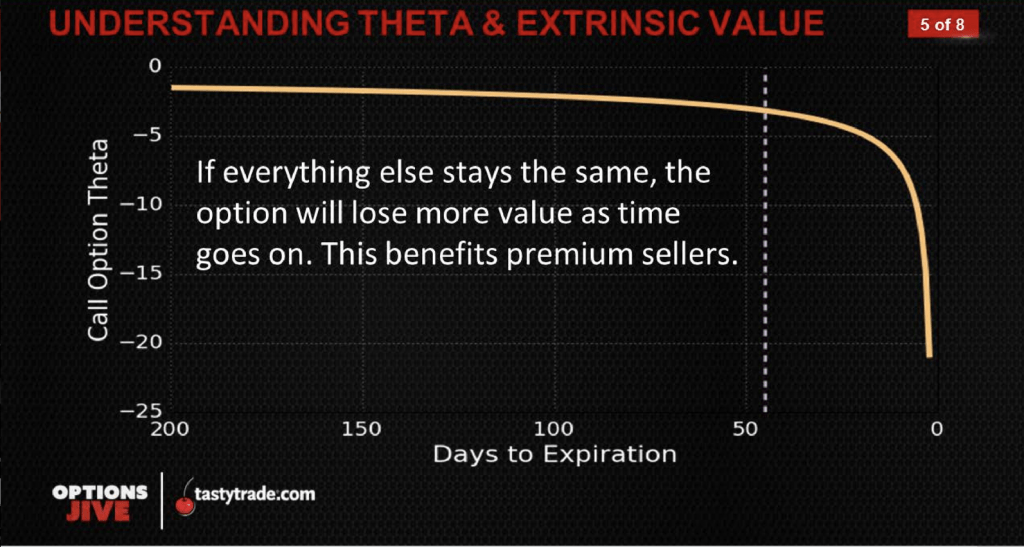

Theta, the “Greek” that measures the rate of change in an option’s theoretical value relative to the passage of time, is often referred to as “time decay” because options lose value as they get closer to expiration.

For example, if an option is worth $1 with five days until expiration, the theta of that option might equal $0.20. That means for each day that passes, the option will theoretically lose $0.20 in value.

Traders can track the value of theta at both the position and portfolio levels for insight into how the value of an option changes as time passes.

Theta also illustrates the vast difference between buying and selling options. Success in selling options generally hinges on limited movement in the underlying. When that happens, sellers of options get to keep the theta that is bleeding out of an option’s value.

On the other side of the equation, options buyers typically make the most profit when an underlying is moving—particularly when the moves are significant. If the underlying is sitting still or moving sideways, options owners typically lose money as the value bleeds out through daily theta.

With that in mind, let’s examine four characteristics of theta that all options traders should know.

- Theta is larger for shorter-duration options

- Theta is larger when implied volatility is high

- Theta decay is largest for at-the-money (ATM) options

- Theta’s rate of decay increases as expiration approaches

Understanding those characteristics ensures traders are deploying positions that match their risk profile and outlook.

Look at the first bullet point: Shorter duration options possess larger theta. That makes sense because a longer-dated option will have a greater number of days remaining until expiration. For longer-dated options, each passing day, therefore, removes a smaller percentage of the option’s value.

However, heading into the final weeks and days before expiration, that same option will start to lose a larger percentage of its value.

Per the second bullet point above, theta is also higher when implied volatility is inflated. This fact is a cornerstone of the short premium approach, which seeks to exploit mean reversion—the fact that elevated implied volatility tends to revert to its historical average.

Given the relationship between risk and reward, it also shouldn’t come as a surprise that theta is larger for at-the-money (ATM) options.

Options with strike prices close to the current price of the underlying stock have a greater likelihood of finishing in-the-money (ITM). That means the risk of selling premium in such options is higher than with out-of-the-money (OTM) options.

That’s why, ATM options have higher premiums than OTM options—and consequently higher theta. The space between ATM and OTM options can be a good place to look when filtering for attractive short premium opportunities, according to tastytrade research.

Focus on strike prices one standard deviation away from at-the-money. That can reduce risk, while also providing the possibility of earning an attractive return by not straying too far out-of-the-money.

One final note about theta relates to time until expiration—the fourth bullet point listed above. This speaks to the number of days between trade initiation and trade expiration.

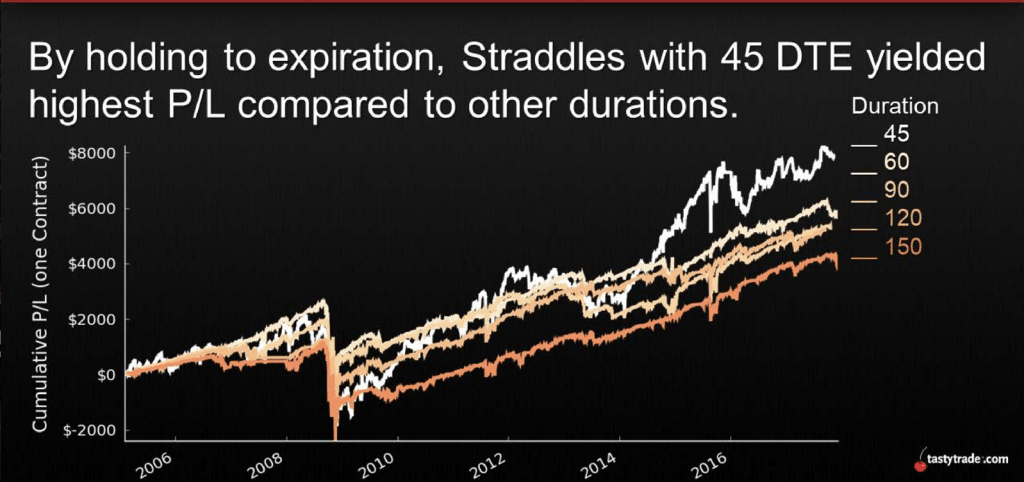

Evidence suggests that 45 may be an optimal number for time until expiration. In this case, 45 refers to the number of “days-until-expiration,” or DTE.

Two primary factors make 45 DTE especially attractive: theta decay (aka premium decay) and “time to be correct.”

As covered already, theta decay refers to the fact that options theoretically lose value as time passes.

“Time to be correct,” on the other hand, refers to how the 45-day target provides the position with a long enough window to move in the trader’s favor, even if the trade were to temporarily move into negative P/L territory.

Trading options with only a couple weeks until expiration (or less) increases the risk of the position ending in negative P/L territory, because there’s less time for the underlying to retrace if it makes a big move in the wrong direction. That means shorter duration options trades are theoretically higher risk from a theta perspective.

So, traders may want to target 45 days-to-expiration (DTE) when selling premium and also consider using a trade management technique (e.g. managing trades at 50% of maximum profit).

Readers seeking to learn more about theta and its influence on options trading strategies, may want to review the following episodes on the tastytrade network:

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.