Prophet to Profit: Turning Market Assumptions into Market Success

Investing and trading are about making money, but they also provide the personal satisfaction that comes with transforming ideas into positive returns.

Coming up with investment and trading ideas is referred to as “forming a market assumption,” or “building a market assumption.”

Traders and investors build assumptions by developing a market idea that’s consistent with their outlook and risk profile—and then deploying it.

For example, traders who viewed the global spread of COVID-19 as a potential disaster for the airline industry, and deployed that idea as a short bet against airline stocks, are likely feeling a strong sense of satisfaction—as are long-time believers in Tesla (TSLA).

And while the tangible confirmation of getting things right is a growing pile of money in one’s trading account, the intangibles are likewise valuable—a positive vibe, a boost in confidence and pride in one’s work/hobby.

Market participants prefer high volatility because it’s often accompanied by a rising number of potential trading opportunities. Fast-moving markets produce more mispricings, which means it can be easier to identify good positions and build associated assumptions.

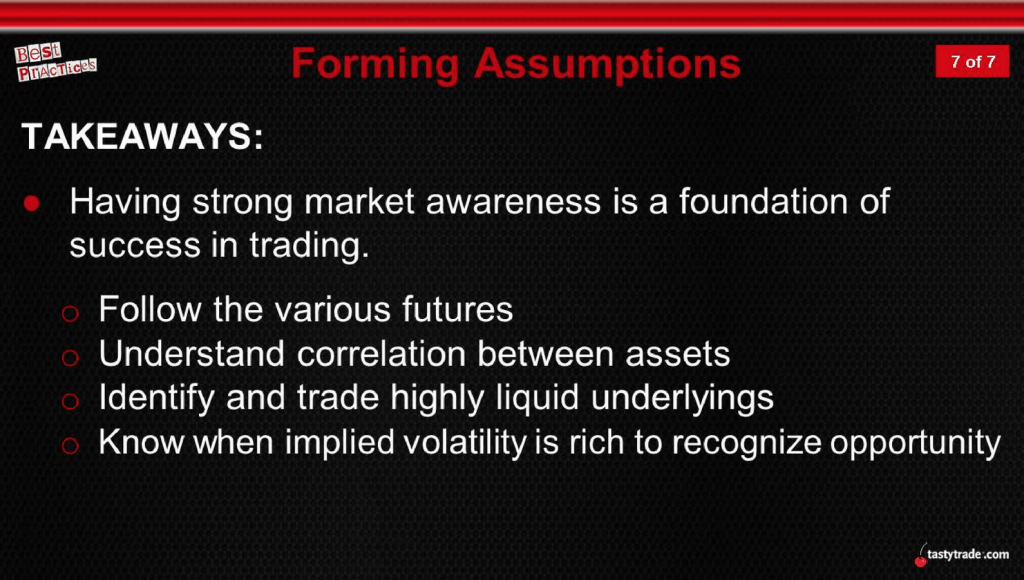

That’s why monitoring the markets closely—by following a variety of market narratives and asset classes—can be such a profitable endeavor. Learning about and experimenting with new tactics, through paper trading (i.e. “mock trading”), helps hone skills.

Investors and traders seeking to enhance their ability to build and deploy effective market assumptions may want to tune into a new show on the tastytrade financial network called What’s Your Assumption?

The show focuses on trading/investment ideas submitted by tastytrade viewers. It’s valuable not only because it builds market awareness, but also because the hosts discuss a range of choices (tactics and products) for deploying a given market assumption.

Viewers can then watch the ideas play out in the financial markets in real time, providing a valuable foundation for building future assumptions.

To watch the latest installment of What’s Your Assumption? on the tastytrade financial network, readers can follow this link.

Guidance on building market assumptions is also presented on this installment of Best Practices and this episode of Trade Logic Unlocked.

By building effective market assumptions, traders can get closer to securing their financial futures, and also find a little personal satisfaction along the way.

“Sage Anderson” is a pseudonym for a contributor who has traded equity derivatives and managed volatility-based portfolios as a prop trading firm employee. He is not an employee of Luckbox, tastytrade or any affiliated company. Readers may direct questions about this blog post or any other trading-related subject, to support@luckboxmagazine.com.