Taking Equity in Futures Options

Equity options traders often rely on implied volatility to assess opportunities, but the practice isn’t limited to the equities segment of the financial markets. Futures traders can also utilize volatility—and in much the same manner—making the crossover from equities options to futures options fairly intuitive.

The big difference between equity options and futures options is the underlying: stock in the case of equity options and futures for options on futures. That means an option on gold futures (/GC) can be traded as easily as an option on Apple (AAPL) stock.

The “official” definition of a futures option is also nearly identical to that of an equities option: futures options provide the holder with the right, but not the obligation, to buy or sell a specific futures contract at a specific price on or before the expiration date.

And just as equity traders can select from a myriad of underlyings when trading options, there’s a large pool of available futures products, too. The six main categories of futures contracts include agricultural, energy, metals, equity index, foreign exchange and interest rates.

Along those lines, traders of futures options tend to look beyond the dollar and cents price of an option, just as equities options traders do.

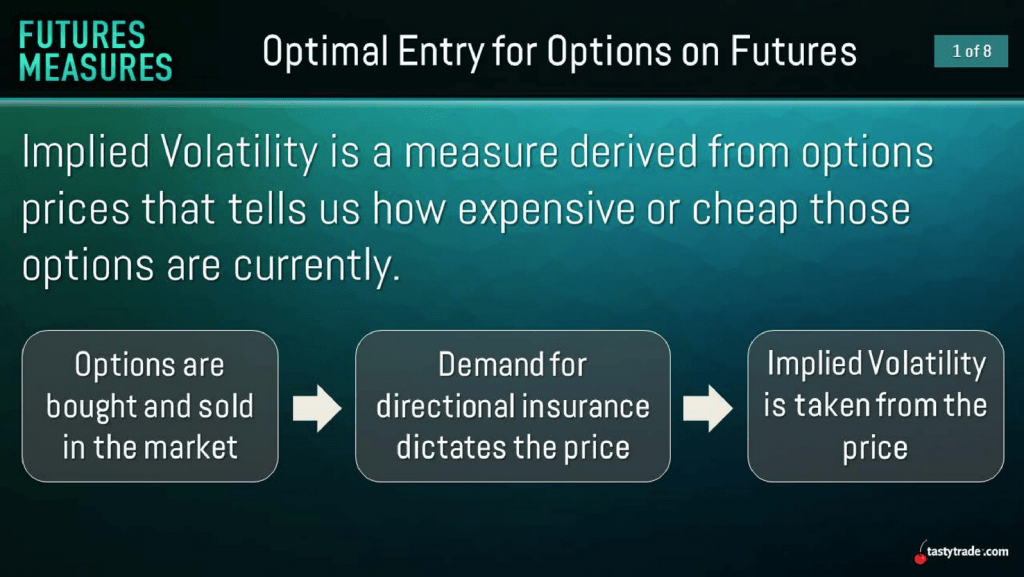

Futures traders use volatility, which is “implied” by the dollar and cents value, to translate market prices into a figure that can be more easily analyzed. That’s why the market price of volatility is often referred to as “implied volatility.”

That in turn means traders can use key metrics such as Implied Volatility Rank (IV Rank) to analyze potential futures options opportunities. IV Rank reports whether implied volatility is high or low in a specific underlying based on the past year of implied volatility data.

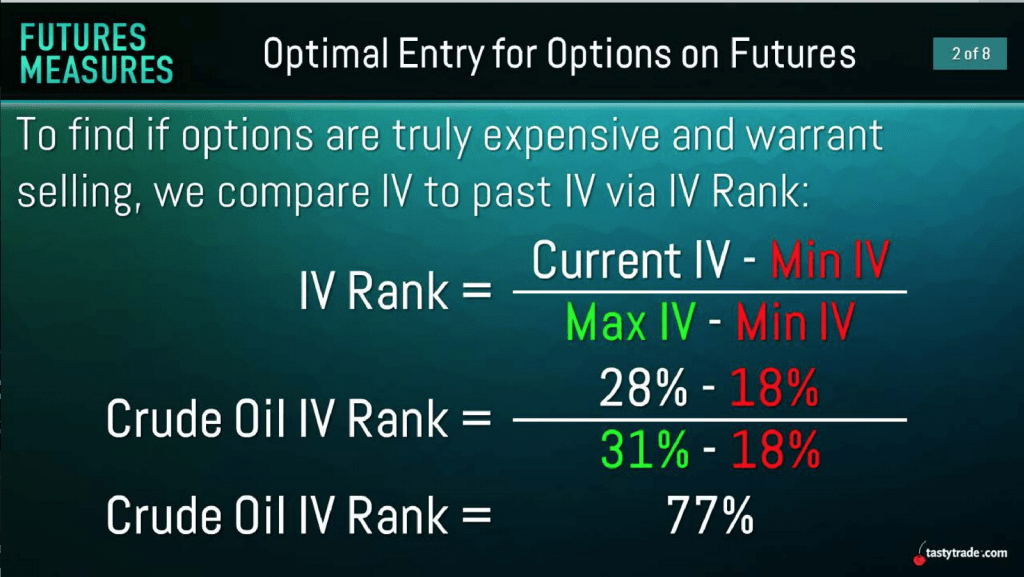

For example, if XYZ has had an implied volatility between 30 and 60 over the past year and implied volatility is currently at 45, XYZ would have an IV Rank of 50%. An implied volatility of 30 would therefore equate to an IV Rank of 0%.

The graphic below illustrates how IV Rank is calculated for futures options.

Traders generally look for opportunities to sell options when IV Rank is above 50%. Crude oil was well above 50% when IV Rank was calculated at that time (example for illustrative purposes only).

However, just like with equity options, there are additional considerations that traders usually take into account before executing a given trade.

For example, an equities trader might consider the type of news that typically affects a given stock or the timing of the next earnings announcement, both of which can catalyze big moves in the underlying price of the stock.

As with equity options, futures options traders generally seek to be on the buy-side when implied volatility is low, or when a gap move is expected. Options sellers usually get active when an underlying is expected to move in a narrow range during the life of the option.

That means that much like equity options, traders can follow futures prices on a daily basis to learn more about what makes those contracts move. When comfortable with the product, traders might then start deploying “live” trades. It’s also recommended to “mock” trade a new product first—meaning not a live trade, but a paper trade to follow how the position behaves and performs.

Importantly, there’s immense value in monitoring both equities and futures to identify possible crossover opportunities.

For example, a trader of crude oil futures might simultaneously monitor ETFs levered to crude oil, such as the Energy Select Sector SPDR Fund (XLE), and also follow single stocks dealing heavily in crude oil, such as Exxon Mobil (XOM), ConocoPhillips (COP), or Chevron (CVX).

It should be noted that volatility in futures doesn’t necessarily need to be traded with options. Many market participants trade back-and-forth action in futures using long and short positions, as outlined in this recent episode of Small Stakes.

To learn more about trading futures options using implied volatility, readers may want to review this recent installment of Market Mindset on the tastytrade network when timing allows.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about any of the topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.