The (Broken Wing) Butterfly Effect

Trading a BWB at price extremes affords the trader room for the trend to continue and zero risk, if the trend reverses.

When markets reach price extremes, either higher or lower, what’s the best move—trade the trend or risk the reversal? If markets are truly memoryless, then either choice may be a 50-50 shot.

But using options can improve those odds and reduce the emphasis on having the right directional opinion. The question is really which strategy should a trader choose: strangles, credit spreads or naked? But that’s an incomplete list. For a high-probability trade for a market extreme, there’s also the broken-wing butterfly (BWB).

Before trading a BWB, traders should familiarize themselves with the structure of a traditional butterfly spread. (For a primer, see this series’ Intermediate article.) Like the traditional butterfly, BWBs are comprised of either all calls or all puts. But the difference is a BWB has a “broken” wing.

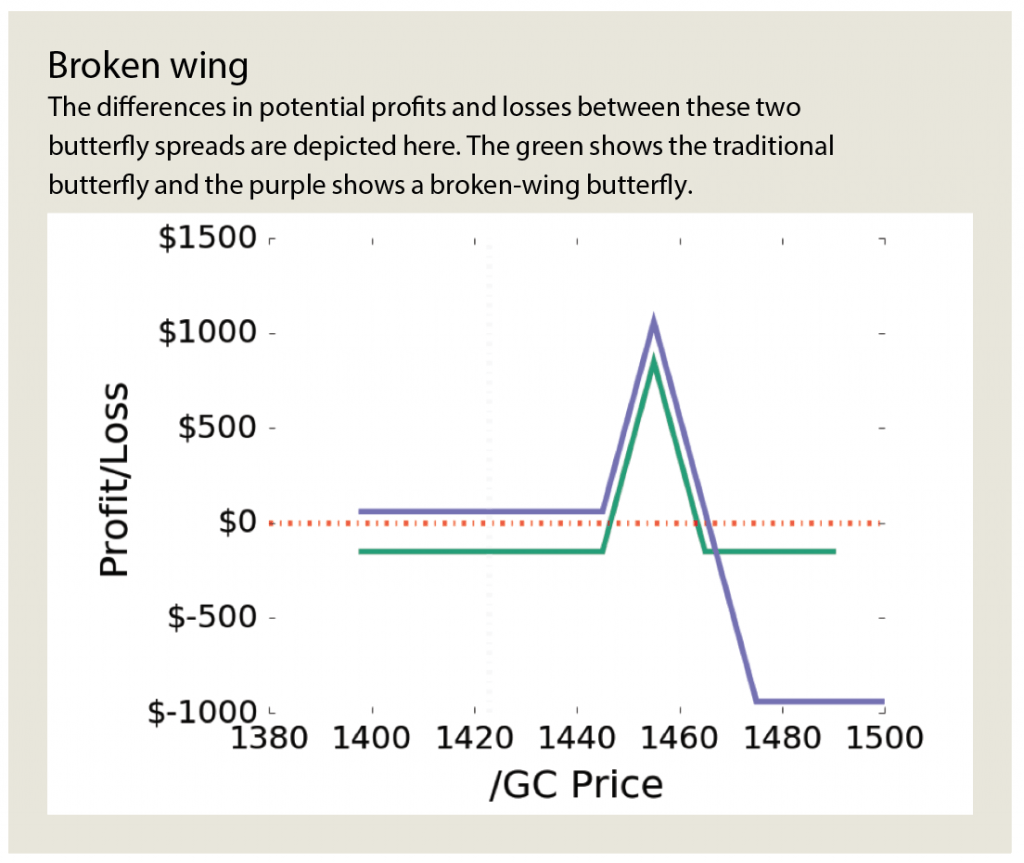

For example, a traditional butterfly has equal width wings (e.g., 95-100-105 strikes), while a BWB has unequal width wings (e.g., 95-100-107 strikes). Breaking the wing can turn the trade from a debit spread to a credit spread. BWBs should always be traded for a credit. This slight alteration drastically improves both the probability of profit and potential max profit of the trade.

To place a BWB, look for an underlying with high implied volatility at a recent price extreme. At the time of this writing, one such underlying is gold. Recent fears of economic uncertainty sent investors flocking to buy gold, which drove up both the price and implied volatility. Prices in this example are for gold futures (commonly denoted “/GC” on brokerage platforms), but a similar trade can be placed on the GLD ETF (An exchange-traded fund for gold) for lower capital requirements.

Traders who are bullish on gold and think the upward trend will continue may consider a call BWB (a contrarian who’s bearish could trade a put BWB). With the underlying at $1,423, a bullish BWB could be the 1445-1455-1475. That’s buying one 1445 call, selling two 1455 calls, and buying one 1475 call for a $1.60 credit. The trade has a max profit of $10.95 and, according to the Tastyworks platform, a 74% probability of making a profit! Because the trade is placed for a credit, the investor takes zero risk to the downside. If gold sits at $1,455 on expiration day the trade will make the max profit of $10.95. If gold reverses direction, the trade still makes $1.60!

Compare that to a traditional butterfly. The 1445-1455-1465 traditional butterfly requires a $0.40 debit to trade and has a max profit of only $9.60 with a 15% probability of making a profit. Breaking the wing drastically alters the performance characteristics of the trade. The differences in potential profits and losses between these two butterfly spreads is depicted in “Broken wing” below.

Note, however, that the increased potential max profit and probability of profit aren’t free; trading is all about risk and return. With its improved risk/return profile, the BWB also has greater risk. The potential max loss of the BWB is $8.40 (width of the wider spread minus the credit received) while the potential max loss of the traditional butterfly is only $0.40 (debit paid to enter the trade).

Trading a BWB at price extremes affords the trader room for the trend to continue and zero risk, if the trend reverses. In this example, if gold continues its rally to the body of the butterfly (short options), the trader would collect max profit. On the other hand, if gold reverses its direction the trader simply keeps the credit received to place the trade. Both butterflies would lose money if gold continues to rally beyond the further out-of-the-money call. As a way to trade the trend or fade a move, consider the broken wing butterfly.

Michael Gough, a self-taught coder who became an options trader, is on the futures product development team at The Small Exchange.