The Long and Short of Weekly Options

Trading in weekly options has exploded in 2021, but investors and traders should consider the respective value propositions of weekly, monthly, and LEAPS options before diving into this niche of the financial markets.

Retail trading volumes have exploded this year and the activity hasn’t been limited to stocks and cryptocurrencies—equity options trading volumes have obliterated historical records in 2021.

During January this year, options volumes on U.S. exchanges increased by a jaw-dropping 70% as compared to the month prior.

Interestingly, index options volumes actually decreased 12% in January, which means all that extra activity was focused on single stocks like GameStop (GME), American Entertainment Holdings (AMC), and any number of other social media-fueled momentum plays.

In the single-stock options world, investors and traders can choose from three different types of option contracts—weeklies, monthlies, and longer-term options known as LEAPS. The primary difference between these three contracts is the time until expiration, often referenced as “days-to-expiration” (DTE).

Weekly options are available with expiration ranges between one and five weeks, while monthly options are generally available from one to 11 months out. Options with longer than one year until expiration are generally referred to as long-term equity anticipation securities (LEAPS).

Due to elevated volatility in the financial markets during the last 12 months, a higher proportion of market participants have gravitated toward weekly options as compared to past years.

One reason for this change is because elevated volatility in the market equates directly to higher options premiums. As a result, some options traders have likely gravitated toward weekly options because the absolute premium is lower.

The reduced premium for weekly options is of course directly correlated to their shorter duration (i.e. they expire more quickly). That means there’s theoretically less time for a weekly option to produce the desired outcome.

This weakness in weeklies can be especially acute for investors and traders trying to use weeklies to ride a big gap (up or down) in the price of an underlying stock.

More so than in the past, investors and traders have been purchasing weekly options in the hopes that an underlying will make a big move higher (in the case of a long call holder), or a big move lower (in the case of a long put holder), before the options expire.

In terms of the risk-reward dynamic, this approach represents an extreme.

In the vast majority of cases, weekly low-probability option bets such as these are losers. But in rare instances, that weekly premium can pay out huge. That’s why weekly options are often referred to as “lottery tickets.”

Considering that reality, one might think that a short approach in weekly options might be more advisable. However, that’s not necessarily true, especially when comparing the performance of short weekly options to longer-dated options, like monthlies.

Investors and traders looking for more insight on the relative value proposition represented by selling weekly options, as compared to monthly options, may want to tune into a recent installment of Market Measures on the tastytrade financial network.

In this episode, the hosts of Market Measures discuss a new market study conducted by the tastytrade research team that examines the historical performance of weekly options vs. monthly options.

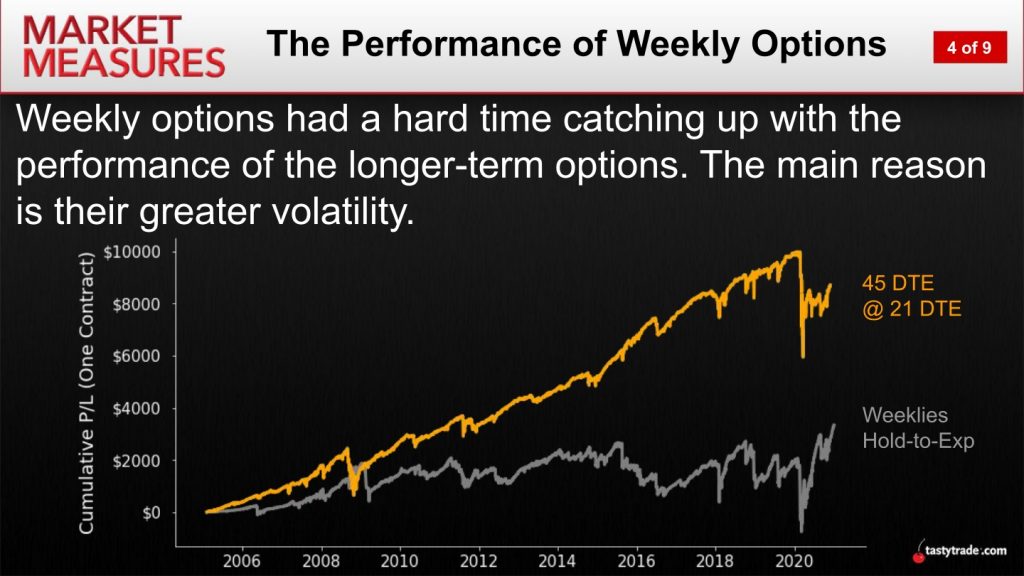

In short, that examination revealed that the short-term risks associated with weekly options made them relatively less attractive than monthly options, in terms of overall historical return. The results of the market study are highlighted in the slide below.

As illustrated in the chart above, the performance of short weekly appears suboptimal as compared to the performance of short monthly options, over the long term.

One reason for the difference in relative performance ties back to time until expiration. Briefly, if a monthly option starts losing money, there’s more time for that trade to move back into a winning position before expiration, as compared to a weekly option.

For losing weeklies—especially those with only days until expiration—there’s simply no time for the position to correct itself.

This concept—”more time to recover”—was explored in greater detail by the tastytrade financial network in a previous episode of ABC.

Market participants seeking to learn more about trading weekly options are encouraged to review the aforementioned tastytrade episodes when scheduling allows:

To follow the daily action in the financial markets, readers can tune into TASTYTRADE LIVE, weekdays from 7 a.m. to 4 p.m. CST, when scheduling allows.

Through April 1, subscribe to Luckbox in print and get a FREE Luckbox T-shirt! See SUBSCRIBE or UPGRADE TO PRINT (upper right) for more info.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.