The Magic of 45: Optimal Short Options Trade Duration

Experienced traders understand there’s no magic crystal ball when it comes to accurately predicting the financial markets. That’s why smart traders focus on approaches that have historically demonstrated a high win percentage, such as mean reversion and the short premium philosophy.

After all, a higher probability of winning at trade deployment reduces trader dependence on “being right.”

Along those lines, traders can utilize market research to help optimize tactics—for example, how to approach trade duration. This is especially relevant when trading options and futures, as both types of securities have definitive dates of expiration.

Trade duration refers to the fact that traders need to consider not only price and implied volatility when evaluating a given option’s value, but also the time until expiration.

Looking specifically at the options world, time until expiration is often denoted as “Days to Expiration,” or DTE. This metric encompasses the total number of days between trade initiation and trade expiration.

According to extensive research conducted by tastytrade, there is evidence suggesting 45 may be a somewhat optimal number for DTE when it comes to short premium positions. And based on this research, there are two primary factors at play when it comes to optimizing trade duration: theta decay and “time to be correct.”

As a reminder, theta decay refers to the fact that options theoretically lose value as time passes. Theta is one of the options Greeks, and this metric provides insight into how much value a given option loses with the passing of a single day. The short volatility/premium approach is predicated on the collection of daily theta—leveraging theta decay to the portfolio’s advantage.

“Time to be correct,” on the other hand, refers to how the 45-day target provides the position with a long enough window to move in the trader’s favor, even if the trade were to temporarily move into negative P/L territory.

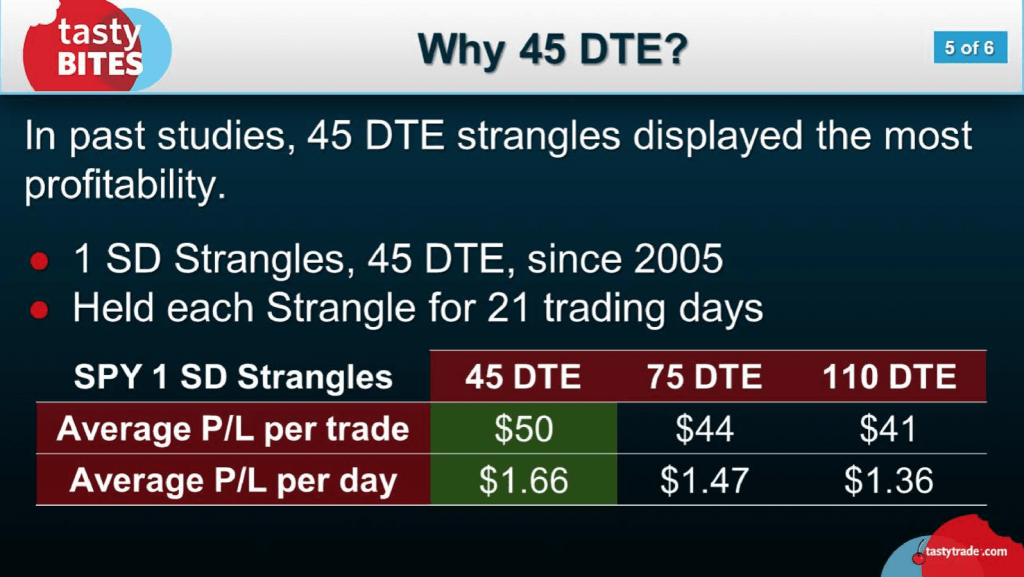

Looking at this research from 30,000 feet, tastytrade has conducted a number of studies utilizing historical market data to ascertain whether discernible patterns indicate whether there’s an optimal level for trade duration. The graphic below highlights one such study, in which the findings pointed toward 45 days:

As one can see in the above data, the 75 DTE and 110 DTE trade durations also produce attractive results, albeit less optimal than the 45-day window.

And while the insights provided by this research are undoubtedly valuable, another study conducted by tastytrade helps refine this thinking further.

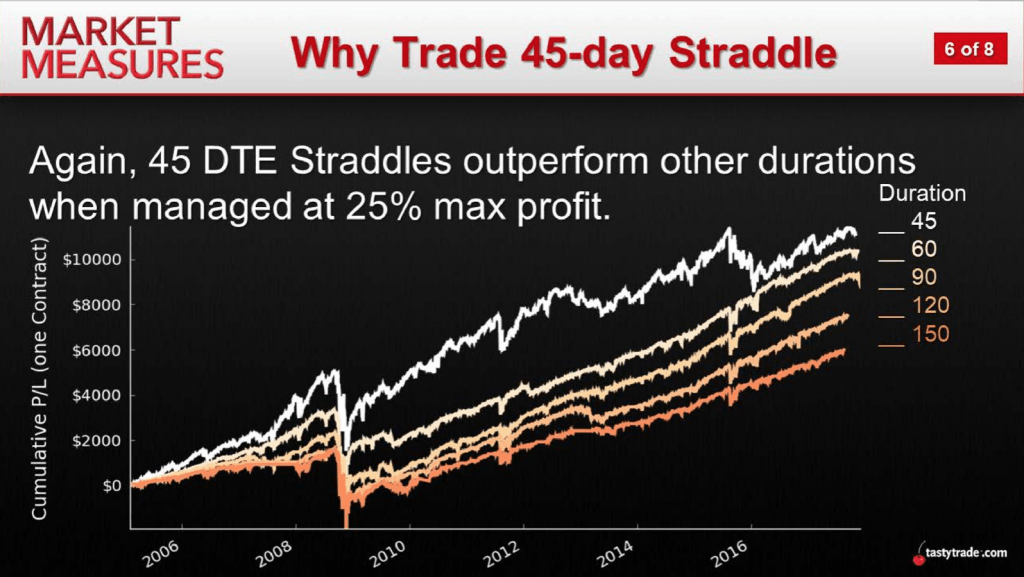

In the second study, the research team focused not only on trade duration (i.e. 45 DTE), but also layering a trade management system into the approach. Trade management refers to a disciplined style of managing open trades such that “trade exit” is reliant on disciplined decision making, instead of emotional reactions.

Aside from providing a systematic framework for managing open trades, trade management also allows for an increase in the total number of occurrences (due to the quicker redeployment of capital)—another key priority for traders seeking to exploit high-probability trading strategies.

In this second market study, the trade management approach that was included in the backtest was a simple strategy calling for the closure of any trade that reached 25% of maximum potential profit.

As one can see in the graphic below, the findings once again illustrated that 45 DTE appears to be an optimal target window:

Traders seeking to review these studies in greater detail may want to watch the complete episodes of tasty Bites and Market Measures when scheduling allows.

It’s entirely possible that the 45-day window won’t fit every trader’s approach and/or outlook. However, the material covered in these episodes should help traders refine their thinking on the trade duration subject.

Additional information is also available in the tastytrade LEARN CENTER.

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.