Trading Low Volatility Markets Amidst Dogecoin Hysteria

Market volatility dipped below its long-term average in April, but despite that relative complacency, investors and traders can still employ a wide range of tactics to uncover new opportunities.

An 18 print in the CBOE Volatility Index (VIX) wouldn’t usually qualify as a boring or complacent market. But relative to the last 14 months of trading—which saw the VIX set a new all-time high above 80—the current market environment is undoubtedly less exhilarating.

Importantly, a quieter market environment doesn’t necessarily equate to less opportunity. It may, however, call for an updated approach when it comes to filtering for potential trading or investment ideas.

Market participants looking for new opportunities may want to consider some of the following tactics during the current lull in market volatility:

- Explore new sectors, products and strategies

- Identify what’s moving

- Identify pockets of the market with high IV

- Consider extending duration in short volatility trades

- Be wary of long volatility trap

While low volatility markets can be boring, these periods can also be viewed as opportunities to learn about new sectors of the markets, new products and new strategies.

For example, investors and traders that have historically focused on domestic markets might expand their watchlist to include international opportunities, as outlined recently on Luckbox.

Along those lines, periods of complacency provide investors and traders with extra time to analyze their overall strategy and current portfolio exposure. In this vein, market participants with no previous experience trading the cryptocurrency space might use this time to expand their knowledge of the sector.

A recent episode of Market Measures on the tastytrade financial network outlines why 4% might be a good starting point when it comes to diversifying the portfolio with cryptocurrency exposure.

The cryptocurrency subject also provides a good segue into the next tactic: identifying what’s moving.

At this time, it’s not Bitcoin (BTC) garnering the most attention in the cryptocurrency sector, but rather Ethereum (ETH) and Dogecoin (DOGE), which have both experienced strong surges in the last several weeks.

Another corner of the financial markets that has been hot in 2021 is the energy sector. Both crude oil and natural gas have experienced strong rallies to start the year and have transformed from 2020 laggards into 2021 leaders.

In fact, a wide variety of key global commodities—beyond oil and natural gas—have experienced strong gains this year, as illustrated in the list of top-performing ETFs in April.

Source: TheStreet.com

For traders of volatility, quieter markets can be especially burdensome. That’s because it’s not easy to sell options when implied volatility is depressed. On the other hand, it’s not necessarily easy to buy volatility, either.

The problem with long volatility positions is that they are constantly fighting against the time decay (aka theta decay) phenomenon. This is the concept that dictates—all else being equal—that options lose value as time passes.

One potential tactic that short volatility traders can adopt during periods of relative complacency (i.e. low volatility) is to extend the duration of trades. For example, instead of targeting options with 45 days-to-expiration (DTE), one might filter for options with 60 days until expiration or longer.

Readers seeking to learn more about adjusting the duration of volatility trades based on market environment may want to review previous research conducted by tastytrade on this topic.

No matter what approach one might adopt in a lower volatility environment, it’s critical that investors and traders remain disciplined, and avoid reaching for opportunities that just aren’t there.

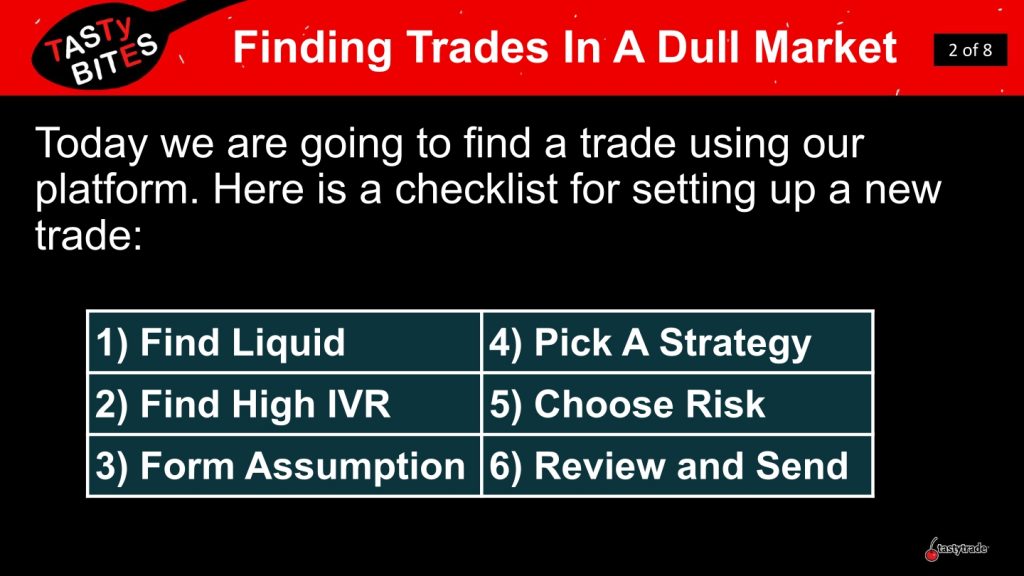

Regardless of the market environment, it’s important to stay mechanical with the decision-making process, as outlined in the steps below.

To review more information on trading in complacent markets, readers may also want to review the following tastytrade programming:

- Tasty Bites: Finding Trades in a Dull Market

- Best Practices: Strategies For Low IV

- Market Measures: Modifying DTE based on IVR

To uncover new ideas in the financial markets, readers can also tune into TASTYTRADE LIVE—weekdays from 7 a.m. to 4 p.m. CST—at their convenience.

Sage Anderson is a pseudonym. He’s an experienced trader of equity derivatives and has managed volatility-based portfolios as a former prop trading firm employee. He’s not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about this blog or other trading-related subjects, to support@luckboxmagazine.com.