A Lithium Trade

Heavy expectations for the world’s lightest metal

For a commodity once celebrated as “the new oil,” lithium has fallen hard—its stock price plunging 80% from the December 2022 all-time high. Blame the soft metal’s soft prices on the slowdown in demand for electric vehicles.

But is it a case of peak pessimism? The EV market’s decline has slowed. Despite a 26% monthly drop in January, global sales grew by 69% from the previous year, according to the EV analytical firm Rho Motion.

“The European market grew by 29% year-over-year, the U.S. and Canada by 41%, and in China sales almost doubled,” Rho Motion reported.

And in February, the investment bankers at Goldman Sachs forecasted EVs would account for half of global new car sales by 2035.

As long as motorists buy EVs in sufficient numbers and no new battery technology supplants lithium, companies that deal with the metal should be on your watch list.

One such company, Arcadium Lithium (ALTM), produces lithium-related chemicals crucial for portable electronics, electric vehicles and stationary storage facilities. It also performs hard-rock mining, conventional pond-based brine extraction and direct lithium brine extraction.

Arcadium has a global presence with operations in Argentina and Australia and downstream conversion assets in China, Japan, the United States and the United Kingdom. It’s based in Ireland and was formed by the merger of Allkem and Livent.

The company had an initial public offering on Dec. 22, 2023, in an attempt to break into the global lithium market. It’s well-positioned as governments continue to mandate a shift away from gas-powered vehicles and offer subsidies and incentives for EVs.

In addition, Arcadium seeks to become a player in renewable energy storage systems, which are declining in price mainly because of China’s success in the sector. But those prices should increase late this year as the world

approaches a lithium deficit in 2025.

It’s all about demand and mandates. Globally, projects requiring lithium will increase by 1,235% over the next 15 years, Statista projects. That would mean rising from 310 metric tons in 2020 to more than 3.8 million by 2035.

If you’re looking for an economic moat here, pay close attention to Arcadium’s Argentina lithium production, which is high in quality and low in impurities, the Morningstar financial services firm suggests.

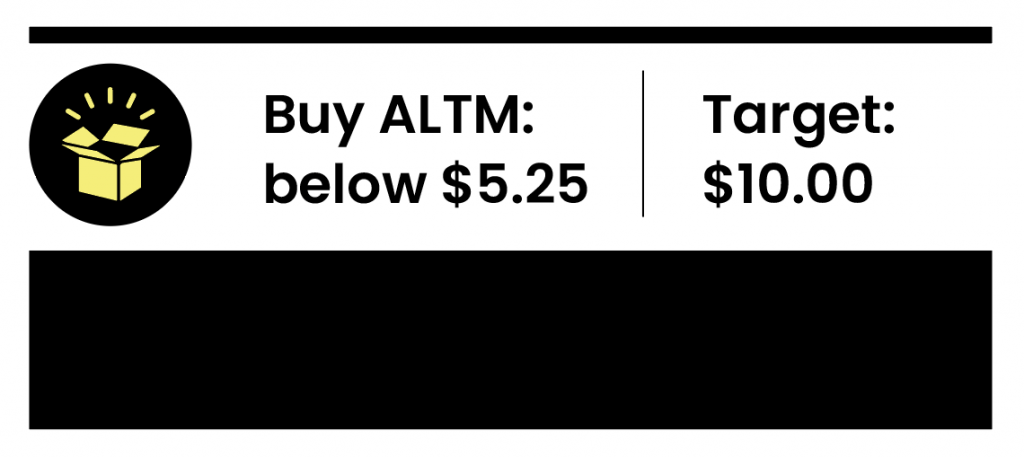

As for the stock, we see a fair value of $7.35. There’s virtually no debt, and the return on invested capital is 19.5%. Its adjusted F score is 7.5, with a price-to-Graham at 0.6. These are all very positive figures.

ALTM’S IPO stock went public at $6.00 on Jan. 4, popped above $7.00 and retreated quickly to $4.15 in early February. It is currently trading at approximately 1.2x book value. But it’s running with net margins above 40%, shows better profitability than sector rivals and could quickly become a momentum stock if inflows continue.

Buy Arcadium with an 18-24-month target, but expect some volatility over time because of overheated U.S. markets.

The ultimate price target is about $10.

The average Arcadium Lithium price target is $7.56, with a high forecast of $12.00 and a low forecast of $5.00, based upon the nine best-performing Wall Street analysts offering 12-month price targets for the stock in the last three months.

—Tipranks

Portions of this article appeared in “The March Wave Model Portfolio Pick” in the author’s Republic Risk Letter on Substack.

Garrett Baldwin is the Editor-at-Large of Luckbox magazine and author of the financial blog Postcards from the Florida Republic on Substack. He is an economist who studies market anomalies, liquidity, and monetary policy. @FloridaRepCap