Bullish? Trade Duration Using Poor Man’s Covered Calls & LEAPS

In the current trading environment, the topic of duration has taken on added gravity.

Duration typically refers to the expected timeframe that a trading position will be open, and considering the current coronavirus outbreak, duration in these volatile markets is getting almost as much attention as price.

The reason this topic has become so paramount is because nobody truly knows how long the coronavirus will weigh on global economies and markets, and to what degree, ultimately. As of now, the lockdown of a good majority of human civilization has impaired the normal functioning of the global economy, which has in turn impaired the earnings of companies (and individuals) operating within it.

The thing is, even after the so-called “peak” of the Coronacrisis has passed, there are still many questions about how soon people can return to work and their “normal” lives. Recent data has suggested that the virus won’t die off just because temperatures rise, and many scientists have expressed concern that a second or third wave of the virus could also factor into the longer-term equation.

Accordingly, it’s possible that until a vaccine is approved (and manufactured and delivered), much of the world’s population will be unable to return to their “normal” routines.

With so many questions swirling over the duration of the coronavirus, it’s likewise certain that many market participants are heavily weighing duration considerations before entering new positions.

For example, purchasing stock just for a short-term gain, as opposed to a “lifetime” buy that an investor plans to hold for many years.

As outlined recently in Luckbox, previous research conducted by tastytrade has shown that short premium positions can achieve targeted levels of profitability more quickly in high-volatility environments, as compared to “normal” or low-volatility trading environments. This research suggests that an aggressive approach to position management (i.e. taking off winners) may be prudent in fast-moving markets.

But what about options positions that inherently involve longer time horizons?

Traders and investors who are currently strategizing about duration and options may want to review a new episode of Tasty Extras on the tastytrade financial network which focuses on “longer-dated options.”

Specifically, this episode examines the value proposition of so-called LEAPs, or Long-Term Equity Anticipation Securities, and whether the relative attractiveness of these securities has changed in the current environment.

LEAPS are somewhat unique because they offer expiration dates greater than one year from the date of trade deployment.

Technically speaking, there aren’t any further differences between LEAPS and other standard, exchange-listed options contracts. From a strategic perspective, however, there are of course many nuances that differentiate LEAPS from shorter duration options.

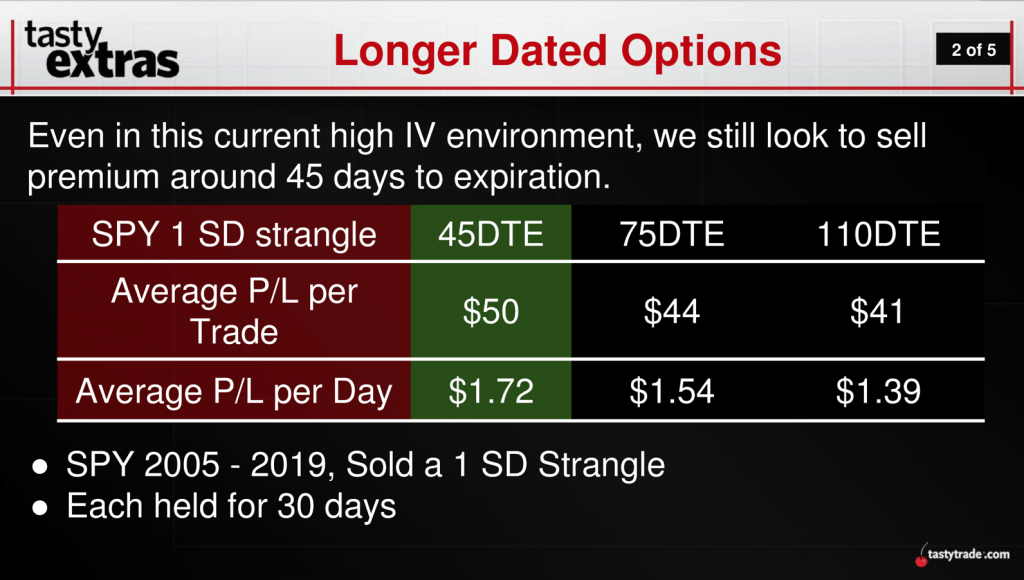

One thing to keep in mind is that historical research has indicated that LEAPS don’t necessarily offer additional trading edge compared to shorter duration options. As shown in the slide below, options with 45 days-to-expiration (DTE) have exhibited the best overall performance when considering risk and reward:

Aside from the historical P/L considerations of longer-dated options, one also has to keep in mind that the liquidity in options with longer time horizons (like LEAPS) can often be much lower. In general, lower liquidity opportunities are relatively less attractive because entering and exiting a position with ease is a critical risk management tactic.

But when it comes to longer-dated positions, one type of structure that may deserve a second look is the covered call, and more specifically, the “poor man’s covered call” (PMCC).

A traditional covered call is deployed when a trader sells a call against an existing stock position, in equivalent terms. A covered call writer may choose to do this because they expect the stock will trade in a narrow range, and the investor intends to make income on the position during this time by collecting short call premium.

Should the underlying stock unexpectedly spike, the covered call writer is protected against significant upside risk because they also own the stock. However, in this scenario, losses on the short call will also negate potential profits from the long stock position.

A poor man’s covered call, on the other hand, involves the same short call position, but instead of long stock, the position involves a second long call with a different expiration.

As such, a poor man’s covered call involves buying an in-the-money (ITM) call in a longer-term expiration cycle, while simultaneously selling an out-of-the-money (OTM) call in a near-term expiration cycle. The poor man’s covered call therefore requires a net outlay of money (debit), and is inherently bullish.

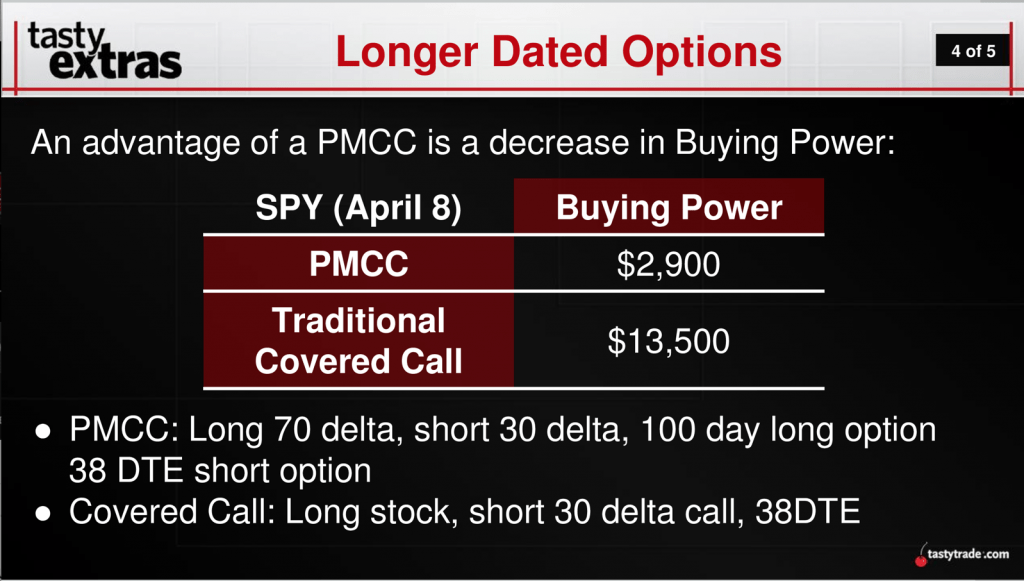

For traders who have used covered calls in the past but are feeling more bullish in the current market environment, the poor man’s covered call utilizing LEAPS may be attractive because it requires less capital, as outlined in the example below:

As one can see in the above information, poor man’s covered calls utilizing longer-dated options (such as LEAPS) may be a consideration for investors and traders who might otherwise be considering the deployment of a covered call in tandem with long stock—especially if their outlook leans bullish.

However, traders must also accept the marginally higher risk associated with lower levels of liquidity in longer-dated options before truly embracing PMCCs using LEAPS. To review these concepts in greater detail, a complete review of Tasty Extras is recommended when scheduling allows.

Additional information is also available via the following links:

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.