Crude Oil Crash: Short Puts in Futures Options

Active investors are lapping up the current market environment like a century-old “dusty” bottle of delicious bourbon.

And much like that long-lost bottle of bourbon, seldom-seen market conditions sometimes require a clearing out of the cobwebs.

Traders seeking fresh ideas or insight into the markets from a slightly different perspective would be well advised to tune into a new episode of Futures Measures on the tastytrade financial network.

The focus of this episode is “selling puts in futures options,” which is especially relevant at this moment because so many different commodities futures have gotten hammered during the coronavirus crisis.

Crude oil, which saw its volatility hit an all-time high in 2020, is one commodity in particular that must be feeling like King Kong used its monster fist to hammer “black gold” into the dirt, back where it came from. The front-month futures contract for crude oil actually went negative on Monday for the first time in history (more on that below).

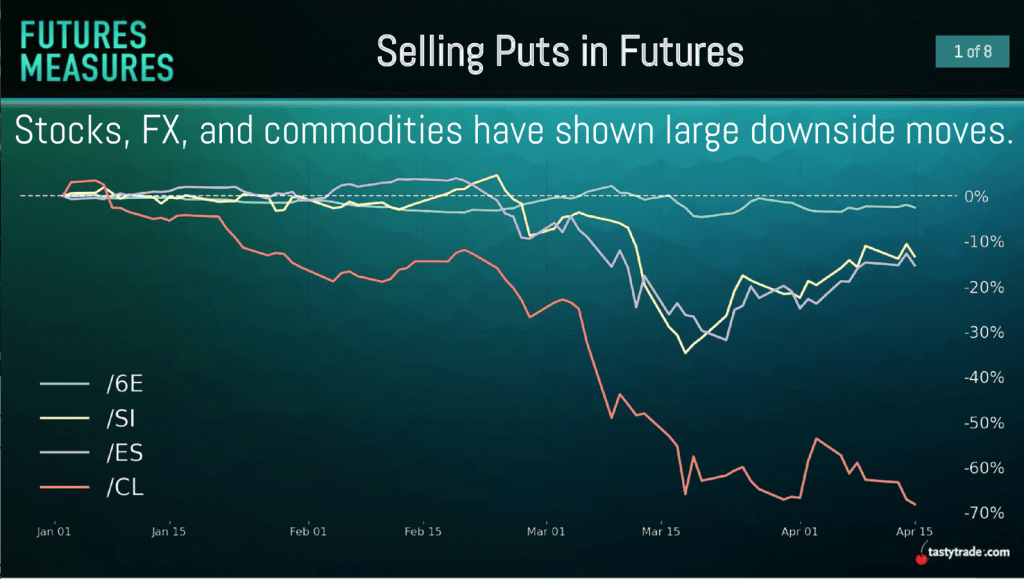

The following chart illustrates how crude oil has remained beaten down this year, even while some other commodities and financial instruments have rallied in recent weeks:

And while passive investors may be sticking their heads in the ground to avoid looking at the slide in value of their energy investments, active investors are instead brainstorming on how they might capitalize on what’s happening in the financial markets right now.

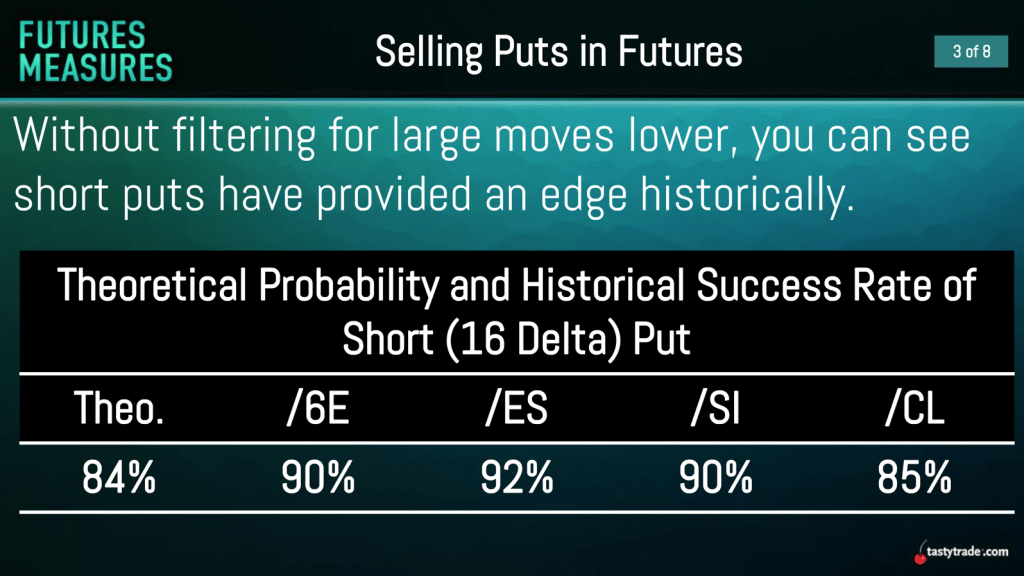

On Futures Measures, the hosts of the show outline previous tastytrade research which illustrates how put sales in a wide range of commodity-based futures options have historically exhibited attractive performance—particularly right after a deep decline, as shown below:

Given how equity indexes (and associated index futures) have rallied in recent weeks after a steep drop, it’s easy to see where the above research is coming from.

But instead of covering just the well-known rebound in the broad market indexes, Futures Measures hosts Pete Mulmat and Frank Kaberna delve into the price charts of a diverse group of commodities, including foreign exchange rates, precious metals, agricultural commodities (i.e. corn, wheat, soybeans), and of course, crude oil.

It’s entirely possible that traders reviewing this information may find an attractive trading idea in one of these products—one that fits their current market outlook, trading approach and risk profile.

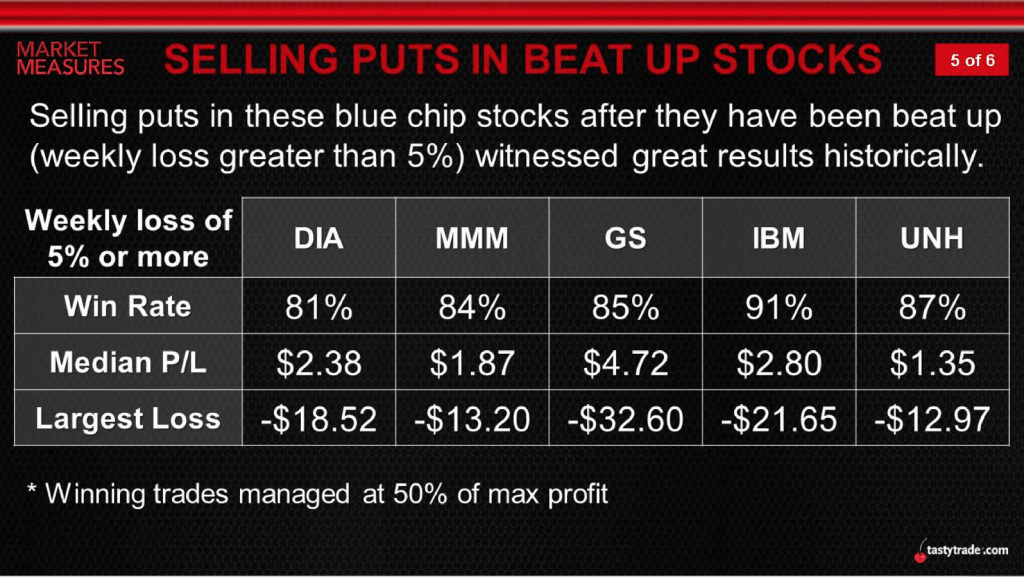

Selling puts in beat-up futures is of course much like the philosophical approach behind selling puts in the options of blue chips after they’ve experienced a correction. Blue chips are well-established large-cap companies that generally have previous experience surviving economic downturns.

Previous research conducted by tastytrade focused on the historical performance of short puts initiated in such companies shortly after a severe weekly pullback.

In order to produce the necessary data for analysis, a series of backtests was conducted on several blue-chip names (MMM, GS, IBM, UNH) which revealed that selling puts after a severe weekly correction (> 5%) produced a win rate above 80% and, on average, a higher win rate than doing so in an index like the Dow Jones Industrial Average (DIA):

Given the recent rally in equities, it’s possible some investors and traders believe that another “shoe” is left to drop in the current coronavirus crisis, and are waiting for another pullback in the market before establishing fresh short puts positions—whether they be in equities or commodities.

To prepare for that potential move, readers may want to review the aforementioned episode of Futures Measures focusing on put sales in futures options when scheduling allows.

Due to the historic moves observed in the crude oil market on Monday, readers may also want to review these new episodes:

To brush up on futures options, this previous blog post may also be of interest: “Diversifying with Options on Futures.”

Sage Anderson is a pseudonym. The contributor has an extensive background in trading equity derivatives and managing volatility-based portfolios as a former prop trading firm employee. The contributor is not an employee of Luckbox, tastytrade or any affiliated companies. Readers can direct questions about topics covered in this blog post, or any other trading-related subject, to support@luckboxmagazine.com.