Falling Lumber Prices: Bearish Signal for Homebuilding Stocks

Another shoe appears to have dropped in the U.S. housing market

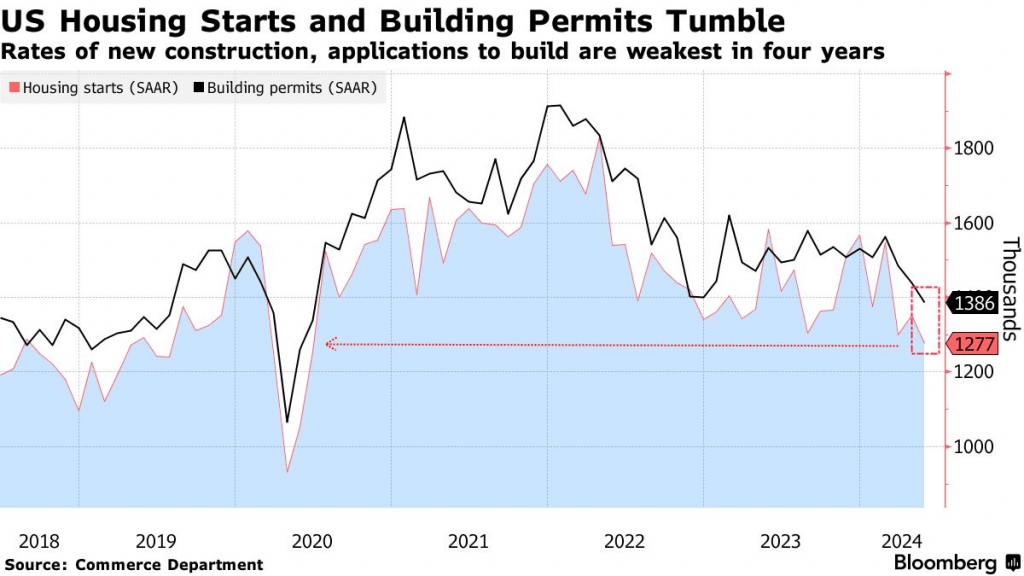

- Housing starts declined to about 1.2 million units in May, a 5.5% decline from the previous month and a significant 19.3% decline from one year ago.

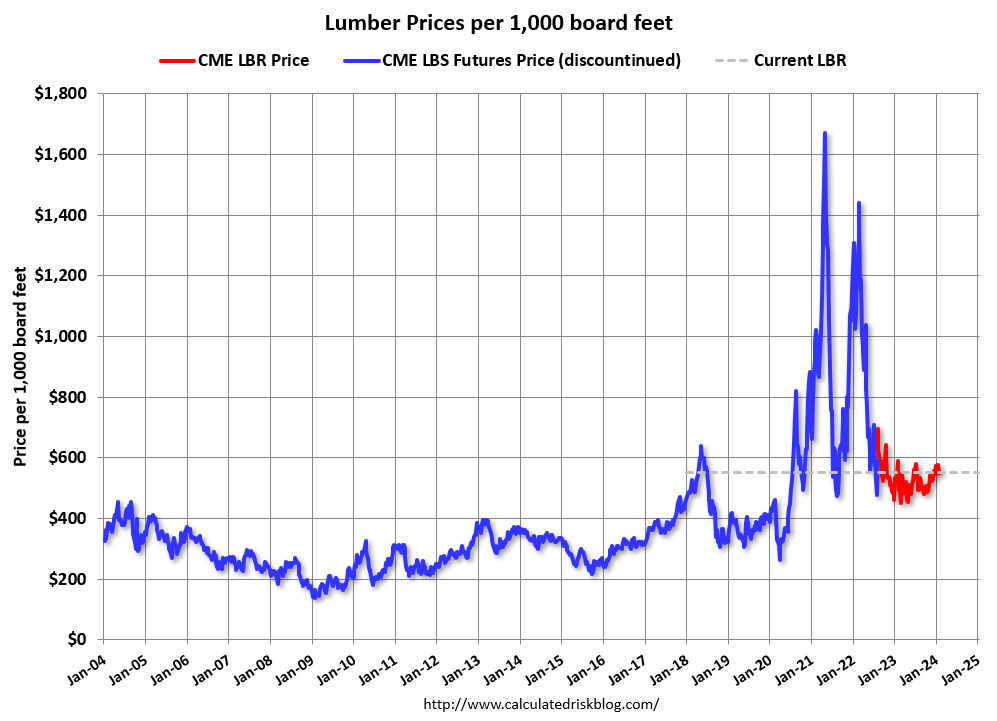

- Lumber prices have also been under pressure in 2024, dropping back to the levels observed before the COVID-19 pandemic.

- Together, these trends paint a troubling picture for the homebuilding sector, which appears increasingly vulnerable to near-term weakness.

In the unpredictable world of financial markets, “good news” often masquerades as “bad news” and vice versa. This paradox was evident in early 2024 when the stock market seemed to celebrate economic slowdowns, betting such news would compel the Federal Reserve to cut interest rates.

However, this faith may have been misguided because rate cuts are often a bearish signal, as outlined in this recent Luckbox article. And the homebuilding sector may soon demonstrate bad news isn’t always good.

Record prices and elevated interest rates have pushed many prospective homeowners out of the market for existing homes and into the new construction market. This shift helped fuel the surge in “housing starts” from April 2020 through April 2022, which continued into 2023.

Unfortunately, the demand for new constructions has weakened in 2024, as underscored by declining lumber prices. These developments are likely to weigh on revenue and profit in the homebuilding sector, potentially weighing on valuations in the stock market. It could come to resemble the commercial real estate sector.

Housing starts slipped

For homebuilders, one of the most important monthly statistics to monitor is “housing starts.” The term comes from economics and refers to the point when a shovel enters the ground to build new housing.

Housing starts are a leading economic indicator because they tend to be closely correlated with strength in the underlying economy. As the economy expands, so do housing starts and vice versa. Builders prosper when housing starts are at the higher end of the historical spectrum.

But starts declined to about 1.2 million in May, a 5.5% decline from the previous month. Alarmingly, that figure also represented a 19.3% decline from one year ago, as illustrated below (in red).

While 1.2 million housing starts isn’t catastrophic by historical standards, it’s important to put this number in context. Over the last 20 years, monthly housing starts have fluctuated between about 475,000 and 2.2 million units, with the current level just below the 20-year average of around 1.3 million units per month.

The lowest point for housing starts occurred during the depths of the 2008-2009 financial crisis, bottoming out at 475,000 units in April 2009. The 1.2 million housing starts in May 2024 are more than double that figure, indicating the market for new homes hasn’t yet plunged into free fall.

However, the reversal is notable. As housing starts decline, so can the fortunes of homebuilding stocks. Over the past month, two prominent homebuilder exchange-traded funds ( ETFs)—the iShares U.S. Home Construction ETF (ITB) and the SPDR S&P Homebuilders ETF (XHB)—have dropped by 6% and 5%, respectively. This reflects newfound concern over the strength of the housing market.

Lumber prices have also tumbled

The lumber market has experienced a tumultuous journey since the onset of the COVID-19 pandemic.

Before the pandemic, lumber futures typically traded below $400 per thousand board feet. The post-COVID surge saw prices skyrocket to $1,500 per thousand board feet because of unprecedented demand and production challenges. Today, prices have settled around $450, essentially completing a “round trip” from pre-pandemic levels to record highs and back down.

Unsurprisingly, these dramatic shifts in the lumber market have closely mirrored the trends in the new home construction market.

The price of lumber, like most commodities, is dictated by the delicate balance between supply and demand. Currently, the market is grappling with a notable decline in demand. Weak demand has combined with persistently strong production and elevated inventories to keep prices low.

Speaking to the current market dynamic, the COO of Sherwood Lumber—Kyle Little—recently told Business Insider that “what many did not recognize is that new demand has been declining faster than the sawmill production. Commodity Forest Product markets continue to be oversupplied.”

What’s alarming is the timing of this slump in demand. Spring and summer are peak seasons for lumber, driven by ideal building conditions and a surge in construction. Yet, this year, the much-anticipated spring rally was conspicuously absent, leaving industry insiders and investors questioning the health of the market.

Russ Taylor, a lumber consultant based in Vancouver, British Columbia, told The Wall Street Journal that “the spring rally never happened. No one is making much money at these prices.” Consequently, experts now expect an uptick in sawmill closures and warn of a potential spike in bankruptcies in the lumber industry.

Final takeaways

Sales of existing homes have been languishing near the lower end of the range observed in the 21st century. This is largely because of record-high interest rates, which have locked many homeowners into their properties.

In response, many prospective homebuyers turned to new construction to fulfill their housing needs. This surge in demand led to increased revenue and profit for domestic homebuilders over the past few years, as well as significant gains in their stock values.

However, the recent decline in housing starts signals demand is cooling for new construction, a trend that has also resulted in falling lumber prices. Given this market context, the homebuilding sector may face continued challenges in 2024. This is especially likely if the Federal Reserve lowers interest rates only one or two times, as currently forecasted.

Because of the uncertainty in this sector, active investors who have booked significant profits in this niche may want to consider lightening their exposure,and building additional cash reserves to utilize during a potential market pullback.

Additionally, those bearish on homebuilder stocks might also consider positions that benefit from a decline in prices, such shorting the associated stock and ETFs or deploying debit put spreads. For those who expect sideways movement, covered calls might also be considered.

To track and trade the homebuilders, readers can add the following stocks and ETFs to their watchlists:

- D.R. Horton (DHI)

- Invesco Building & Construction ETF (PKB)

- iShares U.S. Home Construction ETF (ITB)

- KB Home (KBH)

- Lennar (LEN)

- LGI Homes (LGIH)

- NVR (NVR)

- PulteGroup (PHM)

- SPDR S&P Homebuilders ETF (XHB)

- Toll Brothers (TOL)

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.