The Collapse in Office Properties Could Exacerbate the Banking Crisis

Commercial real estate prices have been sliding since March of last year, with the sharpest losses coming from the office space niche

- The commercial real estate sector has been under pressure since March of last year, with prices sliding by about 16% (on average).

- Distressed debt in the commercial real estate sector has surged to a 14-year high.

- Small and regional banks hold a large percentage of the total commercial real estate loans in the U.S., which could exacerbate the banking crisis.

Dark clouds have gathered above the United States commercial real estate sector, but so far in 2023, they haven’t rained down on the financial markets.

Year-to-date, the Real Estate Select Sector SPDR Fund (XLRE) is up roughly 0.50%.

Moreover, the much-maligned office space niche within the broader commercial real estate sector has held up better than expected. For example, one of the largest-capitalized, office-focused real estate investment trusts (REITs)—Boston Properties (BXP)—is up 1% on the year.

The small, positive returns in BXP and XLRE are even more impressive when one considers that commercial real estate valuations (i.e. the physical properties themselves) have dropped by about 16% (on average) since their March 2022 peak.

And as one might expect, slumping valuations have been accompanied by slowing sales. During the first five months of 2023, investors purchased only $130 billion worth of commercial property, representing a 61% decline from the same period last year.

A big drop in valuations, in tandem with reduced liquidity in the market, is far from ideal. And at present, there’s fresh concern—especially in the office space niche—that reduced occupancy is cutting into the cash flows of property owners, which in turn is making it more difficult for them to service their debt obligations.

Data from the industry suggests those concerns are well-founded. Earlier this year, distressed debt in the commercial real estate sector surged to 5.2%, which marked a 14-year high. Notably, 44% of that distressed debt was concentrated in the office space niche, while 32% was attributable to retail-focused properties.

But despite these worrisome headwinds, some office-focused REITs have rebounded of late, and are trading well off their 52-week lows. Vornado Realty Trust (VNO), highlighted below, is one such example.

On the other hand, one can see in the list below that a large number of office-focused REITs are trading below the water line in 2023:

- Vornado Realty Trust (VNO), +16%

- SL Green Realty (SLG), +15%

- Boston Properties (BXP), +1%

- Corporate Office Properties Trust (OFC), +1%

- Kilroy Realty Corp (KRC), -2%

- Cousins Properties (CUZ), -4%

- Easterly Government Properties (DEA), -7%

- Douglas Emmett (DEI), -8%

- Realty Income (O), -12%

- Global Net Lease (GNL), -13%

- Paramount Group (PGRE), -13%

- Highwoods Properties (HIW), -14%

- JBG SMITH Properties (JBGS), -16%

- Alexandria Real Estate Equities (ARE), -19%

- Brandywine Realty Trust (BDN), -19%

- Equity Commonwealth (EQC), -25%

- Piedmont Office Realty Trust (PDM), -25%

- Hudson Pacific Properties (HPP), -27%

- City Office REIT (CIO), -40%

- Office Properties Income Trust (OPI), -49%

The big question, of course, is where the commercial real estate sector is headed from here. And based on current projections, things are likely to get worse before they get better.

Office-Related Defaults are Expected to Peak in 2024 or 2025

The biggest challenge for the office space niche has been the surge in remote working.

According to Stijn Van Nieuwerburgh—a professor of real estate at Columbia Business School—a large percentage of employees still haven’t returned to the office, which is why this particular niche of the commercial real estate sector has come under so much pressure in the last couple of years.

Van Nieuwerburgh recently told The Banker, “The remote work trend is a secular change, not merely a cyclical one. The return to the office has stalled at 50% of pre-pandemic levels.”

Reduced demand for office properties has in turn pushed down valuations. And while the broader commercial real estate sector has seen a 16% decline since March of 2022, the fallout in the office niche has been far more severe. Over that same period, office-focused properties have declined in value by roughly 30%.

That means property owners—particularly those in the office niche—are now servicing loans which no longer reflect the fair market value of the collateral (i.e. the physical buildings) that underpin those loans. A situation that’s similar to 2008-2009, when residential properties dropped precipitously in value.

As if all that wasn’t enough, property owners are also facing outrageously high refinancing costs. Today, benchmark interest rates are sitting at 22-year highs, which means a refinanced loan—even with a reduced principal amount—still results in sky-high payments.

Speaking to the refinancing issue, Jade Rahmani—an analyst with Keefe, Bruyette & Woods—recently told The Wall Street Journal, “There’s a ton of commercial real estate that was not priced for the rate outlook we have going forward.”

And as a result of the aforementioned market dynamics, some commercial owners are simply walking away from the properties—much like many residential homeowners did during the 2008-2009 Financial Crisis.

For example, in mid-February, Brookfield (BN) defaulted on two major office properties in Los Angeles worth a combined $784 million. Brookfield is the largest owner of office space in the Los Angeles market, and those properties represented two of its “trophy” towers in downtown L.A.

Along those lines, Columbia Property Trust—a large office landlord controlled by PIMCO—defaulted on $1.7 billion in loans that were tied to seven significant office properties across the country. The combined value of that credit event represented the largest office-related default since the year 2020.

And the carnage hasn’t been limited to the coasts. On the first of September, a group of real estate partners in Kansas City defaulted on a $300 million loan that was used to purchase the Country Club Plaza.

Based on a new report released by Newmark, there’s now an estimated $1.2 trillion of commercial real estate debt in the United States that’s potentially “troubled.”

According to Morgan Stanley (MS), about $2.5 trillion in commercial real estate loans is scheduled to be refinanced in the next five years, and by their estimate, the peak in defaults will occur at some point in 2024 or 2025.

Further Erosion in the Commercial Property Sector Could Exacerbate the Banking Crisis

With some property owners already walking away from their loans, it stands to reason that the U.S. banking sector is also at serious risk in the current environment.

That probably helps explain why the credit ratings agency Moody’s Investors Service downgraded 10 regional banks in early August, and put six other lenders on notice that they were being reviewed for a possible downgrade.

Speaking to the uncertainty in the current environment, Howard Marks—a co-founder of Oaktree Capital Management—recently told The Banker, “We’re very likely to see [commercial] mortgage defaults in the headlines, and at a minimum, this may spook lenders, throw sand into the gears of the financing and refinancing processes, and further contribute to a sense of heightened risk.”

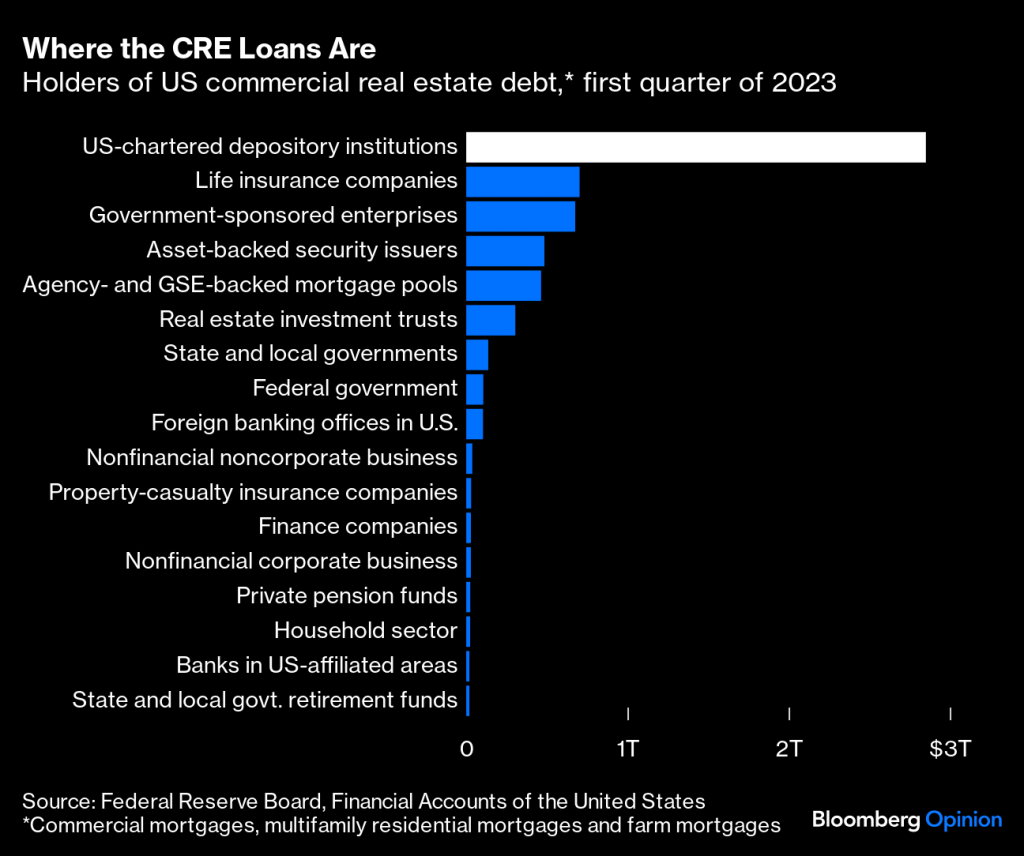

That’s bad news for small and regional banks, which hold a large portion of the loans tied to the commercial real estate sector. According to Marquee Finance, smaller banks in the U.S. have concentrated “around 67 per cent of their total real estate loan exposure to CRE [commercial real estate], while 33 percent is towards residential real estate.”

Those figures dovetail closely with estimates published by The Banker, which highlighted in a recent article that small banks “account for 70% of total CRE lending ($2.9 trillion, highlighted below) and are on average 4.4 times more exposed to the sector than their Wall Street peers, such as JPMorgan and Wells Fargo.”

The above data suggests that many regional banks in the United States, which have already been under pressure in 2023, could be subject to further pain in the near future.

Initially, most banks will likely try to renegotiate the terms of these loans to try and accommodate the borrower, so that the flow of payments isn’t completely disrupted. To help avoid a catastrophic situation, federal regulators actually stepped in recently to provide new guidelines on how these loans can be renegotiated as efficiently as possible, without completely upending the market.

However, in many cases, property owners will still be forced to walk away from certain loans. And in instances like this, the banks will have to take possession of the properties and attempt to sell them on the open market. If the resulting sale price is less than the remaining loan balance, the bank incurs a loss.

In the wake of the 2008-2009 Financial Crisis, residential foreclosures in the U.S. didn’t peak until 2010—two years after Lehman Brothers went bust.

That historical precedent probably helps explain why many experts believe the current crisis in the commercial real estate sector won’t peak until 2024 or 2025.

And because of the close ties between the regional banks and the commercial real estate sector, readers may want to keep a close eye on the health of the regional banking sector going forward. One easy way to do this is via the SPDR S&P Regional Banking ETF (KRE).

To track and trade the broader commercial real estate sector using ETFs, investors and traders can add the following symbols their watchlists (sorted by market capitalization with associated year-to-date return):

- Vanguard Real Estate ETF (VNQ), +0%

- Schwab US REIT ETF (SCHH), -1%

- Real Estate Select Sector SPDR Fund (XLRE), +0%

- iShares U.S. Real Estate ETF (IYR), +1%

- iShares Cohen & Steers REIT ETF (ICF), -1%

- iShares Core U.S. REIT ETF (USRT), +4%

- SPDR Dow Jones REIT ETF (RWR), +3$

- Fidelity MSCI Real Estate Index ETF (FREL), -10%

- Dimensional Global Real Estate ETF (DFGR), -1%

- iShares Residential and Multisector Real Estate ETF (REZ), +4%

To follow everything moving the markets, tune into tastylive—weekdays from 7 a.m. to 4 p.m. CDT.Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox Magazine.

For daily financial market news and commentary, visit the News & Insights page at tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.