Next-level Currency Trading

Options on futures contracts offer possible tax advantages and precise definition of risk

While stock market downfalls and soaring interest rates have dominated the financial headlines in 2022, it’s also been quite a year for the currency markets.

The U.S. dollar saw a relentless rally as capital fled other currencies around the world into the greenback while the Federal Reserve was raising interest rates.

This naturally means a falling price in global currencies as demand for them dropped in favor of the dollar. Three of the world’s major currencies and currency futures—euro (/6E), British pound (/6B), and Japanese yen (/6J)—all collapsed in price.

Putting aside the macroeconomic impacts on global importing and exporting of a strong dollar, 2022 is a unique year for currency traders. Trend followers betting on a continued fall of global currencies were rewarded for days and weeks at a time.

Meanwhile, active investors who rely on selling options found new opportunity in currency futures options in 2022, thanks to materially higher implied volatilities than in recent years.

As with some other asset classes, like soft commodities (wheat and corn), the choices for active investors to trade currencies via exchange-traded funds (ETFs) are extremely limiting.

ETFs that represent the euro, pound and yen have limited liquidity for buy-and-hold investors and near-zero liquidity for active investors focused on options. Investors who want to speculate or sell option premium on currencies are far better served by stepping up to the futures options market.

Here’s a comparison: In early August, the total open interest (contracts) for September options for FXE, a euro ETF, was 19,558, approximately $180 million in notional value. That’s across all strikes of both call and put options. The same metric for September options for the euro futures was 119,522 contracts, with more than $14 billion in notional value.

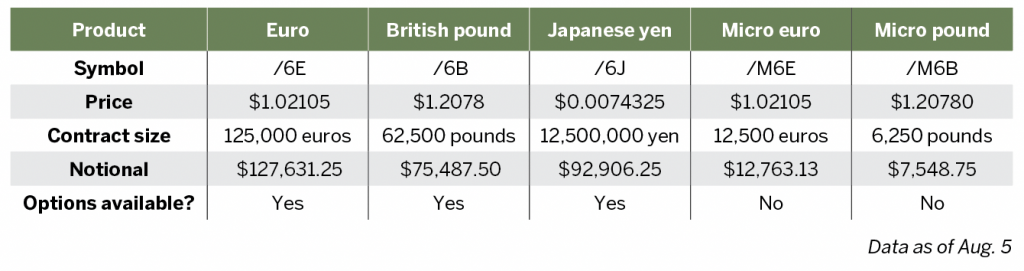

Active investors should be cognizant of the size of the futures contracts and what each futures position or options position controls. For those looking to speculate on outright direction in currencies, the Chicago Mercantile Exchange (CME) offers micro futures such as the micro pound (/M6B) and micro euro (/M6E) contracts (see table).

Unfortunately, given those products are new and still gaining popularity, no options are available. Those looking to add a currency options position will have to stick with the larger contracts.

Keep in mind that options, even futures options, provide the possibility for defined risk trades. Active investors can always buy an option to protect a short option position or sell another option to reduce the cost of buying an option, either scenario creating a spread trade.

For example, consider the euro futures contract, /6E, which controls 125,000 euros. In most months, the options strikes are listed in 0.005 increments, such as 1.03 to 1.025.

That means if an investor buys the 1.03 and sells the 1.025, the total possible value of the spread is $625 (0.005 x 125,000 euros). One begins to see futures options can be versatile products for many active investors, even if the notional size of the contract seems daunting.

While the obvious benefit of trading currency futures options is access to a market underserved by the ETF industry, an additional perk is the tax treatment.

Futures options are subject to the “60/40 rule,” meaning that profits are taxed 60% at the long-term capital gains tax rate of 15% and 40% at the investors personal income tax rate.

So, if a trader has a 24% personal income tax rate and makes $100 on a futures options trade, the tax due would be: ($100 x 60% x 15%) + ($100 x 40% x 24%) = $18.60. Compare this to $100 of profits on ETF options: $100 x 24% = $24. Over the course of a year that can really add up!

Futures can be daunting, futures options more so, but they are often a natural progression for stock, ETF and options investors. Do the research and understand the products and sizing. Ultimately, investors can use currency futures and options to add new layers of diversification.

Pete Mulmat, tastytrade chief futures strategist, serves as the host of Splash Into Futures on the tastytrade network. @traderpetem