The Media Trade

Smaller investors can create a diversified portfolio if they know their options

At least some of the readers who’ve digested the articles on media in this issue of luckbox may have identified trades in that sector with attractive probabilities. If so, they may now be wondering how to use those probabilities in their favor.

The answer might be options. Options aren’t just for investors with large accounts. With a smaller account it’s difficult to buy or short enough stocks to create a portfolio that maximizes exposure across asset classes.

Single name equities are some of the most attractive trading vehicles and narratives, but trading stocks in a capital-efficient way can prove difficult. Using options trades, investors can simulate stock positions while using about 10% of the capital. That’s one of the advantages options have for traders with modest-sized accounts.

Many brokers offer 4x leverage intraday and 2x leverage overnight for stock trading, but even that requires a large amount of capital to avoid getting churned up by commissions margin rates – not to mention being limited to only a handful of positions at a time. Sure, one can buy cheap out-of-the-money options, but that’s a world of low-probability trades requiring large moves and perfect timing.

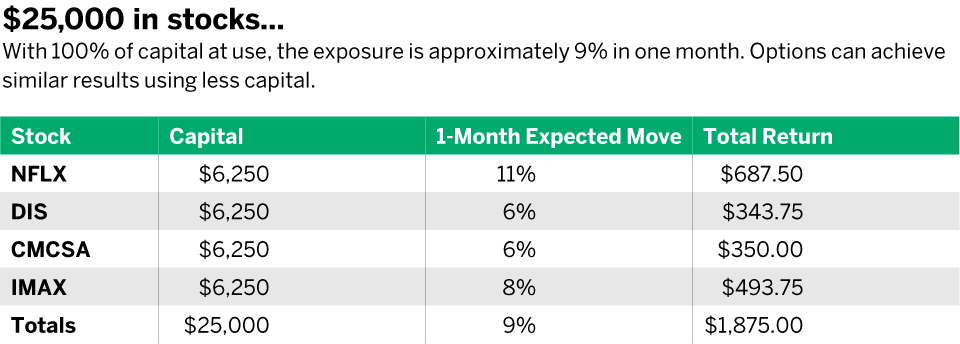

Using a $25,000 account as an example, and spreading capital over four media sectors, an investor could go long Disney (DIS) and Imax (IMAX), and short Netflix (NFLX) and Comcast (CMCSA). Assuming an even allocation of the entire account across those equities, a best-case return assuming a 1-month expected move in a favorable direction in each stock (see “$25,000 in stocks,” right).

In this case, with 100% of $25,000 in capital at use, there is a probable range of return up to 9%. Using options can significantly increase that return while maintaining a similar probability of profit.

Using options, we’ll create strategies with a similar delta as the stock positions in the example above, and cover four trade ideas using different strategies for the aforementioned media stocks.

Using capital efficiently helps traders manage smaller accounts

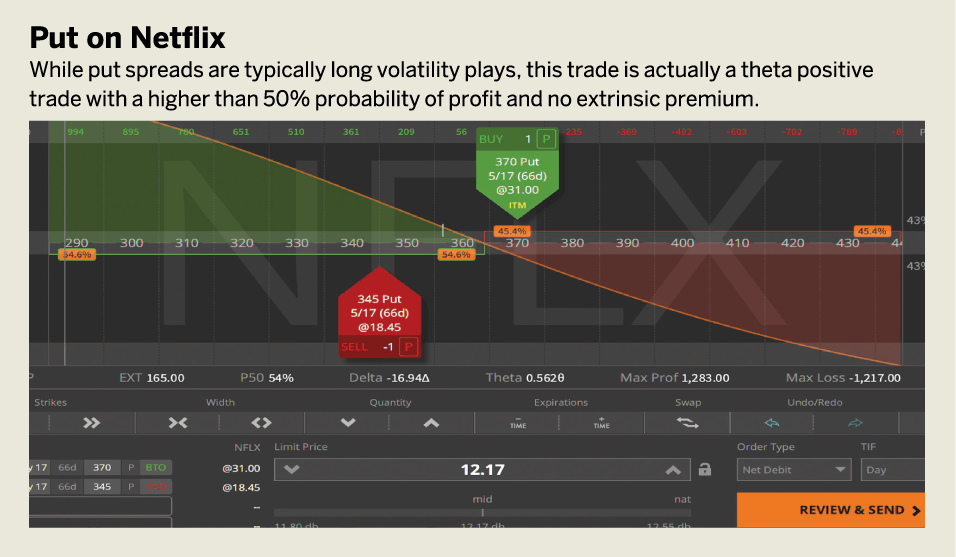

Netflix, which has a relatively low IV rank in the 30s, skewed higher by earnings before April expiration. Using a long deep in-the-money put to simulate short stock, one can sell a far out-of-the-money put to completely offset the extrinsic premium of the in-the-money put. Specifically, an investor could buy the 370-345 May put spread for $12.17, which has no extrinsic premium with the stock trading around 356.

While put spreads are typically long volatility plays, this trade is actually theta positive with a higher than 50% probability of profit and no extrinsic premium. With earnings and the elevated IV, this provides a trader a bit of a hedge against significant volatility movement in either direction, which a short stock lacks. (See “Put on Netflix,” below.)

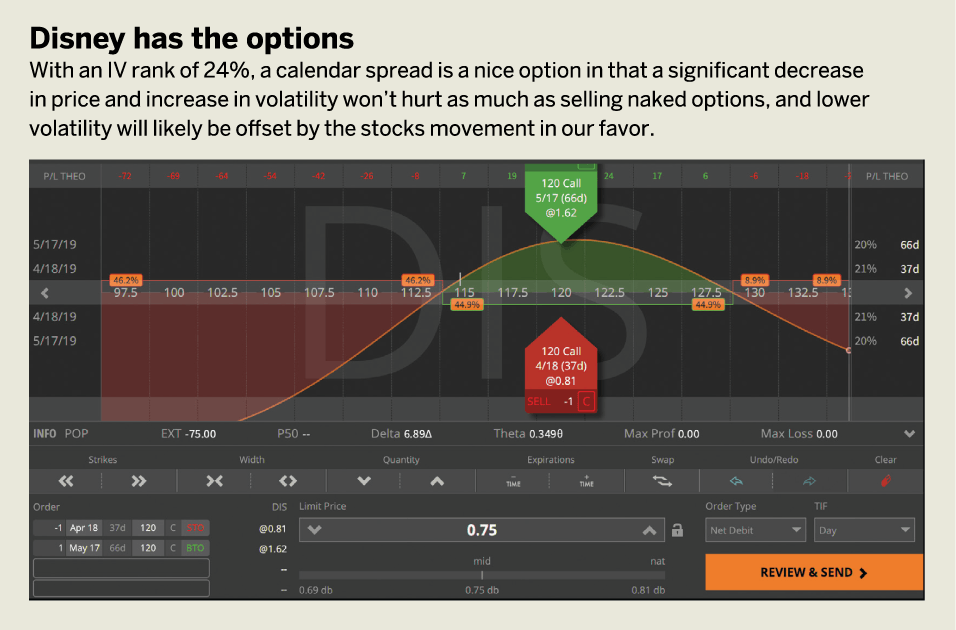

Disney’s IV rank is also relatively low at around 24%, but in a low-volatility market that offers both a short or long volatility opportunity. Selling the April 120 call and buying the May 120 call creates a long call calendar spread, playing for a gradual return to the highs. This trades at a $0.75 debit, with over half the May call price offset by selling the April call. This is an extremely low capital play for a $115 stock.

While calendar spreads are technically long vega plays, a call calendar could be considered somewhat short volatility, assuming a rise in the stock price will coincide with lower volatility in the April call and a stable volatility in the May call. With an IV rank of 24%, a calendar spread provides a nice option because a significant decrease in price and increase in volatility won’t hurt as much as selling naked options, and lower volatility will likely be offset by the stock’s movement in our favor.

A trader would need to buy around 15 of these spreads to equal a similar delta to 100 shares of stock. (See, “Disney has the options,” below.)

Comcast offers an IV rank of almost 0%, which allows a trader to buy in-the-money puts with almost 0 extrinsic value. For instance, the 45 June put has $0.13 of extrinsic premium, giving us nearly an identical profit and loss exposure to short stock. However, the put can be bought for just under $600, as opposed to around $4,000 to short the stock. Buying June locks in the super-low IV rank for a longer time, and enables a trader to sell out-the-money puts in April or May as either the stock moves against/for the position, or any subsequent uptick in volatility.

IMAX has an IV rank of around 6%, favoring buying volatility. To simulate long stock, one can buy the June 20 call for $4.05, containing around $0.70 of extrinsic premium. Here, a trader could sell the April 25 call for $.30, and assuming one could sell a similar call in May in the future, there would be theoretically minimal extrinsic value being paid for this trade.

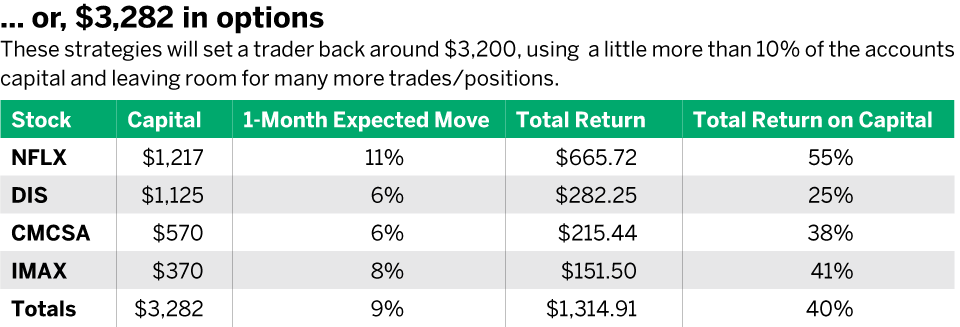

In total, these strategies will set a trader back around $3,200, using a little more than 10% of the account’s capital and leaving room for more trades or positions. Each play uses the leverage options, so note that this elevates the potential gains and losses. However, the idea is to demonstrate options strategies with higher return on capital, while maintaining the 50-50-probability shorting/buying stock provides. Assuming the same move in a trader’s favor as before (and no change in back month volatility) return for the capital deployed increases significantly.

“… or, $3,282 in options,” above, shows the return of these options plays versus their stock counterparts, again assuming expected.

Ryan Shaw, a futures and derivatives trader, specializes in option spreads and pairs trading at NinjaTrader, analyzing order execution, charting and automated strategies.